Rogers 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Media’s publishing group produces 54 consumer, trade and

professional publications.

Media’s digital group provides digital advertising solutions to over

1,000 websites.

Media’s sports entertainment group (“Sports Entertainment”) owns

the Toronto Blue Jays, a Major League Baseball (“MLB”) club, and the

Rogers Centre sports and entertainment venue.

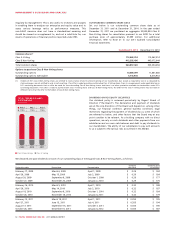

(%)

2011 MEDIA REVENUE MIX

TELEVISION 41%

PUBLISHING 17%

THE SHOPPING

CHANNEL 16%

RADIO 16%

SPORTS ENTERTAINMENT 10%

MEDIA’S STRATEGY

Media seeks to maximize revenues, operating profit and return on

invested capital across its portfolio of businesses. Media’s strategies to

achieve this objective include:

• Continuing to leverage our strong media brands and content across

multiple platforms to offer advertising clients more comprehensive

audience solutions and reach;

• Driving revenue share increases by continually improving audience

ratings in key demographics on conventional, sports and specialty

channels and on digital platforms by securing the rights to, and

promoting, premium and exclusive content;

• Working with Wireless and Cable to provide exclusive and premium

content to our customers over advanced network and distribution

platforms and in association with the Rogers brand;

• Growing and building audiences by focusing on producing unique

and quality content on our radio, TV, publishing and digital

properties;

• Continuing to invest in technology and new digital experiences to

capture the migration of audiences to digital platforms; and

• Enhancing the Sports Entertainment fan experience by continuing

to invest in the Blue Jays and in upgrades to the Rogers Centre.

RECENT MEDIA INDUSTRY TRENDS

Migration to Digital Media

The media landscape continues to evolve driven by the following

major forces impacting audience and advertiser behaviour:

• Digitization and delivery of content;

• Increased availability of high-speed broadband networks;

• The proliferation of international and Canadian content available

to Canadian consumers has significantly fragmented audiences;

• The explosion of easily available free and pirated content has

challenged the monetization of content;

• Marketers searching for higher-ROI media vehicles; and

• The availability and lower costs of social media marketing tools.

The impact of the foregoing is that audiences are shifting a portion

of their time and attention from traditional broadcast and print to

digital properties. As a result, advertisers are following this trend by

shifting a portion of their spending from traditional to digital media

formats.

Consolidation and Ownership of Industry Competitors

Ownership of Canadian radio and TV stations has consolidated

through several large acquisitions in the sector by other media and

telecommunications companies. This has resulted in the Canadian

media sector being composed of fewer owners but larger competitors

with more financial resources to compete in the media marketplace

which is driving up content costs.

MEDIA OPERATING AND FINANCIAL RESULTS

Media’s revenues primarily consist of:

• Advertising revenues;

• Circulation revenues;

• Subscription revenues;

• Retail product sales; and

• Ticket sales, receipts of MLB revenue sharing and concession sales

associated with Rogers Sports Entertainment.

Media’s operating expenses consist of:

• Merchandise for resale, which is primarily comprised of the cost of

retail products sold by The Shopping Channel;

• Other operating expenses, which include all other expenses

incurred to operate the business on a day-to-day basis. These

include:

• employee salaries and benefits, such as remuneration, bonuses,

pension, employee benefits, stock-based compensation and Blue

Jays player salaries; and

• other external purchases, such as sales and marketing related

expenses, and operating, general and administrative related

expenses, which include programming costs, printing and

production costs, circulation expenses, and other back-office

support functions.

42 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT