Rogers 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

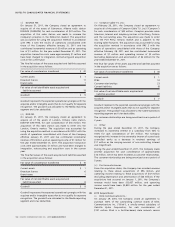

3. TRANSITION TO IFRS:

As stated in note 2(a), these are the Company’s first annual

consolidated financial statements prepared in accordance with IFRS.

The accounting policies set out in note 2 have been applied in

preparing the consolidated financial statements as at and for the year

ended December 31, 2011, the comparative information presented in

these consolidated financial statements as at and for the year ended

December 31, 2010, and for the opening IFRS statement of financial

position at January 1, 2010 (the Company’s Transition Date to IFRS). In

preparing its opening and comparative IFRS statements of financial

positions, the Company has adjusted amounts reported previously in

financial statements prepared in accordance with previous Canadian

GAAP.

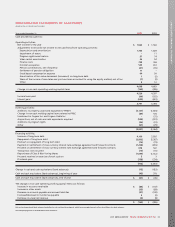

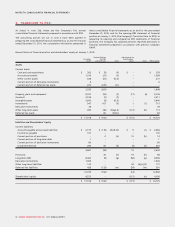

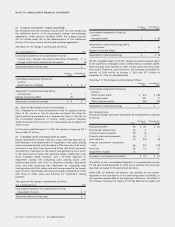

Reconciliation of financial position and shareholders’ equity at January 1, 2010:

Canadian

GAAP

Reclassification

for IFRS

presentation Note

Adjustments to

shareholders’

equity Note IFRS balance

Assets

Current assets:

Cash and cash equivalents $ 383 $ (5) (f) $ – $ 378

Accounts receivable 1,310 (21) (f) – 1,289

Other current assets 338 (61) (f),(l) – 277

Current portion of derivative instruments 4 – – 4

Current portion of deferred tax assets 220 (220) (m) – –

2,255 (307) – 1,948

Property, plant and equipment 8,197 (50) (f) (11) (e) 8,136

Goodwill 3,018 (7) (f) – 3,011

Intangible assets 2,643 (3) (f),(l) – 2,640

Investments 547 167 (f) 1 (i) 715

Derivative instruments 78 – – 78

Other long-term assets 280 (46) (f),(g),(l) (121) (b) 113

Deferred tax assets – 84 (f),(m) – 84

$ 17,018 $ (162) $ (131) $ 16,725

Liabilities and Shareholders’ Equity

Current liabilities:

Accounts payable and accrued liabilities $ 2,175 $ (118) (d),(f),(h) $ 9 (c) $ 2,066

Income tax payable 147 – – 147

Current portion of provisions – 4 (h) 10 (h) 14

Current portion of long-term debt 1 – – 1

Current portion of derivative instruments 80 – – 80

Unearned revenue 284 55 (d) (4) (d) 335

2,687 (59) 15 2,643

Provisions – 39 (h) 19 (h) 58

Long-term debt 8,463 (9) (g) (58) (g) 8,396

Derivative instruments 1,004 – – 1,004

Other long-term liabilities 133 – 44 (b),(c),(f) 177

Deferred tax liabilities 458 (133) (m) (34) (m) 291

12,745 (162) (14) 12,569

Shareholders’ equity 4,273 – (117) (n) 4,156

$ 17,018 $ (162) $ (131) $ 16,725

92 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT