Rogers 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Income tax expense varies from the amounts that would be computed

by applying the statutory income tax rate to income before income

taxes for the following reasons:

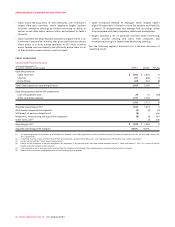

Years ended December 31,

(In millions of dollars) 2011 2010

Statutory income tax rate 28.0%30.5%

Income before income taxes $ 2,098$ 2,114

Computed income tax expense $587$ 645

Increase (decrease) in income taxes resulting from:

Effect of tax rate changes (59) (69)

Recognition of previously unrecognized deferred tax assets (12) (5)

Stock-based compensation 440

Other items 15 1

Income tax expense $ 535 $ 612

Effective income tax rate 25.5%28.9%

Other Income

Other income of $8 million in 2011 was primarily associated with

investment income and expenses from certain of our investments,

compared to income of $1 million in 2010.

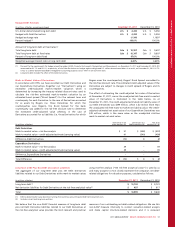

Interest on Long-Term Debt

The $1 million decrease in interest expense during 2011, compared to

2010, reflects the decrease in the weighted-average interest rate on

long-term debt at December 31, 2011 compared to December 31,

2010, substantially offset by an increase in the principal amount of

long-term debt through December 31, 2011, compared to

December 31, 2010, including the impact of cross-currency interest

exchange agreements (“Debt Derivatives”). The change in principal

and weighted-average interest rate primarily reflects the re-financing

activities completed in the first quarter of 2011. See the section

entitled “Liquidity and Capital Resources”.

Loss on Repayment of Long-Term Debt

During 2011, we recorded a loss of repayment of long-term debt of

$99 million, comprised of aggregate redemption premiums of $76

million related to the redemption of two public debt issues, a net loss

on the termination of the related Debt Derivatives of $22 million, and

a write-off of deferred transaction costs of $2 million, partially offset

by a gain of $1 million relating to the non-cash write-down of the fair

value increment of long-term debt. (See the section entitled “Debt

Redemptions and Termination of Derivatives”).

Foreign Exchange Loss (Gain)

During 2011, the Canadian dollar weakened by 2.2 cents versus the

U.S. dollar resulting in a foreign exchange loss of $6 million, primarily

related to our US$350 million of Senior Notes due 2038 for which the

associated Debt Derivatives have not been designated as hedges for

accounting purposes. Much of this foreign exchange loss is offset by

the coincident change in the fair value of our Derivative instruments

as discussed below. During 2010, the Canadian dollar strengthened by

5.6 cents versus the U.S. dollar, resulting in a foreign exchange gain

of $20 million, primarily related to our US$350 million of Senior Notes

due 2038 for which the associated Debt Derivatives have not been

designated as hedges for accounting purposes.

Change in Fair Value of Derivative Instruments

In 2011, the change in fair value of the derivative instruments was the

result of the $14 million (2010 – $22 million) non-cash change in the

fair value of the Debt Derivatives hedging our US$350 million Senior

Notes due 2038 that have not been designated as hedges for

accounting purposes. This change in fair value of the Debt Derivatives

was primarily caused by the Canadian dollar’s weakening by 2.2 cents

in 2011 (2010 – strengthening by 5.6 cents) versus the U.S. dollar. We

have measured the fair value of our Debt Derivatives using an

estimated credit-adjusted mark-to-market valuation. Much of this

change in the fair value of our derivative instruments is offset by the

foreign exchange loss discussed above. For the impact, refer to the

section entitled “Mark-to-Market Value of Derivatives”.

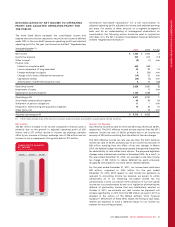

Operating Income

The decrease in our operating income compared to the prior year is

due to the increase in operating expenses of $205 million, an increase

in depreciation and amortization of $104 million, as well as an

increase in stock-based compensation expense, settlement of pension

obligations, integration, restructuring and acquisition expenses and

other items of $41 million, partially offset by an increase in revenue

of $286 million and a decrease in impairment of assets of $11 million.

See the detailed discussion on respective segment results included in

this section entitled “Segment Review” above.

Impairment of Assets

There was no impairment of assets charge for 2011. During 2010, we

determined that the fair values of certain of Media’s radio stations

were lower than their carrying value and we recorded a non-cash

impairment charge of $11 million, primarily resulting from the

weakening of advertising revenues in local markets.

Depreciation and Amortization Expense

The year-over-year increase in depreciation and amortization expense

was due to certain IT and network assets brought to use in 2011,

compared to 2010, and an increase in amortization of intangible

assets resulting from acquisitions over the past year.

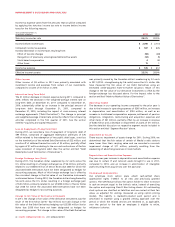

Stock-based Compensation

Our employee stock option plans attach cash-settled share

appreciation rights (“SARs”) to all new and previously granted

options. The SAR feature allows the option holder to elect to receive

in cash an amount equal to the intrinsic value, instead of exercising

the option and acquiring Class B Non-Voting shares. All outstanding

stock options are classified as liabilities and are carried at their fair

value, as adjusted for vesting, measured as using option pricing

models. The liability is marked-to-market each period and is

amortized to expense using a graded vesting approach over the

period in which the related services are rendered or, as applicable,

over the period to the date an employee is eligible to retire,

whichever is shorter.

46 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT