Rogers 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

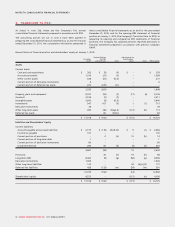

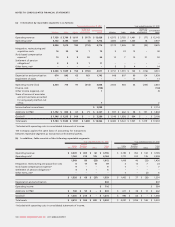

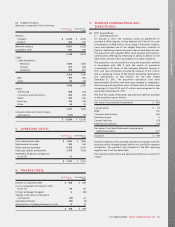

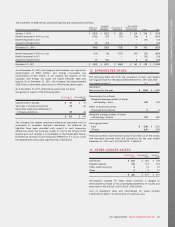

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Cash and cash equivalents $ (5) $ –

Accounts receivable (21) (37)

Other current assets – (1)

Property, plant and equipment (50) (46)

Goodwill (7) (7)

Intangible assets (103) (150)

Investments 167 213

Other long-term assets 2 –

Deferred tax assets (3) –

Bank advances – (5)

Accounts payable and accrued liabilities 20 33

Other long-term liabilities – remove

deferred gain 15 11

Adjustment to retained earnings before

income taxes 15 11

Related income tax effect (10) (9)

Adjustment to retained earnings $ 5 $ 2

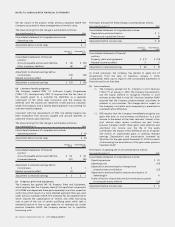

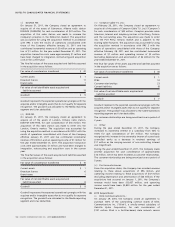

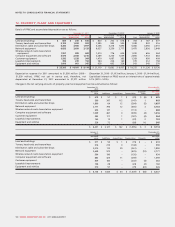

(g) Financial instruments – transaction costs:

The Company has applied IAS 39, Financial Instruments: Recognition

and Measurement (“IAS 39”), at January 1, 2010, which requires

directly attributable costs to be added to certain acquired financial

assets and liabilities and amortized to the consolidated statements of

income over the life of the asset or liability. Under previous Canadian

GAAP, these costs were expensed as incurred. Unamortized

transaction costs of $58 million related to the Company’s long-term

debt were adjusted upon transition. Additionally, unamortized

discounts recognized on long-term debt have been reclassified from

other long-term assets to conform with IFRS presentation

requirements.

The impact of the change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Finance costs – amortization $ 13

Finance costs – debt issuances (10)

Adjustment before income taxes $ 3

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Other long-term assets – reclassify

unamortized discounts $ (9) $ (9)

Long-term debt – reclassify unamortized

discounts 9 9

Long-term debt – unamortized transaction

costs 58 55

Adjustment to retained earnings before

income taxes 58 55

Related income tax effect (16) (15)

Adjustment to retained earnings $ 42 $ 40

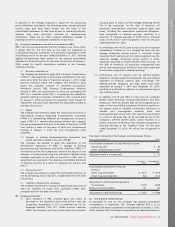

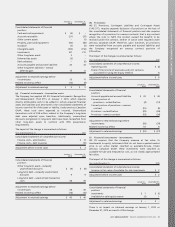

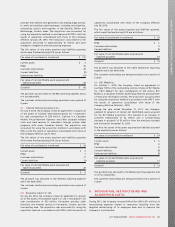

(h) Provisions:

IAS 37, Provisions, Contingent Liabilities and Contingent Assets

(“IAS 37”), requires separate disclosure of provisions on the face of

the consolidated statements of financial position and also requires

recognition of a provision for onerous contracts; that is any contract

where the costs to fulfill the contract exceed the benefits to be

received under the contract, neither of which were required under

previous Canadian GAAP. Therefore, upon transition, all provisions

were reclassified from accounts payable and accrued liabilities and

the Company recognized an onerous contract provision of

$29 million.

The impact of the changes is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Operating costs $ (2)

Share of the income of associates and joint ventures

accounted for using the equity method 8

Adjustment before income taxes $ 6

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Accounts payable and accrued liabilities $ 43 $ 48

Current portion of

provisions – reclassification (4) (12)

Current portion of provisions – onerous

contract (10) (9)

Provisions – reclassification (39) (36)

Provisions – onerous contract (19) (26)

Adjustment to retained earnings before

income taxes (29) (35)

Related income tax effect 10 8

Adjustment to retained earnings $ (19) $ (27)

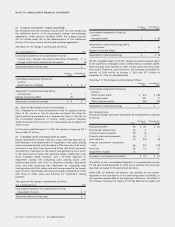

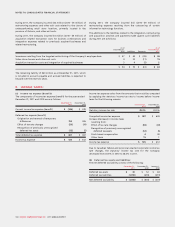

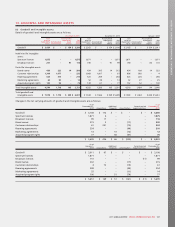

(i) Financial instruments – investments:

IAS 39 requires that the Company measure at fair value its

investments in equity instruments that do not have a quoted market

price in an active market classified as available-for-sale. Under

previous Canadian GAAP, these investments were classified as

available-for-sale and measured at cost, as cost closely approximated

fair value.

The impact of this change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Increase in fair value of available-for-sale investments $ 2

Adjustment before income taxes $ 2

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Investments $ 1 $ (1)

Available-for-sale equity reserve (1) 1

Adjustment to retained earnings $ – $ –

There is no impact on retained earnings at January 1, 2010 or

December 31, 2010 as a result of this change.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 97