Rogers 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

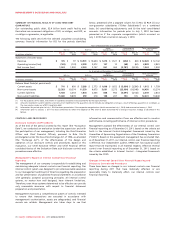

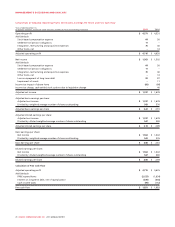

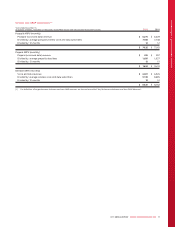

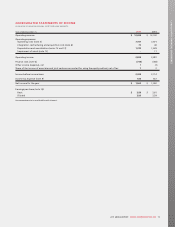

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(TABULAR AMOUNTS IN MILLIONS OF CANADIAN DOLLARS, EXCEPT PER SHARE AMOUNTS)

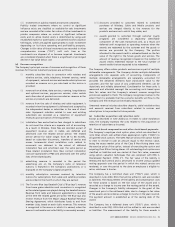

1. NATURE OF THE BUSINESS:

Rogers Communications Inc. (“RCI”) is a diversified Canadian

communications and media company, incorporated in Canada, with

substantially all of its operations and sales in Canada. Through its

Wireless segment (“Wireless”), RCI is engaged in wireless voice and

data communications services. RCI’s Cable segment (“Cable”) consists

of Cable Operations, Rogers Business Solutions (“RBS”) and Rogers

Video (“Video”). Through Cable Operations, RCI provides television,

high-speed Internet and telephony products primarily to residential

customers; RBS provides local and long-distance telephone, enhanced

voice and data networking services, and IP access to medium and large

Canadian businesses and governments; and Video offers digital video

disc (“DVD”) and video game sales and rentals. RCI is engaged in radio

and television broadcasting, televised shopping, consumer, trade and

professional publications, sports entertainment, and digital media

properties through its Media segment (“Media”). RCI and its subsidiary

companies are collectively referred to herein as the “Company”.

The Company’s registered office is located at 333 Bloor Street East,

10th Floor, Toronto, Ontario, M4W 1G9.

RCI Class A Voting and Class B Non-Voting shares are traded in Canada

on the Toronto Stock Exchange (“TSX”) and its Class B Non-Voting

shares are also traded on the New York Stock Exchange (“NYSE“).

2. SIGNIFICANT ACCOUNTING POLICIES:

(a) Statement of compliance:

These consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (“IFRS”)

as issued by the International Accounting Standards Board (“IASB”).

These are the Company’s first annual consolidated financial

statements prepared in accordance with IFRS, and the Company has

elected January 1, 2010 as the date of transition to IFRS

(the “Transition Date”). IFRS 1, First-time Adoption of IFRS (“IFRS 1”),

has been applied. An explanation of how the transition to IFRS has

affected the consolidated financial statements is included in note 3.

The consolidated financial statements of the Company for the years

ended December 31, 2011 and 2010 and as at January 1, 2010 were

approved by the Board of Directors on February 21, 2012.

(b) Basis of presentation:

The consolidated financial statements include the accounts of the

Company. Intercompany transactions and balances are eliminated on

consolidation.

The consolidated financial statements have been prepared mainly

under the historical cost convention. Other measurement bases used

are described in the applicable notes. The Company’s financial year

corresponds to the calendar year. The consolidated financial

statements are prepared in millions of Canadian dollars.

Presentation of the consolidated statements of financial position

differentiates between current and non-current assets and liabilities.

The consolidated statements of income are presented using the

nature classification for expenses.

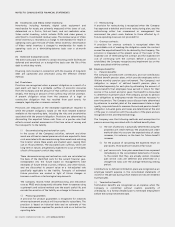

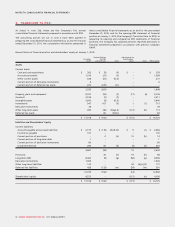

Concurrent with the impact of the transition to IFRS described in

note 3, the Company underwent a change in strategy which impacted

the Company’s management reporting resulting in changes to the

Company’s reportable segments. Commencing January 1, 2011, the

results of the former Rogers Retail segment are segregated as follows:

the results of operations of the Video business are presented as a

separate operating segment and the former Rogers Retail segment

results of operations related to wireless and cable products and

services are included in the results of operations of Wireless and Cable

Operations, respectively. In addition, certain intercompany

transactions between the Company’s RBS segment and other

operating segments, which were previously recorded as revenue in

RBS and operating expenses in the other operating segments, are

recorded as cost recoveries in RBS beginning January 1, 2011. The

effect of these changes in management reporting on the

comparatives for 2010 was a decrease in RBS revenue of $108 million

and a decrease in RBS operating costs of $108 million, and a decrease

in Video revenue of $212 million and a decrease in Video operating

costs of $206 million. These transactions were offset by elimination

entries resulting in no effect to the consolidated revenue or operating

costs.

(c) Basis of consolidation:

(i) Subsidiaries:

Subsidiaries are entities controlled by the Company. The

financial statements of subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date that control ceases.

The acquisition method of accounting is used to account for the

acquisition of subsidiaries as follows:

• consideration transferred is measured as the fair value of the

assets given, equity instruments issued and liabilities incurred

or assumed at the date of exchange, and acquisition

transaction costs are expensed as incurred;

• identifiable assets acquired and liabilities assumed are

measured at their fair values at the acquisition date;

• the excess of the fair value of consideration transferred

including the recognized amount of any non-controlling

interest of the acquiree over the fair value of the identifiable

net assets acquired is recorded as goodwill; and

• if the fair value of the consideration transferred is less than

the fair value of the net assets acquired, the difference is

recognized directly in the consolidated statements of income.

(ii) Investments in associates and joint ventures:

The Company’s interests in investments in associates and joint

ventures are accounted for using the equity method of

accounting. Associates are those entities in which the Company

has significant influence, but not control, over the financial and

operating policies. Significant influence is presumed to exist

when the Company holds between 20 and 50 percent of the

voting power of another entity. Joint ventures are those entities

over whose activities the Company has joint control, established

by contractual agreement and requiring unanimous consent for

strategic financial and operating decisions.

The investments in associates and joint ventures are initially

recognized at cost. The carrying amount is increased or

decreased to recognize, in net income, the Company’s share of

the income or loss of the investee after the date of acquisition.

Distributions received from an investee reduce the carrying

amount of the investment.

84 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT