Rogers 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

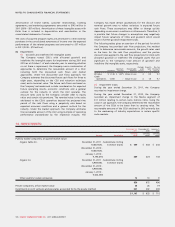

liabilities, is to reclassify the current deferred tax asset of $220 million

at January 1, 2010 and $159 million at December 31, 2010 to

non-current and reclassify $87 million at January 1, 2010 and

$52 million at December 31, 2010 from deferred tax liability to

deferred tax asset.

IFRS requires that subsequent changes to the tax effect of items

recorded in OCI in previous years be also recorded in OCI, where

previously this was recorded in the consolidated statements of

income. The impact of this difference on transition is to reduce equity

reserves by $16 million and increase opening retained earnings by

$16 million.

In addition, the Company reclassified an amount of $61 million at

January 1, 2010 and $138 million at December 31, 2010 from income

tax payable to deferred tax liability as compared to amounts

previously reported under Canadian GAAP relating to its investment

in its wholly-owned operating partnership.

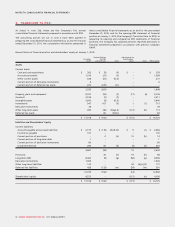

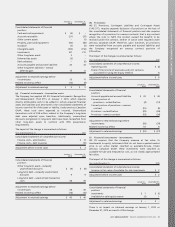

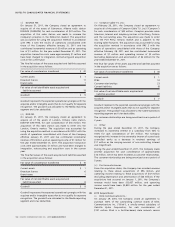

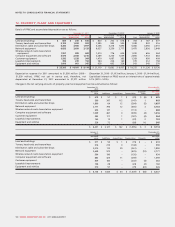

(n) The above changes decreased (increased) shareholders’ equity (each net of related tax) as follows:

Note January 1,

2010 December 31,

2010

Employee benefits (b) $ 130 $ 185

Stock-based compensation (c) 11 18

Customer loyalty programs (d) (3) (1)

Property, plant and equipment (e) 8 7

Joint ventures (f) (5) (2)

Financial instruments–transaction costs (g) (42) (40)

Provisions (h) 19 27

Financial instruments–hedge accounting (j) (6) (1)

Impairment of assets (l) – 4

Income tax impact transferred from equity reserves (16) (16)

Adjustment to retained earnings 96 181

Equity reserves–available-for-sale investments (i) (1) 1

Equity reserves–hedging (j) 6 1

Income tax impact transferred to retained earnings 16 16

Adjustment to shareholders’ equity $ 117 $ 199

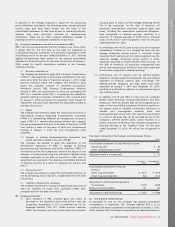

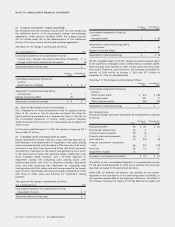

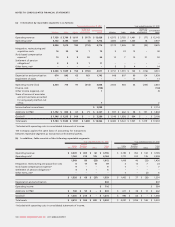

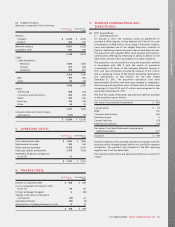

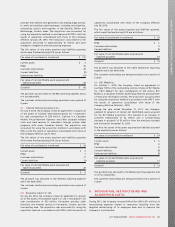

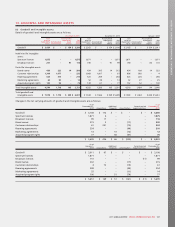

4. SEGMENTED INFORMATION:

OPERATING SEGMENTS:

Management reviews the operations of the Company by business

segments. Effective January 1, 2011, the results of the business

segments were reclassified to reflect the change in strategy as

described in note 2(b). These business segments are the primary

operating segments and are described as follows:

(a) Wireless–This segment provides retail and business voice and

data wireless communications services.

(b) Cable–This segment provides cable television, cable telephony

and high speed Internet access and telephony products primarily

to residential customers. The Cable business consists of the

following three sub segments:

(i) Cable Operations segment which provides cable services,

high speed Internet service and Rogers Home Phone;

(ii) RBS segment offers local and long-distance telephone,

enhanced voice and data services, and IP access to medium

and large Canadian businesses and governments; and

(iii) Video segment operates a DVD and video game sale and

rental business.

(c) Media–This segment operates the Company’s radio and

television broadcasting operations, televised shopping,

consumer, trade and professional publications, sports

entertainment, and digital media properties.

The accounting policies of the segments are the same as those

described in the significant accounting policies note 2 to the

Company’s consolidated financial statements. The Company discloses

segment operating results based on income before integration,

restructuring and acquisition costs, stock-based compensation

expense, loss on settlement of pension obligations, other items,

depreciation and amortization, impairment of assets, finance costs,

other income (loss), share of income of associates and joint ventures

accounted for using the equity method, and income taxes, consistent

with internal management reporting. This measure of segment

operating results differs from operating income in the consolidated

statements of income. All of the Company’s reportable segments are

substantially in Canada.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 99