Rogers 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

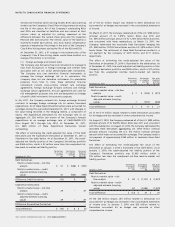

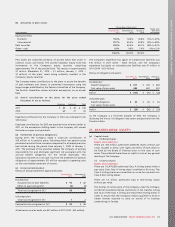

(c) Subsidiaries and joint ventures:

The following are the significant subsidiaries and joint ventures of the Company:

Ownership interest

Jurisdiction of

incorporation December 31,

2011 December 31,

2010 January 1,

2010

Subsidiaries:

Rogers Holdings Inc. Canada 100%100% 100%

Rogers Media Inc. Canada 100%100% 100%

FIDO Solutions Inc. Canada 100%100% 100%

Rogers Wireless Alberta Inc. Canada –100% 100%

Rogers Communications Partnership Canada 100%100% –

Rogers Broadcasting Limited Canada 100%100% 100%

Rogers Publishing Limited Canada 100%100% 100%

Blue Jays Holdco Inc. Canada 100%100% 100%

Joint ventures:

Inukshuk Wireless Inc. Canada 50%50% 50%

Dome Productions Inc. Canada 50%50% 50%

The annual financial statement reporting period of the Company is

the same as the annual financial statement reporting periods of all its

subsidiaries and joint ventures. There are no significant restrictions on

the ability of subsidiaries, joint ventures and associates to transfer

funds to the Company in the form of cash dividends or to repay loans

or advances.

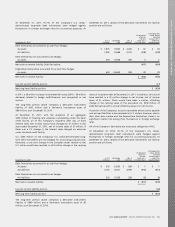

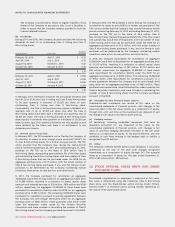

The following business transactions were carried out with the

Company’s joint ventures and associates. Transactions between the

Company and its subsidiaries have been eliminated on consolidation

and are not disclosed in this note.

Transaction value

2011 2010

Revenue:

Joint ventures and associates – Rent, parking,

interconnect fees $1$–

Purchases:

Joint ventures and associates – Network access

fees 12 13

Access fees paid to broadcasters 17 16

Production fees 20 14

License fees and service obligation 21

The sales to and purchases from the Company’s joint ventures and

associates are made at terms equivalent to those that prevail in arm’s

length transactions. Outstanding balances at the year-end are

unsecured, interest free and settlement occurs in cash. The

outstanding balances with these related parties relating to similar

business transactions as at December 31, 2011 was $5 million

(December 31, 2010 – $4 million; January 1, 2010 – $4 million).

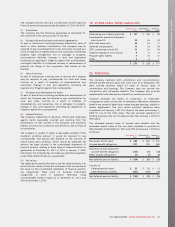

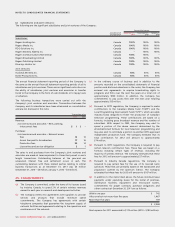

25. COMMITMENTS:

(a) The Company is committed, under the terms of its licences issued

by Industry Canada, to spend 2% of certain wireless revenues

earned in each year on research and development activities.

(b) The Company enters into agreements with suppliers to provide

services and products that include minimum spend

commitments. The Company has agreements with certain

telephone companies that guarantee the long-term supply of

network facilities and agreements relating to the operations and

maintenance of the network.

(c) In the ordinary course of business and in addition to the

amounts recorded on the consolidated statements of financial

position and disclosed elsewhere in the notes, the Company has

entered into agreements to acquire broadcasting rights to

programs and films over the next five years at a total cost of

approximately $950 million. In addition, the Company has

commitments to pay access fees over the next year totalling

approximately $15 million.

(d) Pursuant to CRTC regulation, the Company is required to make

contributions to the Canadian Media Fund (“CMF”) and the

Local Programming Improvement Fund (“LPIF”), which are cable

industry funds designed to foster the production of Canadian

television programming. These contributions are based on a

formula, including gross broadcast revenue and the number of

subscribers. With respect to CMF, the Company may elect to

spend a portion of the above amount determined by the

aforementioned formula for local television programming and

may also elect to contribute a portion to another CRTC-approved

independent production fund. The Company estimates that its

total contribution for 2012 will amount to approximately

$74 million.

(e) Pursuant to CRTC regulations, the Company is required to pay

certain telecom contribution fees. These fees are based on a

formula including certain types of revenue, including the

majority of wireless revenue. The Company estimates that these

fees for 2012 will amount to approximately $27 million.

(f) Pursuant to Industry Canada regulations, the Company is

required to pay certain fees for the use of its licenced radio

spectrum. These fees are primarily based on the bandwidth and

population covered by the spectrum licence. The Company

estimates that these fees for 2012 will amount to $107 million.

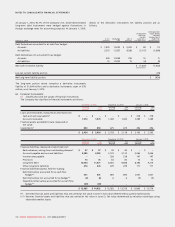

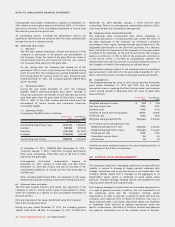

(g) In addition to the items listed above, the future minimum lease

payments under operating leases for the rental of premises,

distribution facilities, equipment and microwave towers,

commitments for player contracts, purchase obligations and

other contracts at December 31, 2011 are as follows:

Within one year $ 742

After one but not more than five years 1,467

More than five years 159

$ 2,368

Rent expense for 2011 amounted to $172 million (2010 – $180 million).

124 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT