Rogers 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Of the $286 million year-over-year increase in our consolidated

revenue, Wireless contributed $165 million, Cable Operations

contributed $119 million and Media contributed $150 million,

partially offset by decreases in revenue of $47 million in RBS and

$61 million in Video, and an increase in corporate items and

eliminations of $40 million.

Of the $81 million year-over-year increase in our consolidated

adjusted operating profit, Cable Operations contributed $130 million,

RBS contributed $46 million, Video contributed $10 million and Media

contributed $49 million, partially offset by a decrease in Wireless of

$137 million and an increase in corporate items and eliminations of

$17 million.

Refer to the respective individual segment discussions for details of

the revenue, operating expenses, operating profit and additions to

PP&E of Wireless, Cable and Media.

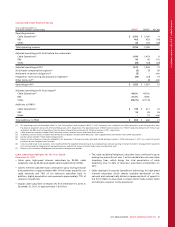

2011 Performance Against Targets

The following table sets forth the guidance ranges for selected

full-year financial and operating metrics that we provided for 2011

versus the actual results we achieved for the year. We achieved

performance consistent with our adjusted operating profit and

after-tax free cash flow financial objectives that were set forth for

2011, and additions to PP&E exceeded the high end of our guidance

range by $77 million, which was primarily related to the accelerated

deployment of our LTE 4G wireless network.

(In millions of dollars)

IFRS

2010

Actual

2011 Guidance

Range $ (As at

February 16, 2011) 2011

Actual

Consolidated Guidance

Adjusted operating profit(1) $ 4,635 $ 4,600 to $ 4,765 $ 4,716

Additions to PP&E(2) 1,834 1,950 to 2,050 2,127

After-tax free cash flow(3) 1,983 1,850 to 1,975 1,851

(1) Excludes (i) stock-based compensation expense; (ii) integration, restructuring and

acquisition expenses; (iii) settlement of pension obligations; and (iv) other items,

net.

(2) Includes additions to Wireless, Cable Operations, Media, RBS, Video and

Corporate PP&E expenditures.

(3) After-tax free cash flow is defined as adjusted operating profit less PP&E

expenditures, interest on long-term debt (net of capitalization) and cash income

taxes, and is not a defined term under IFRS.

2012 FINANCIAL GUIDANCE

The following table outlines guidance ranges and assumptions for

selected 2012 financial metrics. This information is forward-looking

and should be read in conjunction with the section entitled “Caution

Regarding Forward-Looking Statements, Risks and Assumptions” and

the related disclosures, for the various economic, competitive, and

regulatory assumptions and factors that could cause actual future

financial and operating results to differ from those currently

expected.

Full Year 2012 Guidance

(In millions of dollars) 2011

Actual 2012

Guidance

Consolidated Guidance

Adjusted operating profit(1) $ 4,716 $ 4,730 to $ 4,915

Additions to PP&E(2) 2,127 2,075 to 2,175

Pre-tax free cash flow(3) 1,950 1,950 to 2,050

Cash income taxes 99 425 to 475

(1) Excludes (i) stock-based compensation expense (recovery); (ii) integration,

restructuring and acquisition expenses; (iii) settlement of pension obligations;

and (iv) other items, net.

(2) Includes additions to Wireless, Cable Operations, Media, RBS, Video and

Corporate PP&E expenditures.

(3) Pre-tax free cash flow is defined as adjusted operating profit less PP&E

expenditures and interest on long-term debt (net of capitalization), and is not a

defined term under IFRS.

2. SEGMENT REVIEW

WIRELESS

WIRELESS BUSINESS

Wireless is the largest Canadian wireless communications service

provider, serving approximately 9.3 million retail voice and data

subscribers at December 31, 2011, representing approximately 35% of

Canadian wireless subscribers. Wireless operates on the global

standard Global System for Mobile communications/High-Speed

Packet Access/Long Term Evolution (“GSM/HSPA/LTE”) wireless

network technology platforms.

Wireless customers are able to access their services in most parts of

the world through roaming agreements with various other GSM and

HSPA wireless network operators. Rogers has one of the largest

roaming footprints and number of available destinations for its

customers’ wireless usage in the world. With each roaming

agreement, Rogers has established a direct relationship with the

operator rather than implementing third party services. Wireless has

generally negotiated wireless roaming with multiple operators within

the majority of its roaming destinations in order to eliminate the

possibility of its customers travelling in an area without coverage. This

coverage depth also helps to ensure that Wireless’ customers roam on

the best possible network available in a specific destination.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 25