Rogers 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(o) Property, plant and equipment:

(i) Recognition and measurement:

Items of PP&E are measured at cost less accumulated depreciation

and accumulated impairment losses. Cost includes expenditures

that are directly attributable to the acquisition of the asset. The

cost of self-constructed assets includes the cost of materials and

direct labour, any other costs directly attributable to bringing the

assets to a working condition for their intended use, the costs of

dismantling and removing the items and restoring the site on

which they are located, and borrowing costs on qualifying assets

for which the commencement date of acquisition, construction or

development is on or after January 1, 2010.

The cost of the initial cable subscriber installation is capitalized.

Costs of other cable connections and disconnections are

expensed, except for direct incremental installation costs related

to reconnect Cable customers, which are deferred to the extent

of reconnect installation revenues. Deferred reconnect revenues

and expenses are amortized over the related estimated service

period.

When parts of an item of PP&E have different useful lives, they

are accounted for as separate components of PP&E.

Gains and losses on disposal of an item of PP&E are determined

by comparing the proceeds from disposal with the carrying

amount of PP&E, and are recognized within other income in the

consolidated statements of income.

(ii) Subsequent costs:

Subsequent costs are included in the asset’s carrying amount or

recognized as a separate asset only when it is probable that

additional future economic benefits associated with the

subsequent expenditures will flow to the Company and the costs

of the item can be reliably measured. All other expenditures are

charged to operating expenses as incurred.

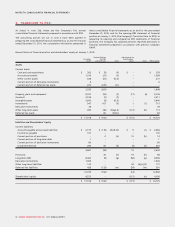

(iii) Depreciation:

PP&E are stated at cost less accumulated depreciation and any

impairment losses.

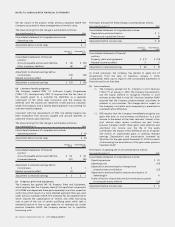

Depreciation is charged to the consolidated statements of income over their estimated useful lives as follows:

Asset Basis Rate

Buildings Mainly diminishing balance 4% to 18%

Towers, head-ends and transmitters Straight-line 6-2/3% to 25%

Distribution cable and subscriber drops Straight-line 5% to 20%

Network equipment Straight-line 6-2/3% to 33-1/3%

Wireless network radio base station equipment Straight-line 12-1/2% to 14-1/3%

Computer equipment and software Straight-line 14-1/3% to 33-1/3%

Customer equipment Straight-line 20% to 33-1/3%

Leasehold improvements Straight-line Over shorter of estimated

useful life and lease term

Equipment and vehicles Mainly diminishing balance 5% to 33-1/3%

Depreciation methods, rates and residual values are reviewed

annually and revised if the current method, estimated useful life

or residual value is different from that estimated previously. The

effect of such changes is recognized in the consolidated

statements of income prospectively.

(p) Acquired program rights:

Program rights represent contractual rights acquired from third parties to

broadcast television programs. Acquired program rights for broadcasting

are carried at cost less accumulated amortization, and accumulated

impairment losses, if any. Acquired program rights and the related

liabilities are recorded on the consolidated statements of financial position

when the licence period begins and the program is available for use. The

cost of acquired program rights is amortized to other external purchases

in the consolidated statements of income over the expected exhibition

period of 1 to 5 years. If program rights are not scheduled, they are

considered impaired and written off. Otherwise, they are subject to

non-financial asset impairment testing as intangible assets with finite

useful lives. Program rights for multi-year sports programming

arrangements are expensed as incurred, when the games are aired.

(q) Goodwill and intangible assets:

(i) Goodwill:

Goodwill is the amount that results when the fair value of

consideration transferred for an acquired business exceeds the net

fair value of the identifiable assets, liabilities and contingent

liabilities recognized. When the Company enters into a business

combination, the acquisition method of accounting is used.

Goodwill is assigned, as of the date of the business combination, to

cash generating units that are expected to benefit from the business

combination. Each cash generating unit represents the lowest level

at which goodwill is monitored for internal management purposes

and it is never larger than an operating segment.

(ii) Intangible assets:

Intangible assets acquired in a business combination are

recorded at their fair values. Intangible assets with finite useful

lives are amortized over their estimated useful lives and are

tested for impairment, as described in note 2(r). Useful lives,

residual values and amortization methods for intangible assets

with finite useful lives are reviewed at least annually.

Intangible assets having an indefinite life, being spectrum and

broadcast licences, are not amortized but are tested for

impairment on an annual basis, as described in note 2(r).

Spectrum licences and broadcast licences are indefinite life

intangible assets, because there is no foreseeable limit to the

period over which these assets are expected to generate net cash

inflows for the Company. The determination of these assets’

indefinite life is based on an analysis of all relevant factors,

including the expected usage of the asset, the typical life cycle of

the asset and anticipated changes in the market demand for the

products and services that the asset helps generate.

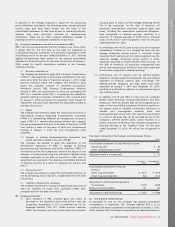

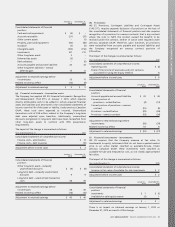

Intangible assets with finite useful lives are amortized on a

straight-line basis over their estimated useful lives as follows:

Brand names 5 to 20 years

Customer relationships 2 to 5 years

Roaming agreements 12 years

Marketing agreements 2 to 5 years

During the year ended December 31, 2011, no significant

changes were made in estimated useful lives compared to 2010.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 89