Rogers 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company has contributed certain assets to joint ventures (note

24(c)). Certain investments in private companies are carried at a

nominal amount, as the fair market value is not determinable.

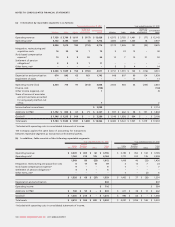

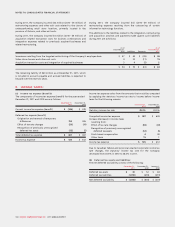

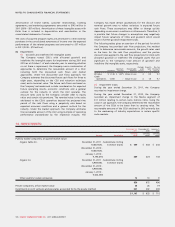

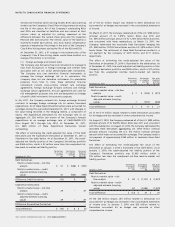

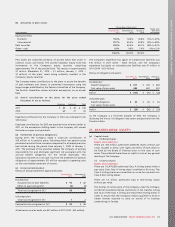

The following presents the summarized financial information of the

Company’s portion of joint ventures that are recorded by the

Company as investments accounted for using the equity method:

December 31,

2011 December 31,

2010 January 1,

2010

Statements of financial

position:

Current assets $12 $12 $13

Non-current assets 219 223 183

Current liabilities 768

Non-current liabilities 52 54 16

Net assets 172 175 172

December 31,

2011 December 31,

2010

Statements of comprehensive income:

Revenues $68$68

Expenses 62 61

There are no contingent liabilities or capital commitments relating to

the Company’s joint venture interests or relating to the joint ventures

themselves. The financial statements of the joint ventures and

associates are prepared for the same reporting period as the

Company. When necessary, adjustments are made to conform the

accounting policies in line with those of the Company.

On December 9, 2011, the Company announced that it, along with

BCE Inc., is jointly acquiring a net 75 percent equity interest in Maple

Leaf Sports & Entertainment Ltd. (“MLSE”) from the Ontario Teachers’

Pension Plan. MLSE is one of Canada’s largest sports and

entertainment companies and owns and operates, among other

things, the Air Canada Centre, the NHL’s Toronto Maple Leafs, the

NBA’s Toronto Raptors, the MLS’s Toronto FC and the AHL’s Toronto

Marlies. The Company’s net cash commitment, following a planned

leveraged recapitalization of MLSE, will total approximately

$533 million, representing a 37.5% equity interest in MLSE. The

transaction is expected to close in mid 2012. The timing and

completion of the transaction is subject to regulatory and league

approvals, customary closing conditions and termination rights.

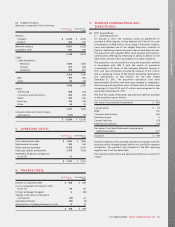

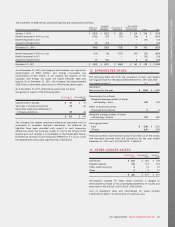

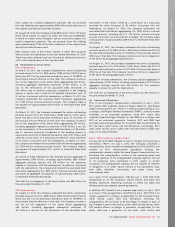

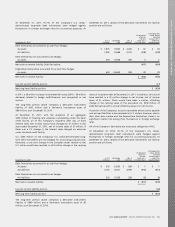

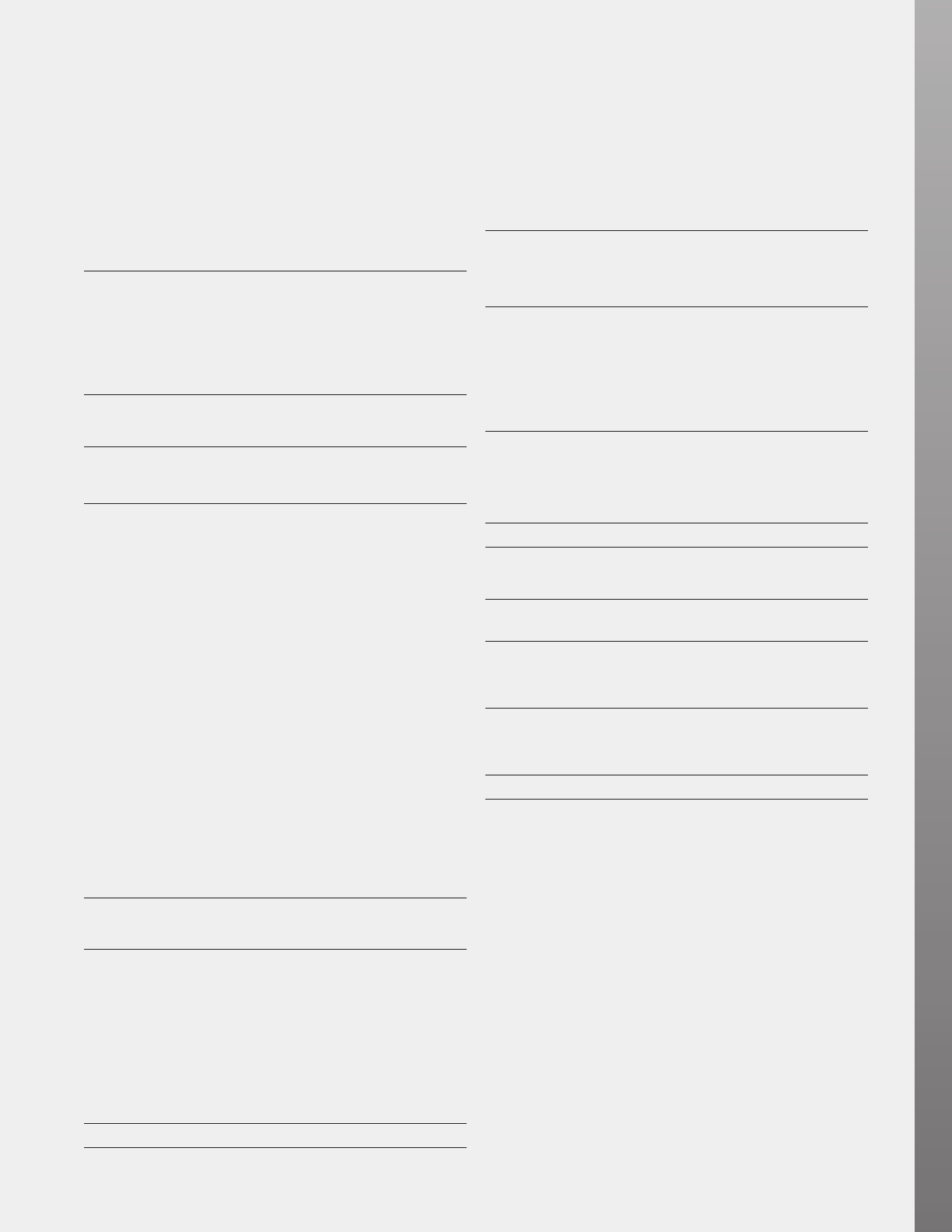

15. OTHER LONG-TERM ASSETS:

December 31,

2011 December 31,

2010 January 1,

2010

Deferred pension asset (note

20) $33 $26 $13

Indefeasible right of use

agreements 25 27 29

Long-term receivables 16 47 23

Cash surrender value of life

insurance 15 13 11

Deferred installation costs 12 14 16

Deferred compensation 10 10 12

Other 23 10 9

$ 134 $ 147 $ 113

Amortization of certain long-term assets for the year

ended December 31, 2011 amounted to $5 million (2010 – $1 million).

Accumulated amortization as at December 31, 2011, amounted to

$11 million (December 31, 2010 – $6 million; January 1, 2010 – $5 million).

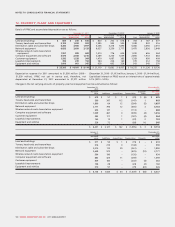

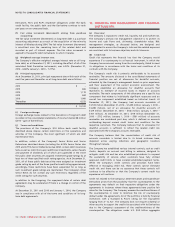

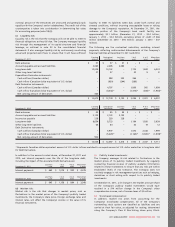

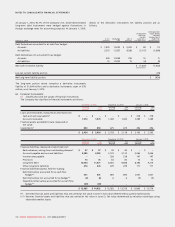

16. PROVISIONS:

Details of provisions are as follows:

Decommissioning

and restoration

obligations Onerous

contracts Other Total

January 1, 2010 $ 18 $ 29 $ 25 $ 72

Additions – 8 24 32

Adjustment to existing

provisions – 9 (1) 8

Amounts used (2) (11) (12) (25)

Unused amounts

reversed – – (4) (4)

December 31, 2010 16 35 32 83

Additions 4 2 8 14

Adjustment to existing

provisions 6 – – 6

Amounts used – (13) (17) (30)

December 31, 2011 $ 26 $ 24 $ 23 $ 73

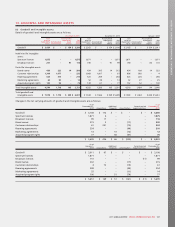

Decommissioning

and restoration

obligations Onerous

contracts Other Total

Current $ 1 $ 11 $ 2 $ 14

Long-term 17 18 23 58

January 1, 2010 18 29 25 72

Current $ 2 $ 9 $ 10 $ 21

Long-term 14 26 22 62

December 31, 2010 16 35 32 83

Current 6 23 6 35

Long-term 20 1 17 38

December 31, 2011 $ 26 $ 24 $ 23 $ 73

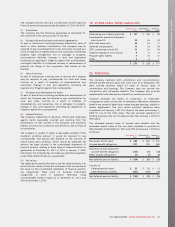

In the course of the Company’s activities, a number of sites and other

PP&E assets are utilized which are expected to have costs associated

with exiting and ceasing their use. The associated decommissioning

and restoration obligation cash outflows are generally expected to

occur at the dates of exit of the assets to which they relate, which are

long-term in nature. The extent of restoration work that will be

ultimately be required for these sites is uncertain.

The provisions for onerous contracts relate to contracts that have

costs to fulfill in excess of the economic benefits to be obtained.

These include non-cancellable contracts, which are expected to be

completed within two years.

The other provisions include product guarantee provisions and legal

provisions.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 109