Rogers 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

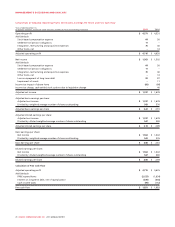

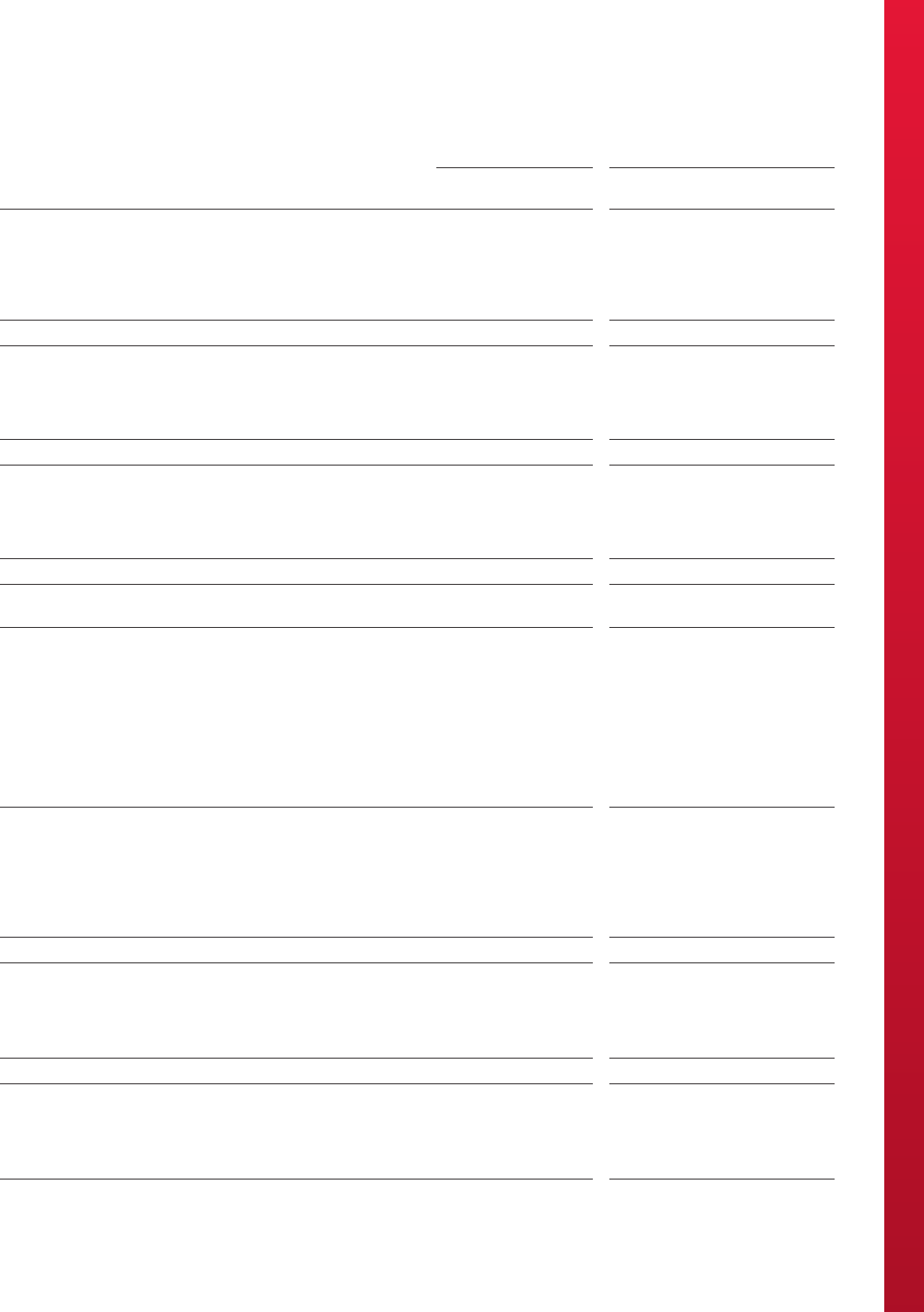

MANAGEMENT’S DISCUSSION AND ANALYSIS

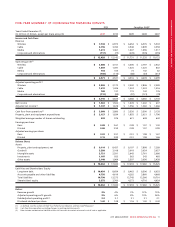

FIVE-YEAR SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

IFRS Canadian GAAP

Years Ended December 31,

(In millions of dollars, except per share amounts) 2011 2010 2009 2008 2007

Income and Cash Flow:

Revenue

Wireless $ 7,138 $ 6,973 $ 6,654 $ 6,335 $ 5,503

Cable 3,796 3,785 3,948 3,809 3,558

Media 1,611 1,461 1,407 1,496 1,317

Corporate and eliminations (117) (77) (278) (305) (255)

$ 12,428 $ 12,142 $ 11,731 $ 11,335 $ 10,123

Operating profit(1)

Wireless $ 3,008 $ 3,151 $ 3,006 $ 2,797 $ 2,532

Cable 1,559 1,391 1,325 1,220 802

Media 154 105 73 142 82

Corporate and eliminations (150) (116) (88) (81) (317)

$ 4,571 $ 4,531 $ 4,316 $ 4,078 $ 3,099

Adjusted operating profit(1)

Wireless $ 3,036 $ 3,173 $ 3,042 $ 2,806 $ 2,589

Cable 1,612 1,426 1,324 1,233 1,016

Media 180 131 119 142 176

Corporate and eliminations (112) (95) (97) (121) (78)

$ 4,716 $ 4,635 $ 4,388 $ 4,060 $ 3,703

Net income $ 1,563 $ 1,502 $ 1,478 $ 1,002 $ 637

Adjusted net income(1) $ 1,747 $ 1,678 $ 1,556 $ 1,260 $ 1,066

Cash flow from operations(2) $ 3,960 $ 3,880 $ 3,526 $ 3,500 $ 3,135

Property, plant and equipment expenditures $ 2,127 $ 1,834 $ 1,855 $ 2,021 $ 1,796

Weighted average number of shares outstanding 543 576 621 638 642

Earnings per share:

Basic $ 2.88 $ 2.61 $ 2.38 $ 1.57 $ 1.00

Diluted 2.86 2.59 2.38 1.57 0.99

Adjusted earnings per share:

Basic $ 3.22 $ 2.91 $ 2.51 $ 1.98 $ 1.67

Diluted 3.19 2.89 2.51 1.98 1.66

Balance Sheet:

Assets

Property, plant and equipment, net $ 9,114 $ 8,437 $ 8,197 $ 7,898 $ 7,289

Goodwill 3,280 3,108 3,018 3,024 3,027

Intangible assets 2,721 2,591 2,643 2,761 2,086

Investments 1,107 933 563 343 485

Other assets 2,140 1,964 2,597 3,056 2,438

$ 18,362 $ 17,033 $ 17,018 $ 17,082 $ 15,325

Liabilities and Shareholders’ Equity

Long-term debt $ 10,034 $ 8,654 $ 8,463 $ 8,506 $ 6,033

Accounts payable and other liabilities 4,756 4,619 4,282 3,860 4,668

Total liabilities 14,790 13,273 12,745 12,366 10,701

Shareholders’ equity 3,572 3,760 4,273 4,716 4,624

$ 18,362 $ 17,033 $ 17,018 $ 17,082 $ 15,325

Ratios:

Revenue growth 2% 4% 3% 12% 15%

Adjusted operating profit growth 2% 6% 8% 10% 26%

Debt/adjusted operating profit(3) 2.2 2.1 2.1 2.1 2.1

Dividends declared per share $ 1.42 $ 1.28 $ 1.16 $ 1.00 $ 0.42

(1) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”.

(2) Cash flow from operations excluding changes in working capital amounts.

(3) Debt includes net derivative liabilities at the risk free mark-to-market value and is net of cash as applicable.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 71