Rogers 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

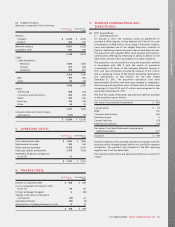

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(ii) BOUNCE FM:

On January 31, 2011, the Company closed an agreement to

acquire all of the assets of Edmonton, Alberta radio station

BOUNCE (CHBN-FM) for cash consideration of $22 million. The

acquisition of this radio station was made to increase the

Company’s presence in the Edmonton market. The acquisition

was accounted for using the acquisition method in accordance

with IFRS 3 with the results of operations consolidated with

those of the Company effective January 31, 2011 and has

contributed incremental revenue of $3 million and an operating

loss of $1 million for the year ended December 31, 2011. The

acquisition transaction costs were approximately $1 million and

have been charged to integration, restructuring and acquisition

costs in the current year.

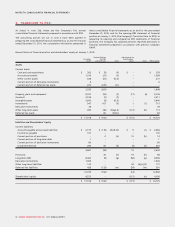

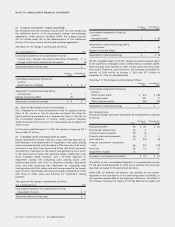

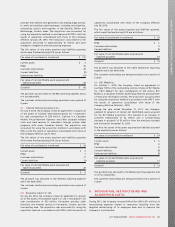

The final fair values of the assets acquired and liabilities assumed

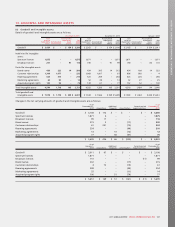

in the acquisition are as follows:

Fair value of consideration transferred $ 22

Current assets $ 1

Broadcast licence 11

Brand name 1

Fair value of net identifiable assets acquired and

liabilities assumed 13

Goodwill $ 9

Goodwill represents the expected operational synergies with the

acquiree and/or intangible assets that do not qualify for separate

recognition. The goodwill was allocated to the Media reporting

segment and is tax deductible.

(iii) BOB-FM:

On January 31, 2011, the Company closed an agreement to

acquire all of the assets of London, Ontario radio station,

BOB-FM (CHST-FM), for cash consideration of $16 million. The

acquisition of this radio station was made to enter into the

London, Ontario market. The acquisition was accounted for

using the acquisition method in accordance with IFRS 3 with the

results of operations consolidated with those of the Company

effective January 31, 2011 and has contributed incremental

revenue of $5 million and an operating income of $1 million for

the year ended December 31, 2011. The acquisition transaction

costs were approximately $1 million and have been charged to

integration, restructuring and acquisition costs in the current

year.

The final fair values of the assets acquired and liabilities assumed

in the acquisition are as follows:

Fair value of consideration transferred $ 16

Current assets $ 1

Broadcast licence 6

Brand name 1

Fair value of net identifiable assets acquired and

liabilities assumed 8

Goodwill $ 8

Goodwill represents the expected operational synergies with the

acquiree and/or intangible assets that do not qualify for separate

recognition. The goodwill was allocated to the Media reporting

segment and is tax deductible.

(iv) Compton Cable T.V. Ltd.:

On February 28, 2011, the Company closed an agreement to

acquire all of the assets of Compton Cable T.V. Ltd. (“Compton”)

for cash consideration of $40 million. Compton provides cable

television, Internet and telephony services in Port Perry, Ontario

and the surrounding area. The acquisition was made to enter

into the Port Perry, Ontario market and is adjacent to the

existing Cable footprint. The acquisition was accounted for using

the acquisition method in accordance with IFRS 3 with the

results of operations consolidated with those of the Company

effective February 28, 2011 and has contributed incremental

revenue of $7 million and operating income of $3 million

(excluding depreciation and amortization of $6 million) for the

year ended December 31, 2011.

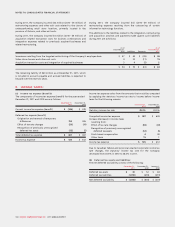

The final fair values of the assets acquired and liabilities assumed

in the acquisition are as follows:

Fair value of consideration transferred $ 40

Current assets $ 1

PP&E 10

Customer relationships 23

Current liabilities (1)

Fair value of net identifiable assets acquired and

liabilities assumed 33

Goodwill $ 7

Goodwill represents the expected operational synergies with the

acquiree and/or intangible assets that do not qualify for separate

recognition. The goodwill was allocated to the Cable Operations

reporting segment and is tax deductible.

The customer relationships are being amortized over a period of

3 years.

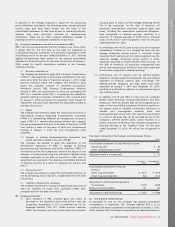

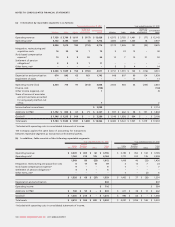

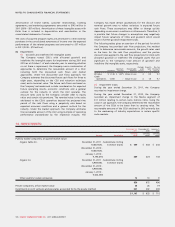

(v) Other:

During the year ended December 31, 2011, the Company

increased its ownership interest in a subsidiary from 53% to

100% for cash consideration of $11 million. The Company

recognized this increase in the ownership interest of a previously

controlled entity as a decrease in retained earnings of

$11 million as the carrying amount of non-controlling interest

was insignificant.

During the year ended December 31, 2011, the Company made

another acquisition for cash consideration of approximately

$16 million, which has been recorded as customer relationships.

The customer relationships are being amortized over a period of

5 years.

(vi) Pro forma disclosures:

Since the acquisition dates, the Company has recorded revenue

relating to these above acquisitions of $96 million, and

operating income relating to these acquisitions of $47 million

(excluding depreciation and amortization of $66 million). If the

acquisitions had occurred on January 1, 2011, the Company’s

revenue would have been $12,437 million, and operating

income would have been $2,830 million for the year ended

December 31, 2011.

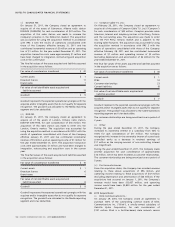

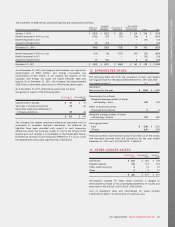

(b) 2010 Acquisitions:

(i) Blink Communications Inc.:

On January 29, 2010, the Company closed an agreement to

purchase 100% of the outstanding common shares of Blink

Communications Inc. (“Blink”), a wholly-owned subsidiary of

Oakville Hydro Corporation, for cash consideration of

$131 million. Blink is a facilities-based, data network service

102 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT