Rogers 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

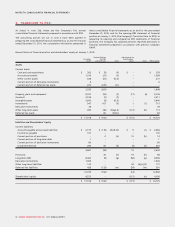

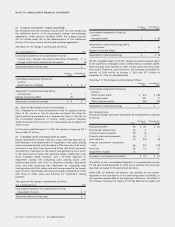

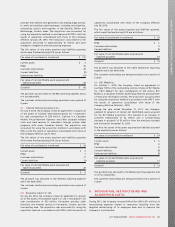

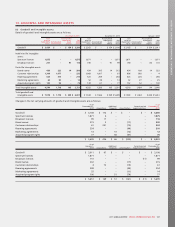

(c) Product revenue:

Revenue is comprised of the following:

December 31,

2011 December 31,

2010

Wireless:

Postpaid $ 6,275 $ 6,229

Prepaid 326 297

Network revenue 6,601 6,526

Equipment sales 537 447

7,1386,973

Cable:

Cable Operations:

Television 1,904 1,835

Internet 927 848

Telephony 478507

3,309 3,190

RBS 405 452

Video 82143

3,796 3,785

Media:

Advertising 838763

Circulation and subscription 303 234

Retail 263 265

Blue Jays 164 156

Other 43 43

1,611 1,461

Corporate items and intercompany

eliminations (117) (77)

$ 12,428$ 12,142

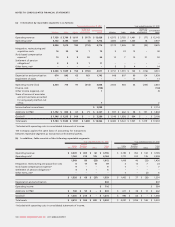

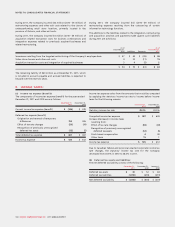

5. OPERATING COSTS:

December 31,

2011 December 31,

2010

Cost of equipment sales $ 1,454 $ 1,266

Merchandise for resale 209 260

Other external purchases 4,335 4,316

Employee salaries and benefits 1,7781,729

Settlement of pension obligations

(note 20) 11 –

$ 7,787$ 7,571

6. FINANCE COSTS:

December 31,

2011 December 31,

2010

Interest on long-term debt $668$ 669

Loss on repayment of long-term debt

(note 17) 99 87

Foreign exchange loss (gain) 6(20)

Change in fair value of derivative

instruments (14) 22

Capitalized interest (29) (3)

Amortization of deferred transaction costs 813

$738$ 768

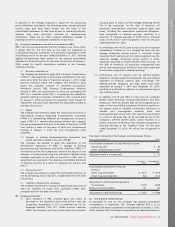

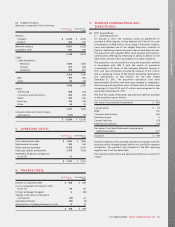

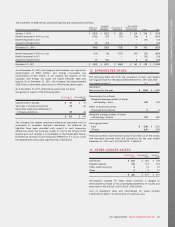

7. BUSINESS COMBINATIONS AND

DIVESTITURES:

(a) 2011 Acquisitions:

(i) Atria Networks LP:

On January 4, 2011, the Company closed an agreement to

purchase a 100% interest in Atria Networks LP (“Atria”) for cash

consideration of $426 million. Atria, based in Kitchener, Ontario,

owns and operates one of the largest fibre-optic networks in

Ontario, delivering premier business Internet and data services.

The acquisition will augment RBS’s small business and medium-

sized business offerings by enhancing its ability to deliver on-net

data centric services within and adjacent to Cable’s footprint.

The acquisition was accounted for using the acquisition method

in accordance with IFRS 3 with the results of operations

consolidated with those of the Company effective January 4,

2011 and has contributed incremental revenue of $72 million

and an operating income of $42 million (excluding depreciation

and amortization of $60 million) for the year ended

December 31, 2011. The acquisition transaction costs were

approximately $3 million and have been charged to integration,

restructuring and acquisition costs. Of these costs, $2 million was

recognized in fiscal 2010 and $1 million was recognized in the

year ended December 31, 2011.

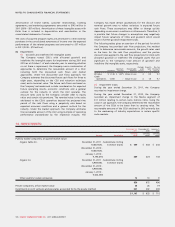

The final fair values of the assets acquired and liabilities assumed

in the acquisition are as follows:

Fair value of consideration transferred $ 426

Current assets $ 10

PP&E 132

Customer relationships 200

Spectrum licence 4

Current liabilities (17)

Deferred tax liabilities (52)

Fair value of net identifiable assets acquired and

liabilities assumed 277

Goodwill $ 149

Goodwill represents the expected operational synergies with the

acquiree and/or intangible assets that do not qualify for separate

recognition. The goodwill was allocated to the RBS reporting

segment and is not tax deductible.

The customer relationships are being amortized over a period of

5 years.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 101