Rogers 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOR A DETAILED DISCUSSION OF OUR FINANCIAL AND OPERATING METRICS AND RESULTS, PLEASE SEE THE ACCOMPANYING MD&A LATER IN THIS REPORT.

* Comprised of: Rogers, BCE, Bell Aliant, Cogeco, MTS, Quebecor, Shaw and Telus

(IN MILLIONS OF DOLLARS, EXCEPT PER SHARE, SUBSCRIBER AND EMPLOYEE DATA) 2011 2010 2009 2008 2007

Revenue $ 12,428 $ 12,142 $ 11,731 $ 11,335 $ 10,123

Adjusted operating profit 4,716 4,635 4,388 4,060 3,703

Adjusted operating profit margin 38% 38% 37% 36% 37%

Adjusted net income 1,747 1,678 1,556 1,260 1,066

Adjusted diluted earnings per share 3.19 2.89 2.51 1.98 1.66

Annualized dividend rate at year-end 1.42 1.28 1.16 1.00 0.50

Total assets 18,362 17,033 17,018 17,0 82 15, 325

Long-term debt (includes current portion) 10,034 8,654 8,464 8,507 6,033

Shareholders’ equity 3,572 3,760 4,273 4,716 4,624

Market capitalization of equity 20,736 19,435 19,476 23,679 29,614

Wireless subscribers (000s) 9,335 8,977 8,494 7,942 7,338

Cable subscribers (000s) 2,297 2,305 2,296 2,320 2,295

Internet subscribers (000s) 1,793 1,686 1,619 1,571 1,465

Cable telephony subscribers (000s) 1,052 1,003 937 840 656

Number of employees 28,745 27,971 28,985 29,200 27,900

FINANCIAL HIGHLIGHTS

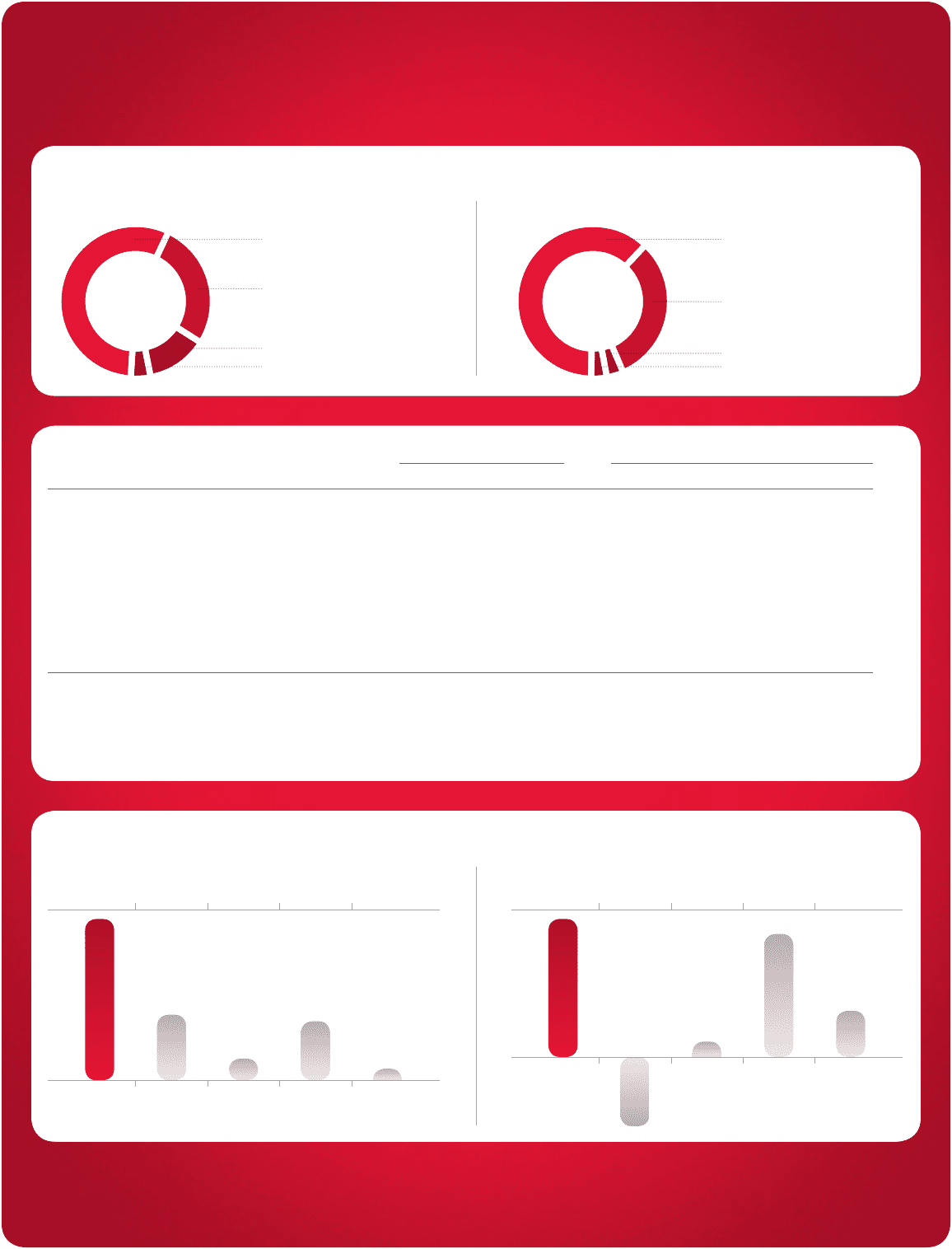

2011 CONSOLIDATED REVENUE AND OPERATING PROFIT PROFILE

REVENUE

$12.4

BILLION

WIRELESS 57%

CABLE OPERATIONS 27%

MEDIA 13%

BUSINESS SOLUTIONS 3%

ADJUSTED OPERATING PROFIT

$4.7

BILLION

TOTAL SHAREHOLDER RETURN

TEN-YEAR COMPARATIVE TOTAL RETURN: 2002–2011 ONE-YEAR COMPARATIVE TOTAL RETURN: 2011

RCI.B

on TSX

241%

S&P/TSX

COMPOSITE

INDEX

97%

S&P 500

INDEX

TSX*

TELECOM

AND CABLE

S&P 500

TELECOM

INDEX

33% 88% 17%

RCI.B

on TSX

18%

S&P/TSX

COMPOSITE

INDEX

(9)%

S&P 500

INDEX

TSX*

TELECOM

AND CABLE

S&P 500

TELECOM

INDEX

2% 16% 6%

2011 FINANCIAL HIGHLIGHTS

WIRELESS 62%

CABLE OPERATIONS 32%

MEDIA 4%

BUSINESS SOLUTIONS 2%

IFRS CDN GAAP