Rogers 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

United Kingdom, and Wireless expects the Canadian wireless industry

to continue to grow by approximately 4 percentage points of

penetration over the next several years. As penetration deepens, it

requires an increasing focus on customer satisfaction, the promotion

of new data and voice services to existing customers, and customer

retention.

Demand for Sophisticated Data Applications

The ongoing development of wireless data transmission technologies,

such as handsets and portable computing devices, has led wireless

device developers to develop more sophisticated smartphone type

devices with increasingly advanced capabilities, including access to

e-mail and other corporate information technology platforms, news,

sports, financial information and services, shopping services, photos,

music, applications, and streaming video clips, mobile television and

other functions. Wireless believes that the introduction of such new

devices and applications will continue to drive growth of wireless

data services.

Convergence of Technologies

Technologies across different platforms have been converging over

the past few years, and examples of such applications have been

proliferating across the industry. Wireless launched several such

applications in the market place, including a remote digital cable

terminal control application, where the user can manage their

recordings on the terminal from a smartphone or a tablet, and a live

TV content streaming application to smartphones and tablets.

Increased Competition from Other Wireless Operators

Wireless faces increased competition from incumbent wireless

operators as well as new entrants in the wireless market, which is fully

described in the section of this MD&A entitled “Competition in our

Businesses”. The new entrants have introduced new unlimited pricing

plans and extremely aggressive pricing and promotions which have

resulted in downward price adjustments and lower ARPU as well as

increases in customer churn for Wireless.

Migration to Next Generation Wireless Technology

The ongoing development of wireless data transmission technologies

and the increased demand for sophisticated wireless services,

especially data communications services, have led wireless providers

to migrate towards the next generation of digital voice and data

broadband wireless networks such as HSPA+ and LTE. These networks

are intended to provide wireless communications with wireline

quality sound, far higher data transmission speeds with increased

efficiency, and enhanced video streaming capabilities. These networks

support a variety of increasingly advanced data applications,

including broadband Internet access, multimedia services and

seamless access to corporate information systems, including desktop,

client and server-based applications that can be accessed on a local,

national or international basis. Wireless has been a leader in

deploying next generation technology with LTE. As at December 31,

2011, more than eight million Canadians already had access to Rogers’

LTE network, which will continue to expand during 2012.

Development of Additional Technologies

In addition to the two main technology paths of the mobile/

broadband wireless industry, namely GSM/HSPA and Code Division

Multiple Access/Evolution Data Optimized (“CDMA/EVDO”), the next

significant broadband wireless technology in deployment is LTE.

Wireless Interoperability for Microwave Access (“WiMAX”)

deployments have slowed down and several WiMAX operators have

announced plans to move over to LTE.

WiFi (the IEEE 802.11 industry standard) allows suitably equipped

devices, such as laptop computers and personal digital assistants, to

connect to a local area wireless access point. These access points

utilize unlicenced spectrum and the wireless connection is only

effective within a local area radius of approximately 50-100 metres of

the access point, and provide speeds similar to a wired local area

network (“LAN”) environment (most recently the version designated

as 802.11n). As the technology is primarily designed for in-building

wireless access, many access points must be deployed to cover the

selected local geographic area, and must also be interconnected with

a broadband network to supply the connectivity to the Internet.

Future enhancements to the range of WiFi service and the

networking of WiFi access points may provide additional

opportunities for wireless operators or municipal WiFi network

operators, each providing capacity and coverage under the

appropriate circumstances.

LTE, the worldwide GSM community’s new fourth generation (“4G”)

broadband wireless technology evolution path, is an all IP-based

wireless data technology based on a new modulation scheme

(orthogonal frequency-division multiplexing) that is specifically

designed to improve efficiency, lower costs, improve and expand the

range of voice and data services available via mobile broadband

wireless networks, make use of new spectrum allocations, and better

integrate with other open technology standards. As a 4G technology,

LTE is designed to build on and evolve the capabilities inherent in

UMTS/HSPA, which is the world standard for mobile broadband

wireless and standard upon which Wireless operates. LTE is fully

backwards compatible with UMTS/HSPA and is designed to provide

seamless voice and broadband data capabilities and data rates

capable of up to 150 Mbps. Wireless deployed and launched its LTE

network and services in 2011 as discussed above.

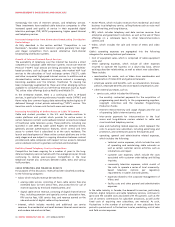

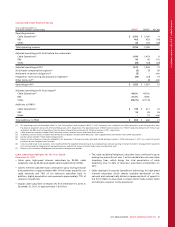

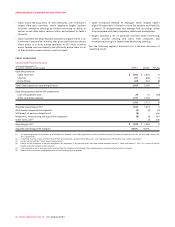

WIRELESS OPERATING AND FINANCIAL RESULTS

For purposes of this discussion, our Wireless segment revenue has

been classified according to the following categories:

• Network revenue, which includes revenue derived from:

• postpaid (voice and data services), which consist of revenues

generated principally from monthly fees, airtime, data usage,

long-distance charges, optional service charges, system access

and government cost recovery fees, and roaming charges; and

• prepaid (voice and data services), which consist of revenues

generated principally from airtime, data usage and other

ancillary charges such as long-distance and roaming.

• Equipment sales net of subsidies, which consist of revenue

generated from the sale, generally at or below our cost, of

hardware and accessories to independent dealers, agents and

retailers, and directly to subscribers through direct fulfillment by

Wireless’ customer service groups, websites and telesales.

Wireless’ operating expenses are segregated into the following

categories for assessing business performance:

• Cost of equipment sales, which is comprised of wireless equipment

costs; and

• Other operating expenses, which includes all other expenses

incurred to operate the business on a day-to-day basis, service

existing subscriber relationships, as well as attract new subscribers.

These include:

• employee salaries and benefits, such as remuneration, bonuses,

pension, employee benefits and stock-based compensation; and

• other external purchases, such as:

• service costs, including inter-carrier payments to roaming

partners and long-distance carriers, network service delivery

costs, and the Canadian Radio-television Telecommunications

Commission (“CRTC”) contribution levy;

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 27