Rogers 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company is authorized to refuse to register transfers of any

shares of the Company to any person who is not a Canadian in

order to ensure that the Company remains qualified to hold the

licences referred to above.

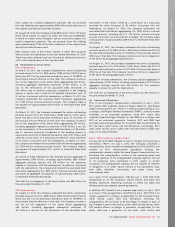

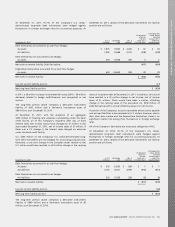

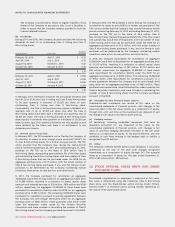

(b) Dividends:

During 2011 and 2010, the Company declared and paid the following

dividends on each of its outstanding Class A Voting and Class B

Non-Voting shares:

Date declared Date paid Dividend

per share

February 16, 2010 April 1, 2010 $ 0.32

April 29, 2010 July 2, 2010 0.32

August 18, 2010 October 1, 2010 0.32

October 26, 2010 January 4, 2011 0.32

$ 1.28

February 15, 2011 April 1, 2011 $ 0.355

April 27, 2011 July 4, 2011 0.355

August 17, 2011 October 3, 2011 0.355

October 26, 2011 January 4, 2012 0.355

$ 1.42

In February 2011, the Board increased the annualized dividend rate

from $1.28 to $1.42 per Class A Voting and Class B Non-Voting share

to be paid quarterly in amounts of $0.355 per share on each

outstanding Class A Voting and Class B Non-Voting share.

Consequently, the Class A Voting shares may receive a dividend at a

quarterly rate of up to $0.355 per share only after the Class B

Non-Voting shares have been paid a dividend at a quarterly rate of

$0.355 per share. The Class A Voting and Class B Non-Voting shares

share equally in dividends after payment of a dividend of $0.355 per

share for each class. Such quarterly dividends are only payable as and

when declared by the Board and there is no entitlement to any

dividends prior thereto.

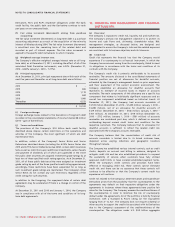

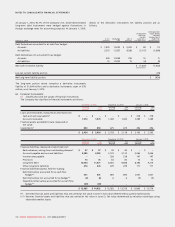

(c) Normal course issuer bid:

In February 2011, the TSX accepted a notice filed by the Company of

its intention to renew its prior normal course issuer bid (“NCIB”) for

its class B Non-Voting shares for a further one-year period. The TSX

notice provides that the Company may, during the twelve-month

period commencing February 22, 2011 and ending February 21, 2012,

purchase on the TSX up to the lesser of 39.8 million Class B

Non-Voting shares, representing approximately 9% of the then issued

and outstanding Class B Non-Voting shares, and that number of Class

B Non-Voting shares that can be purchased under the NCIB for an

aggregate purchase price of $1.5 billion, with the actual number of

Class B Non-Voting shares purchased, if any, and the timing of such

purchases to be determined by the Company considering market

conditions, share prices, its cash position, and other factors.

In 2011, the Company purchased for cancellation an aggregate

30,942,824 Class B Non-Voting shares for an aggregate purchase price

of $1,099 million, resulting in a reduction to stated capital, share

premium and retained earnings of $30 million, $870 million and $199

million, respectively. An aggregate 21,942,824 of these shares were

purchased for cancellation directly under the NCIB for an aggregate

purchase price of $814 million. The remaining 9,000,000 shares were

purchased for cancellation pursuant to private agreements between

the Company and arm’s-length third-party sellers for an aggregate

purchase price of $285 million. These purchases were made under

issuer bid exemption orders issued by the Ontario Securities

Commission and were included in calculating the number of Class B

Non-Voting shares that the Company purchased pursuant to the NCIB.

In February 2010, the TSX accepted a notice filed by the Company of

its intention to renew its prior NCIB for a further one-year period. The

TSX notice provides that the Company may, during the twelve-month

period commencing February 22, 2010 and ending February 21, 2011,

purchase on the TSX up to the lesser of 43.6 million Class B

Non-Voting shares, representing approximately 9% of the then issued

and outstanding Class B Non-Voting shares, and that number of Class

B Non-Voting shares that can be purchased under the NCIB for an

aggregate purchase price of $1.5 billion, with the actual number of

Class B Non-Voting shares purchased, if any, and the timing of such

purchases will be determined by the Company considering market

conditions, share prices, its cash position, and other factors.

In 2010, the Company repurchased for cancellation an aggregate

37,080,906 Class B Non-Voting shares for an aggregate purchase price

of $1,312 million, resulting in a reduction to stated capital, share

premium and retained earnings of $37 million, $1,191 million and

$84 million, respectively. An aggregate 22,600,906 of these shares

were repurchased for cancellation directly under the NCIB for an

aggregate purchase price of $830 million. The remaining 14,480,000

of these shares were repurchased for cancellation pursuant to a

private agreement between the Company and an arm’s-length third

party seller for an aggregate purchase price of $482 million. These

purchases were made under issuer bid exemption orders issued by the

Ontario Securities Commission and were included in calculating the

number of Class B Non-Voting shares that the Company purchased

pursuant to the NCIB.

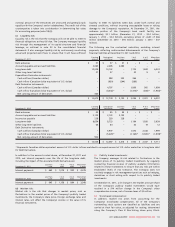

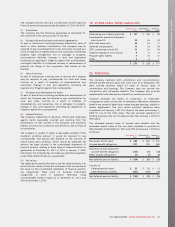

(d) Available-for-sale financial assets reserve:

Available-for-sale investments are carried at fair value on the

consolidated statements of financial position, with changes in fair

value recorded in the fair value reserve as a component of equity,

through OCI, until such time as the investments are disposed of and

the change in fair value is recorded in profit and loss.

(e) Hedging reserve:

All derivatives, including embedded derivatives that must be

separately accounted for, are measured at fair value on the

consolidated statements of financial position, with changes in fair

value of cash-flow hedging derivatives recorded in the fair value

reserve as a component of equity, to the extent effective, until the

variability of cash flows relating to the hedged asset or liability is

recognized in profit and loss.

(f) Other:

The Company’s defined benefit pension plan obligation is actuarially

determined at the end of the year with changes recognized

immediately as a component of equity through OCI. The actuarial

losses as a component of equity for the year ended December 31,

2011 is $67 million (2010 – $59 million).

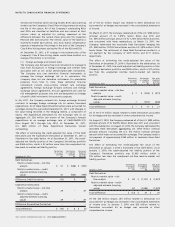

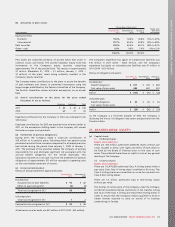

22. STOCK OPTIONS, SHARE UNITS AND SHARE

PURCHASE PLANS:

Stock-based compensation to employees is measured at fair value.

Fair value is determined using the Company’s Class B Non-Voting

share price, and the Black-Scholes option pricing model (“Black-

Scholes model”) or trinomial option pricing models, depending on

the nature of the share-based award.

120 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT