Rogers 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

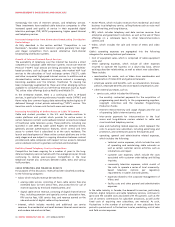

(%)

2011 WIRELESS REVENUE MIX

POSTPAID VOICE 56%

DATA 33%

PREPAID VOICE 3%

EQUIPMENT 8%

Wireless Products and Services

Wireless offers wireless voice, data and messaging services including

related handset devices and accessories, across Canada. Wireless’

services are generally all available under either postpaid or prepaid

payment options. Wireless’ networks provide customers with

advanced high-speed wireless data services, including mobile access to

the Internet, e-mail, digital picture and video transmission, mobile

video, music and application downloading, video calling, two-way

short messaging service (“SMS” or “text messaging”), and an

increasing number of machine-to-machine wireless applications.

Wireless Distribution

Wireless’ nationwide distribution network includes: an independent

dealer network; Rogers Wireless, Fido and chatr stores; major retail

chains; and convenience stores. Wireless markets its products and

services under the Rogers Wireless, Fido and chatr brands through an

extensive nationwide distribution network across Canada of

approximately 3,400 dealer and retail third party locations and

approximately 360 Rogers owned retail locations. The distribution

network sells its service plans and devices, and there are also

thousands of additional locations selling its prepaid services. Wireless

also offers many of its products and services through telemarketing

and on the rogers.com, fido.ca and chatrwireless.com e-business

websites.

Wireless Networks and Spectrum

Wireless is a facilities-based carrier operating its wireless networks

over a broad, national coverage area, much of which is

interconnected by its own fibre-optic and broadband microwave

transmission infrastructure. The seamless, integrated nature of its

networks enables subscribers to make and receive calls and to activate

network features anywhere in Wireless’ coverage area and in the

coverage area of roaming partners as easily as if they were in their

home area.

Wireless’ underlying GSM/General Packet Radio Service/Enhanced

Data for GSM Evolution (“GSM/GPRS/EDGE”) network provides

coverage to approximately 95% of Canada’s population. Overlaying

the infrastructure used for the GSM network is a next generation

wireless data technology called Universal Mobile Telephone System/

Evolved HSPA (“UMTS/HSPA+”) which covers approximately 91% of

the population with wireless data services at speeds capable of up to

42 Mbps. Further overlaying the infrastructure is the latest generation

wireless data technology called LTE which covers approximately 32%

of the population with wireless data service speeds capable of up to

150 Mbps. Wireless was first in Canada in deploying LTE across the

country, starting with Ottawa in July 2011 and followed by Toronto,

Montreal and Vancouver. By the end of 2011, the LTE network

expanded to several cities around the Greater Toronto Area such as

Mississauga, Brampton, Vaughan, Richmond Hill and Markham, and

the Greater Vancouver Area, such as West and North Vancouver, Port

Coquitlam, Delta, Langley, Surrey and Maple Ridge.

Wireless holds 25 MHz of contiguous spectrum across Canada in the

850 MHz frequency range and 60 MHz in the 1900 MHz frequency

range across the country, with the exception of southwestern

Ontario, northern Québec, and the Yukon, Northwest and Nunavut

territories, where Wireless holds 50 MHz in the 1900 MHz frequency

range. Wireless also has Advanced Wireless Services (“AWS”)

spectrum, which operates in the 1700/2100 MHz frequency range,

across all 10 provinces and 3 territories.

Wireless also holds certain broadband fixed wireless spectrum in the

2300 MHz, 2500 MHz and 3500 MHz frequency ranges, together with

Bell Canada, through an equally-owned joint venture called Inukshuk.

Late in 2011, Rogers and Bell Canada jointly agreed to dissolve the

Inukshuk joint venture during 2012 and split the jointly owned

spectrum between the two parties.

Rogers has initiated a network sharing arrangement with Manitoba

Telecom Services (“MTS”) for the purpose of building a joint HSPA+

3.5G wireless network in the province of Manitoba. This joint network

was completed in 2010 and was launched during the first quarter of

2011 covering approximately 96% of the Manitoba population. In

addition, Rogers completed a business network sharing arrangement

with TBayTel that enables our combined base of customers in North

Western Ontario to receive HSPA+ 3.5G wireless services under a joint

brand (TBayTel with the power of Rogers) and Rogers customers in

the rest of Canada to receive such services within the Thunder Bay

coverage area in North Western Ontario.

WIRELESS STRATEGY

Wireless’ objective is to drive profitable growth within the Canadian

wireless communications industry, and its strategy is designed to

maximize subscriber share, cash flow and return on invested capital.

The key elements of its strategy are as follows:

• Continually enhancing its scale and competitive position in the

Canadian wireless communications market;

• Focusing on offering innovative voice and wireless data services

into the targeted youth, family, and small and medium-sized

business segments, and specifically to drive increased penetration

of smartphones and other advanced wireless devices;

• Enhancing the customer experience through ongoing focus

principally in the areas of wireless devices, network quality and

customer service in order to maximize service revenue and

minimize customer deactivations, or churn;

• Increasing revenue from existing customers by cross-selling and

up-selling innovative new wireless data and other enhanced and

converged services to wireless voice customers;

• Enhancing and expanding owned and third party sales distribution

channels to deliver products, services and support to customers;

• Maintaining the most technologically advanced, high-quality and

national wireless network possible with global coverage enabled

by widely adopted global standard network technologies; and

• Leveraging relationships across the Rogers group of companies to

provide bundled product and service offerings at attractive prices

to common customers, in addition to implementing cross-selling,

distribution and branding initiatives as well as leveraging

infrastructure sharing opportunities.

RECENT WIRELESS INDUSTRY TRENDS

Focus on Customer Retention

The wireless communications industry’s current market penetration in

Canada is estimated to be 78% of the population, compared to

approximately 103% in the U.S. and approximately 122% in the

26 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT