Rogers 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Cable Additions to Property, Plant and Equipment

Cable additions to PP&E are classified into the following categories:

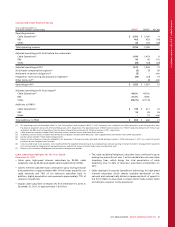

Years ended December 31,

(In millions of dollars) 2011 2010 % Chg

Additions to PP&E

Customer premise equipment $ 225 $ 234 (4)

Scalable infrastructure 267 201 33

Line extensions 47 43 9

Upgrades and rebuild 13 20 (35)

Support capital 196 113 73

Total Cable Operations 748611 22

RBS 55 38 45

Video –13 n/m

Total additions to PP&E $803 $ 662 21

The Cable Operations segment categorizes its PP&E expenditures

according to a standardized set of reporting categories that were

developed and agreed to by the U.S. cable television industry and

that facilitate comparisons of additions to PP&E between different

cable companies. Under these industry definitions, Cable Operations

additions to PP&E are classified into the following five categories:

• Customer premise equipment (“CPE”), which includes the

equipment for digital set-top terminals, Internet modems and

associated installation costs;

• Scalable infrastructure, which includes non-CPE costs to meet

business growth and to provide service enhancements;

• Line extensions, which includes network costs to enter new service

areas;

• Upgrades and rebuild, which includes the costs to modify or

replace existing co-axial cable, fibre-optic equipment and network

electronics; and

• Support capital, which includes the costs associated with the

purchase, replacement or enhancement of non-network assets.

Additions to Cable PP&E include continued investments in the cable

network to continue to enhance the customer experience through

increased speed and performance of our Internet service and capacity

enhancements to our digital network to allow for incremental HD

and on-demand services to be added.

The increase in Cable Operations PP&E for 2011, resulted from higher

scalable infrastructure and support capital expenditures due to

projects associated with quality related investments on IPv6

compliance initiatives, timing of spend on infrastructure projects and

development work on new video platform capabilities. Support

capital investments that contributed to the increase relate to

customer billing systems and platforms for new services. Lower

investments in set top boxes due to lower subscriber activity and

lower unit pricing contributed to the decrease in Customer premise

equipment for 2011.

The increase in RBS PP&E additions for 2011 reflects increased activity

and timing of expenditures on customer networks and support

capital.

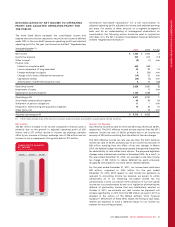

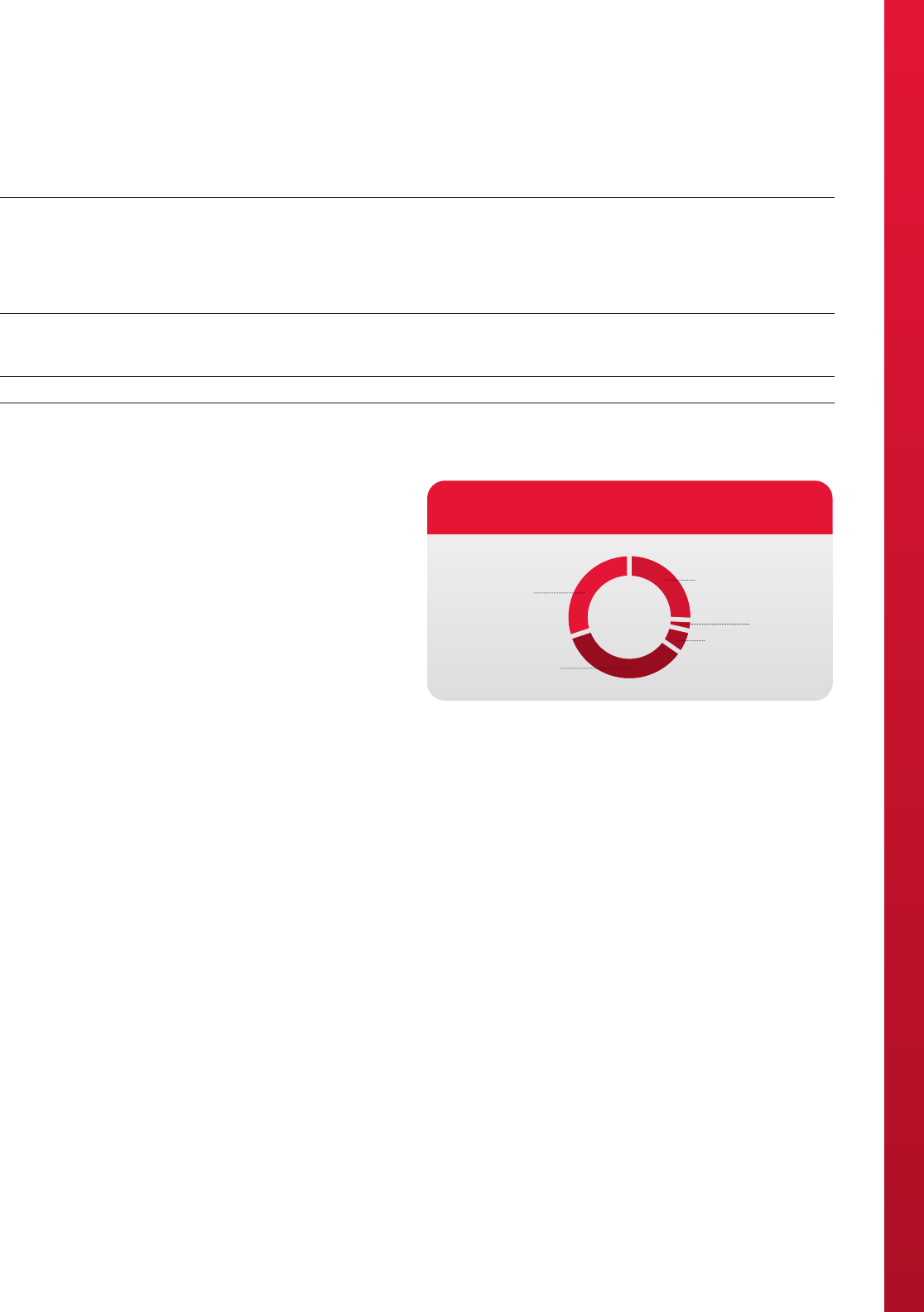

(%)

2011 CABLE OPERATIONS ADDITIONS TO PP&E

CUSTOMER PREMISE

EQUIPMENT 30%

SUPPORT CAPITAL 26%

LINE EXTENSIONS 6%

UPGRADES AND

REBUILD 2%

SCALABLE

INFRESTRUCTURE 36%

MEDIA

MEDIA’S BUSINESS

Media operates our television and radio broadcasting assets,

consumer and trade publications, nationally-televised home shopping

service and Sports Entertainment. Media is also focused on the

explosive growth in digital properties and has invested significantly in

infrastructure and people to grow our digital operations by

producing and acquiring content for our on-line and mobile

platforms, selling advertising on behalf of other digital content

providers and operating e-commerce businesses.

Media’s broadcasting group (“Broadcasting”) comprises 55 radio

stations across Canada; the multicultural OMNI broadcast television

stations; the five-station Citytv broadcast television network; specialty

sports television services including Sportsnet, Sportsnet ONE and

Sportsnet World; other specialty services including Outdoor Life

Network, The Biography Channel (Canada), FX (Canada), G4 Canada,

and CityNews Channel; and The Shopping Channel, Canada’s only

nationally televised shopping service. Broadcasting also owns 50% of

Dome Productions, Canada’s leader in HD mobile sports and events

production and distribution services.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 41