Rogers 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

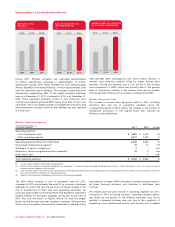

RBS Revenue

The decrease in RBS revenue for the year ended December 31, 2011,

primarily reflects the planned decline in certain categories of the

lower margin off-net legacy business, partially offset by growth in the

next generation IP and other on-net services. RBS’ focus is primarily

on IP-based services and increasingly on leveraging higher margin

on-net and near-net revenue opportunities utilizing both the

acquired Atria and Blink networks and Cable’s existing network

facilities to expand offerings to the medium-sized enterprise, public

sector and carrier markets. The lower margin off-net legacy business,

which includes long-distance, local and certain legacy data services,

continues to decline and is down 32% year-to-date. In comparison,

the higher margin next generation business is up 11%. For the year

ended December 31, 2011, the acquisition of Atria contributed

revenue of $72 million.

RBS Operating Expenses

Operating expenses decreased for the year ended December 31, 2011

compared to the corresponding period in 2010. This reflects a

planned decrease in the legacy service related costs due to lower

volumes and subscriber levels, permanent cost reductions resulting

from a 2010 restructuring of the employee base, lower sales within

certain customer segments, and operating efficiencies stemming from

the integration of Blink and Atria.

RBS Adjusted Operating Profit

The year-over-year growth in adjusted operating profit reflects the

acquisition of the higher margin Atria and Blink on-net data

businesses and RBS’ focus on growing its on-net next generation data

revenue. This strategic shift has more than offset the planned declines

in the lower margin legacy voice and data services. Cost reductions

and efficiency initiatives across various functions have also

contributed to higher operating profit margins in the quarter. For the

year ended December 31, 2011, the acquisition of Atria contributed

adjusted operating profit of $43 million, contributing to the growth

of the next generation services market, including data and Internet.

VIDEO

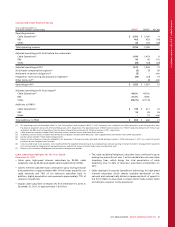

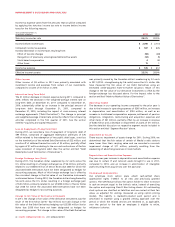

Summarized Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2011 2010 % Chg

Operating revenue $82$ 143 (43)

Operating expenses before the undernoted 105 176 (40)

Adjusted operating loss(1) (23) (33) (30)

Integration, restructuring and acquisition expenses(2) (14) (7) 100

Other items, net(3) –2 n/m

Operating loss(1) $ (37) $ (38) (3)

Adjusted operating loss margin(1) (28.0%)(23.1%)

(1) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(2) Costs relate to (i) severance costs resulting from the targeted restructuring of our employee base and (ii) the closure of certain Video stores.

(3) Relates to the resolution of accruals relating to prior periods.

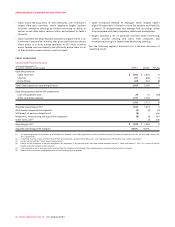

Video Revenue

The results of the Video segment include our video and game sale

and rental business which has been, and continues to be, restructured

and downsized coinciding with the declining market opportunity. The

decrease in Video revenue for 2011, compared to 2010, was the result

of a continued decline in video rental and sales activity and the

reduction of nearly 20% in the number of store locations since the

start of 2010.

Our initiative is to more deeply integrate our wireless, cable and

video rental distribution channels to better respond to changing

customer needs and preferences. As a result of the declining market

opportunity and the integration of our wireless and cable businesses,

certain facilities and stores associated principally with the Video

rental business have been, and will continue to be, closed.

Video Adjusted Operating Loss

The adjusted operating loss at Video decreased for 2011, compared to

2010, reflecting the changes and trends noted above.

CABLE ACQUISITIONS

Acquisition of Atria Networks LP

On January 4, 2011, Cable closed an agreement to purchase a 100%

interest in Atria for cash consideration of $426 million. Atria, based in

Kitchener, Ontario, owns and operates one of the largest fibre-optic

networks in Ontario, delivering premier business Internet and data

services. The acquisition will augment RBS’ small business and

medium-sized business offerings by enhancing its ability to deliver

on-net data centric services within and adjacent to Cable’s footprint.

The acquisition was accounted for using the acquisition method in

accordance with IFRS 3 with the results of operations consolidated

with those of ours effective January 4, 2011.

Acquisition of Compton Cable T.V. Ltd.

On February 28, 2011, Cable closed an agreement to acquire the assets

of Compton for cash consideration of $40 million. Compton provides

cable television, Internet and telephony services in Port Perry, Ontario

and the surrounding area. The acquisition was made to enter into the

Port Perry, Ontario market and is adjacent to the existing Cable

footprint. The acquisition was accounted for using the acquisition

method in accordance with IFRS 3 with the results of operations

consolidated with those of ours effective February 28, 2011.

40 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT