Rogers 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

The determination of the estimated useful lives of brand names

involves historical experience, marketing considerations and the

nature of the industries in which we operate. The useful lives of

subscriber bases are based on the historical churn rates of the

underlying subscribers and judgments as to the applicability of these

rates going forward. The useful lives of roaming agreements are

based on estimates of the useful lives of the related network

equipment. The useful lives of wholesale agreements and dealer

networks are based on the underlying contractual lives. The useful life

of the marketing agreement is based on historical customer lives. The

determination of the estimated useful lives of intangible assets

impacts amortization expense in the current period as well as future

periods. The impact on net income on a full-year basis of changing

the useful lives of the finite-lived intangible assets by one year is

shown in the chart below.

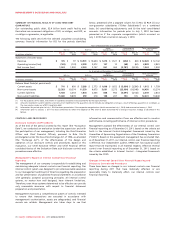

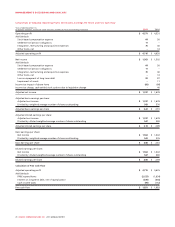

Impact of Changes in Estimated Useful Lives

(In millions of dollars) Amortization Period Increase in Net Income if

Life Increased by 1 year Decrease in Net Income if

Life Decreased by 1 year

Brand Names 5 – 20 years $ 1 $ (1)

Customer Relationships 2 – 5 years $ 13 $ (23)

Roaming Agreements 12 years $ 3 $ (4)

Marketing Agreements 2 – 5 years $ 3 $ (5)

Impairment of Assets

Indefinite-lived intangible assets, including goodwill and spectrum/

broadcast licences, as well as definite life assets, including PP&E and

other intangible assets, are assessed for impairment on an annual

basis or more often if events or circumstances warrant. A cash

generating unit (“CGU”) is the smallest identifiable group of assets

that generates cash inflows that are largely independent of the cash

inflows from other assets or groups of assets. Goodwill and indefinite

life intangible assets are allocated to CGUs for the impairment testing

based on the level at which management monitors it, which is not

higher than an operating segment. These analyses involve estimates

of future cash flows, estimated periods of use and applicable discount

rates. During 2011, no impairment was recorded. During 2010, we

recorded an impairment charge of $11 million related to certain of

our broadcast assets, due to the challenging economic conditions and

weakening industry expectations in the radio business and a decline

in advertising revenues.

Income Tax Estimates

The Company provides for income taxes based on currently available

information in each of the jurisdictions in which we operate. The

calculation of income taxes in many cases, however, requires

significant judgment in interpreting tax rules and regulations. The

Company’s tax filings are subject to audits, which could materially

change the amount of current and deferred income tax assets and

liabilities, and could, in certain circumstances, result in the assessment

of interest and penalties.

Additionally, estimation of the income provisions includes evaluating

the recoverability of deferred tax assets based on our assessment of

the ability to use the underlying future tax deductions before they

expire against future taxable income. Our assessment is based upon

existing tax laws, estimates of future profitability and tax planning

strategies. Deferred tax assets are recognized to the extent that it is

more likely than not that taxable profit will be available against

which the deferred tax assets can be utilized.

Credit Spreads and the Impact on Fair Value of Derivatives

Rogers’ Derivatives are recorded using an estimated credit-adjusted

mark-to-market valuation, which is determined by increasing the

treasury-related discount rates used to calculate the risk-free

estimated mark-to-market valuation by an estimated Bond Spread for

the relevant term and counterparty for each Derivative. In the case of

Derivatives in an asset position (i.e., those Derivatives for which the

counterparties owe Rogers), the Bond Spread for the bank

counterparty is added to the risk-free discount rate to determine the

estimated credit-adjusted value. In the case of Derivatives in a liability

position (i.e., those Derivatives for which Rogers owes the

counterparties), Rogers’ Bond Spread is added to the risk-free

discount rate. The estimated credit-adjusted values of the Derivatives

are subject to changes in credit spreads of Rogers and its

counterparties.

Pension Plans

When accounting for defined benefit pension plans, assumptions are

made in determining the valuation of benefit obligations and the

future performance of plan assets. The primary assumptions and

estimates include the discount rate, the expected return on plan

assets and the rate of compensation increase. Changes to these

primary assumptions and estimates would impact pension expense,

pension asset and liability, and other comprehensive income. The

current economic conditions may also have an impact on the pension

plan of the Company as there is no assurance that the plan will be

able to earn the assumed rate of return. As well, market-driven

changes may result in changes in the discount rates and other

variables which would result in the Company being required to make

contributions in the future that differ significantly from the current

contributions and assumptions incorporated into the actuarial

valuation process.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 67