Rogers 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

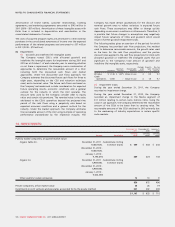

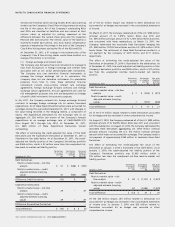

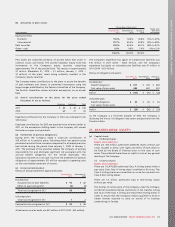

The following information is provided on pension fund assets

measured at December 31, 2011 and 2010 for the years then ended:

Years ended December 31, 2011 2010

Plan assets, January 1 $ 652 $ 541

Expected return on plan assets 44 40

Actuarial gain (loss) recognized in equity (17) 21

Contributions by employees 20 21

Contributions by employer 8060

Benefits paid (27) (31)

Plan settlements (68)–

Plan assets, December 31 $684$ 652

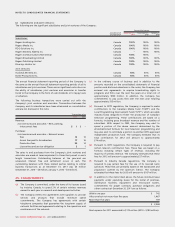

The following information is provided on pension fund assets

measured at January 1, 2010, including the adjustments from the

previously disclosed September 30, 2009 measurement date under

Canadian GAAP:

January 1,

2010

Plan assets, measured at September 30, 2009 $ 518

Actuarial gain recognized in equity 10

Contributions by employees 6

Contributions by employer 15

Benefits paid (8)

Plan assets, January 1, 2010 $ 541

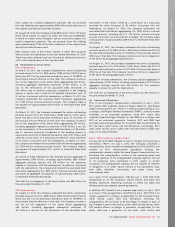

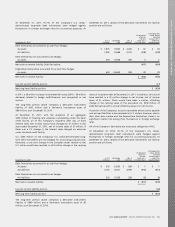

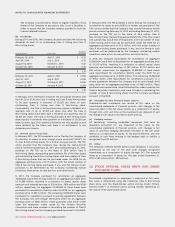

Accrued benefit obligations arising from funded obligations are

outlined below for the years ended December 31, 2011 and 2010:

Years ended December 31, 2011 2010

Accrued benefit obligations, January 1 $728$ 569

Service cost 36 25

Interest cost 44 40

Benefits paid (27) (31)

Contributions by employees 20 22

Actuarial loss recognized in equity 73 103

Plan settlements (57) –

Accrued benefit obligations, December 31 $817 $ 728

The following information is provided on accrued benefit obligations

measured at January 1, 2010 related to funded obligations including

the adjustments from the previously disclosed September 30, 2009

measurement date under Canadian GAAP:

January 1,

2010

Accrued benefit obligations, September 30, 2009 $ 526

Service cost 4

Interest cost 10

Benefits paid (9)

Contributions by employees 6

Actuarial loss recognized in equity 32

Accrued benefit obligations, January 1, 2010 $ 569

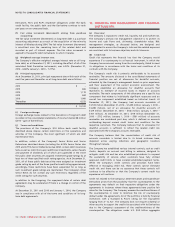

Net pension expense, which is included in employee salaries and

benefits expense, is outlined below:

Years ended December 31, 2011 2010

Plan cost:

Service cost $36 $25

Interest cost 44 40

Expected return on plan assets (44) (40)

Net pension expense 36 25

Plan settlements 11 –

Total pension cost recognized in the consolidated

statements of income $47 $25

The Company also provides supplemental unfunded pension benefits

to certain executives. The accrued benefit obligations relating to

these supplemental plans amounted to approximately $39 million at

December 31, 2011 (December 31, 2010 – $36 million; January 1,

2010 – $32 million), and the related expense for 2011 was $4 million

(2010 – $4 million). In connection with these plans, $1 million (2010 –

$2 million) of actuarial losses were recorded directly to OCI and

retained earnings.

Certain subsidiaries have defined contribution plans with total

pension expense of $2 million in 2011 (2010 – $2 million).

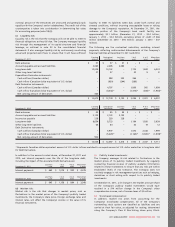

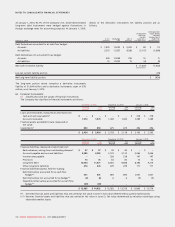

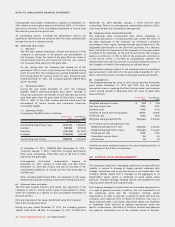

(a) Actuarial assumptions:

December 31,

2011 December 31,

2010 January 1,

2010

Weighted average discount rate used to determine accrued benefit obligations 5.5%5.9% 6.9%

Weighted average discount rate used to determine pension expense 6.0%6.9% N/A

Weighted average rate of compensation increase used to determine accrued benefit obligations 3.0%3.0% 3.0%

Weighted average rate of compensation increase used to determine pension expense 3.0%3.0% N/A

Weighted average expected long-term rate of return on plan assets 6.8% 7.0% 7.0%

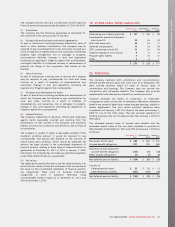

Expected return on assets represents management’s best estimate of

the long-term rate of return on plan assets applied to the fair value of

the plan assets. The Company establishes its estimate of the expected

rate of return on plan assets based on the fund’s target asset

allocation and estimated rate of return for each asset class. Estimated

rates of return are based on expected returns from fixed income

securities which take into account bond yields. An equity risk

premium is then applied to estimate equity returns. Differences

between expected and actual return are included in actuarial gains

and losses.

The estimated average remaining service periods for the plans range

from 8 to 11 years.

118 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT