Rogers 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

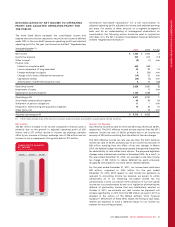

Cable Television Revenue

The increase in Cable Television revenue for 2011, compared to 2010,

reflects the continuing increase in penetration of our digital cable

product offerings and pricing changes. The increase in the year-over-

year growth rate of Cable Television revenue from 2010 to 2011

partially reflects the timing of annual pricing changes, which took

place in July 2010 and March 2011, combined with the cumulative

effect of targeted bundling and retention initiatives to transition

portions of the subscriber base to term contracts and a lower number

of subsidized digital box sales.

The digital cable subscriber base grew by 3% and represented 77% of

television households passed by our cable networks as at

December 31, 2011, compared to 75% as at December 31, 2010.

Increased demand from subscribers for the larger selection of digital

content, video on-demand, HDTV and PVR equipment continues to

contribute to the growth in the digital subscriber base and cable

television revenue.

Cable expects to begin a substantial conversion of the remaining

analog cable customers onto its digital cable platform during 2012

and 2013. This migration will enable the reclamation of significant

amounts of network capacity as well as reduce network operating

and maintenance costs going forward. The migration will entail

incremental PP&E and operating costs as each of the remaining

analog homes are fitted with digital converters and various analog

filtering equipment is removed.

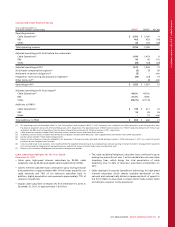

(In thousands)

DIGITAL HOUSEHOLDS AND

PENETRATION OF TELEVISION

CUSTOMERS

1,6641,733 1,777

2009 20102011

72% 75% 77%

(In thousands)

HIGH-DEFINITION

HOUSEHOLDS

715 850 942

2009 20102011

Cable Internet Revenue

The year-over-year increase in Internet revenue for 2011 primarily

reflects the increase in the Internet subscriber base, combined with

Internet services price changes made over the previous twelve

months. Also impacting the increase is the timing and mix of

promotional programs and a general movement by subscribers

towards higher end tiers and a modest increase in revenue from

additional usage.

With the high-speed Internet customer-base at approximately

1.8 million subscribers, Internet penetration is approximately 48% of

the homes passed by our cable networks and 78% of our television

subscriber base, as at December 31, 2011.

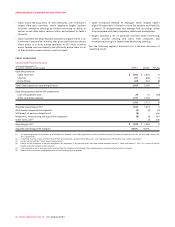

(In thousands)

INTERNET SUBSCRIBERS

AND PENETRATION

OF HOMES PASSED

1,6191,6861,793

2009 20102011

45% 45% 48%

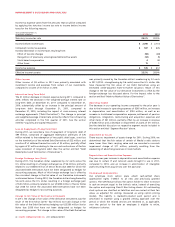

Home Phone Revenue

The year-over-year decrease in Home Phone revenue for 2011 reflects

the declines in revenue associated with the legacy circuit-switched

telephony base that Cable has divested over the past five quarters.

The decline was partially offset by the increase in the cable telephony

customer base combined with price changes in March 2011.

Home Phone revenue decreased year-over-year as a result of the

ongoing decline of the legacy circuit-switched telephony base,

partially offset by the growth in cable telephony lines of

approximately 5% for 2011. The decline of the legacy circuit-switched

telephony base included approximately 34,000 subscribers which were

migrated to a third party reseller during 2011, per the sale agreement

entered into during the third quarter of 2010, as discussed below. The

lower net additions of cable telephony lines in 2011 versus 2010 were

the result of lower sales activity as campaigns were less aggressive

compared to the prior year.

Cable telephony lines in service grew 5% from December 31, 2010 to

December 31, 2011. At December 31, 2011, cable telephony lines

represented 28% of the homes passed by our cable networks and

46% of television subscribers.

Cable continues to focus principally on growing its on-net cable

telephony line base. Therefore, it continues its strategy to

de-emphasize the off-net circuit-switched telephony business where

services cannot be provisioned fully over Rogers’ own network

facilities. During the third quarter of 2010, Cable announced that it

was divesting most of the assets related to the remaining circuit-

switched telephony operations. Under this arrangement, most of its

co-location sites and related equipment were sold. In addition, the

sale involved residential circuit-switched lines, with the customers

served by these facilities being migrated from Cable Operations to a

third party reseller. During 2011, approximately 34,000 of these

subscribers were migrated to third-party resellers. For the year ended

December 31, 2011 the revenue reported by Cable Operations

associated with the residential circuit-switched telephony business

being divested totalled approximately $15 million.

38 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT