Rogers 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

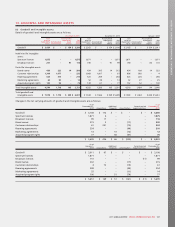

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

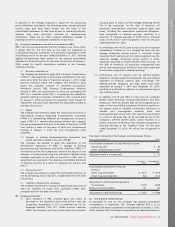

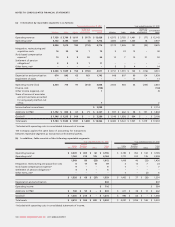

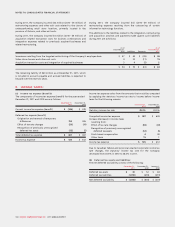

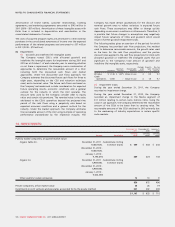

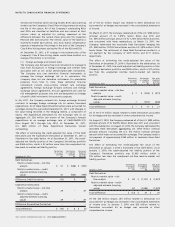

The movement of deferred tax assets and liabilities are summarized as follows:

Deferred tax assets (liabilities) PP&E and

Inventory

Goodwill

and other

intangibles Investment in

Partnership

Non-capital

income tax loss

carryforwards Other Total

January 1, 2010 $ (263) $ (323) $ (61) $ 124 $ 316 $ (207)

Benefit (expense) in Profit or Loss (199) (27) (77) (70) 6 (367)

Benefit (expense) in OCI – – – – (17) (17)

Acquisitions/dispositions (2) (10) – – – (12)

December 31, 2010 (464) (360) (138) 54 305 (603)

Benefit (expense) in Profit or Loss (18) (8) (727) 105 (33) (681)

Benefit (expense) in OCI – – – – (21) (21)

Acquisitions/dispositions (2) (53) – 3 (3) (55)

December 31, 2011 $ (484) $ (421) $ (865) $ 162 $ 248 $ (1,360)

As at December 31, 2011, the Company had Canadian non-capital loss

carryforwards of $583 million, and foreign non-capital loss

carryforwards of $61 million. If not utilized, the majority of the

Canadian and foreign tax losses will expire between 2026 and

beyond. As at December 31, 2011, the Company had approximately

$228 million of available capital losses to offset future capital gains.

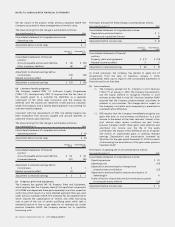

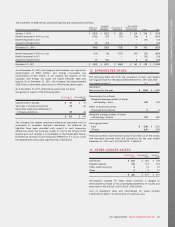

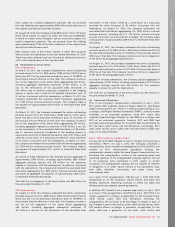

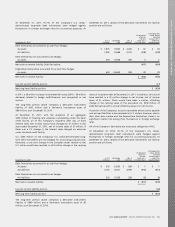

As at December 31, 2011, deferred tax assets have not been

recognized in respect of the following items:

December 31,

2011 December 31,

2010

Capital losses in Canada $41 $41

Tax losses in foreign jurisdictions 45 62

Deductible temporary differences in

foreign jurisdictions 45 44

$ 131 $ 147

The Company has taxable temporary differences associated with its

investment in Canadian domestic subsidiaries. No deferred tax

liabilities have been provided with respect to such temporary

differences where the Company is able to control the timing of the

reversal and such reversal is not probable in the foreseeable future.

Furthermore, reversal of such temporary differences, if it occurs, could

be implemented without any significant tax implications.

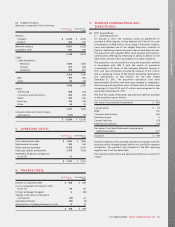

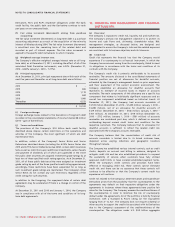

10. EARNINGS PER SHARE:

The following table sets forth the calculation of basic and diluted

earnings per share for the years ended December 31, 2011 and 2010:

Years ended December 31, 2011 2010

Numerator:

Net income for the year $ 1,563 $ 1,502

Denominator (in millions):

Weighted average number of shares

outstanding – basic 543 576

Effect of dilutive securities:

Employee stock options 44

Weighted average number of shares

outstanding – diluted 547 580

Earnings per share:

Basic $2.88 $ 2.61

Diluted 2.862.59

The total number of anti-dilutive options that were out of the money

and therefore excluded from the calculation for the year ended

December 31, 2011 was 1,570,760 (2010 – 1,406,013).

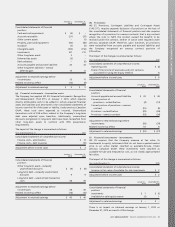

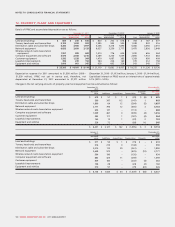

11. OTHER CURRENT ASSETS:

December 31,

2011 December 31,

2010 January 1,

2010

Inventories $ 206 $ 185 $ 129

Prepaid expenses 108113 110

Video rental inventory 614 27

Other 2311

$ 322 $ 315 $ 277

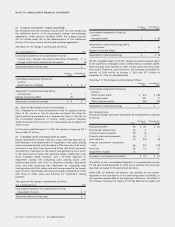

Amortization expense for Video rental inventory is charged to

merchandise for resale in the consolidated statements of income and

amounted to $26 million in 2011 (2010 – $54 million).

Cost of equipment sales and merchandise for resale includes

$1,637 million (2010 – $1,472 million) of inventory costs.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 105