Rogers 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

• Increase our vulnerability to general adverse economic and industry

conditions;

• Limit our flexibility in planning for, or reacting to, changes in our

business and the industry in which we operate;

• Place us at a competitive disadvantage compared to some of our

competitors that have less financial leverage; and

• Limit our ability to obtain additional financing required to fund

working capital and capital expenditures and for other general

corporate purposes.

Our ability to satisfy our obligations depends on our future operating

performance and on economic, financial, competitive and other

factors, many of which are beyond our control. Our business may not

generate sufficient cash flow and future financings may not be

available to provide sufficient net proceeds to meet these obligations

or to successfully execute our business strategy.

We Are Reliant on Third Party Service Providers Through

Outsourcing Arrangements.

Through outsourcing arrangements, third parties provide certain

essential components of our business operations to our employees

and customers, including payroll, call centre support, installation and

service technicians, certain information technology functions, and

invoice printing. Interruptions in these services can adversely affect

our ability to provide services to our customers.

We Are Heavily Involved in Operational Convergence.

In an effort to more efficiently serve our customer base, there is an

ongoing emphasis on convergence of our wireless and cable

operations, including organization structure and network platforms.

We have also commenced an enterprise-wide billing and business

support system initiative. In the event that implementation of our

convergence plans lead to operational problems or unforeseen delays

are incurred, operational efficiencies may not be achieved and service

impairment may result in loss of revenue and customers.

Our Businesses Are Complex.

Our businesses, technologies, processes and systems are operationally

complex. A failure to execute properly may lead to negative customer

experiences, resulting in increased churn and loss of revenue.

Copyright Tariff Increases Could Adversely Affect Results of

Operations.

Copyright tariff pressures continue to affect our services. If fees were

to increase, such increases could adversely affect our results of

operations.

We Are and Will Continue to Be Involved in Litigation.

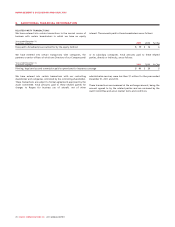

In August 2004, a proceeding under the Class Actions Act

(Saskatchewan) was commenced against providers of wireless

communications in Canada relating to the system access fee charged

by wireless carriers to some of their customers. The plaintiffs are

seeking unspecified damages and punitive damages, effectively the

reimbursement of system access fee collected. In September 2007, the

Saskatchewan Court granted the plaintiffs’ application to have the

proceeding certified as a national, “opt-in” class action. The “opt-in”

nature of the class was later confirmed by the Saskatchewan Court of

Appeal. As a national, “opt-in” class action, affected customers

outside Saskatchewan have to take specific steps to participate in the

proceeding. In February 2008, our motion to stay the proceeding

based on the arbitration clause in our wireless service agreements was

granted and the Saskatchewan Court directed that its order in respect

of the certification of the action would exclude from the class of

plaintiffs those customers who are bound by an arbitration clause.

In August 2009, counsel for the plaintiffs commenced a second

proceeding under the Class Actions Act (Saskatchewan) asserting the

same claims as the original proceeding. This second proceeding was

ordered conditionally stayed in December 2009 on the basis that it

was an abuse of process.

The Company’s appeal of the 2007 certification decision was dismissed

by the Saskatchewan Court of Appeal. The Company is applying for

leave to appeal to the Supreme Court of Canada. We have not

recorded a liability for this contingency since management’s

assessment is that the likelihood and amount of any potential loss

cannot be reasonably estimated. If the ultimate resolution of this

action differs from our assessment and assumptions, a material

adjustment to our financial position and results of operations could

result.

In June 2008, a proceeding was commenced in Saskatchewan under

that province’s Class Actions Act against providers of wireless

communications services in Canada. The proceeding involves

allegations of, among other things, breach of contract,

misrepresentation and false advertising in relation to the 911 fee

charged by us and the other wireless communication providers in

Canada. The plaintiffs are seeking unquantified damages and

restitution. The plaintiffs intend to seek an order certifying the

proceeding as a national class action in Saskatchewan. Any potential

liability is not yet determinable.

In December 2011, a proceeding under the Class Proceedings Act

(British Columbia) was commenced against providers of wireless

communications in Canada relating to the system access fee charged

by wireless carriers to some of their customers. The proceeding

involves, among other things, allegations of misrepresentations

contrary to the Business Practices and Consumer Protection Act (BC).

The Plaintiffs are seeking unquantified damages and restitution. Any

potential liability is not yet determinable.

In August 2008, a proceeding was commenced in Ontario pursuant to

that province’s Class Proceedings Act, 1992 against Cable and other

providers of communications services in Canada. The proceedings

involved allegations of, among other things, false, misleading and

deceptive advertising relating to charges for long-distance telephone

usage. The plaintiffs were seeking $20 million in general damages

and punitive damages of $5 million. This proceeding was settled in

December 2011 and the settlement amount was insignificant.

We believe that we have adequately provided for income and indirect

taxes based on all of the information that is currently available. The

calculation of applicable taxes in many cases, however, requires

significant judgment in interpreting tax rules and regulations. Our tax

filings are subject to audits, which could materially change the

amount of current and deferred income tax assets and liabilities and

provisions, and could, in certain circumstances, result in the

assessment of interest and penalties.

There exist certain other claims and potential claims against us, none

of which is expected to have a materially adverse effect on our

consolidated financial position.

Our Holding Company Structure May Limit Our Ability to Meet

Our Financial Obligations.

As a holding company, our ability to meet our financial obligations is

dependent primarily upon the receipt of interest and principal

payments on intercompany advances, rental payments, cash dividends

and other payments from our subsidiaries together with proceeds

raised by us through the issuance of equity and debt and from the

sale of assets.

Substantially all of our business activities are operated by our

subsidiaries. All of our subsidiaries are distinct legal entities and have

no obligation, contingent or otherwise, to make funds available to us

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 61