Rogers 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

the fair values of the awards. Under previous Canadian GAAP, the

Company accounted for these arrangements at intrinsic value.

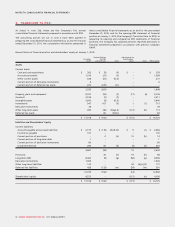

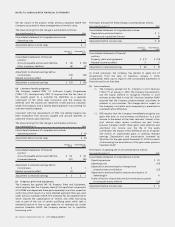

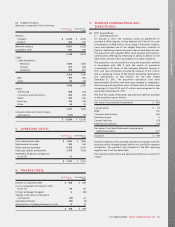

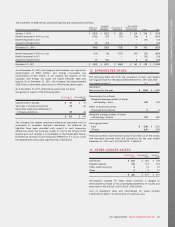

The impact arising from the change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Operating costs $ 3

Adjustment before income taxes $ 3

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Accounts payable and accrued liabilities $ (9) $ (14)

Other long-term liabilities (6) (4)

Adjustment to retained earnings before

income taxes (15) (18)

Related income tax effect 4 –

Adjustment to retained earnings $ (11) $ (18)

(d) Customer loyalty programs:

The Company applied IFRIC 13, Customer Loyalty Programmes

(“IFRIC 13”), retrospectively. IFRIC 13 requires that the fair value of

the awards given to a customer be identified as a separate

component of the initial sales transaction and the revenue be

deferred until the awards are redeemed. Under previous Canadian

GAAP, the Company took a liability-based approach in accounting for

customer loyalty programs.

Consistent with the requirements of IFRS, the liability balance has

been reclassified from accounts payable and accrued liabilities to

unearned revenue upon transition.

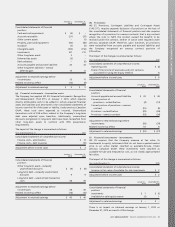

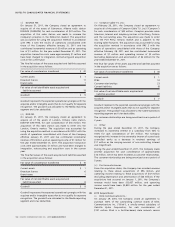

The impact arising from the change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Operating revenue $ (3)

Adjustment before income taxes $ (3)

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Accounts payable and accrued liabilities $ 55 $ 56

Unearned revenue (51) (55)

Adjustment to retained earnings before

income taxes 4 1

Related income tax effect (1) –

Adjustment to retained earnings $ 3 $ 1

(e) Property, plant and equipment:

The Company has applied IAS 16, Property, Plant and Equipment,

which requires that the Company identify the significant components

of its PP&E and depreciate these parts separately over their respective

useful lives which results in a more detailed approach than was used

under previous Canadian GAAP. The Company has also applied IAS 23

which requires the capitalization of interest and other borrowing

costs as part of the cost of certain qualifying assets which take a

substantial period of time to get ready for its intended use. Under

previous Canadian GAAP, the Company elected not to capitalize

borrowing costs.

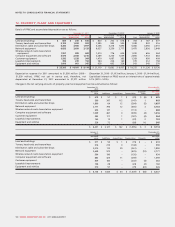

The impact arising from these changes is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Depreciation and amortization $ 2

Finance costs–capitalized interest (3)

Adjustment before income taxes $ (1)

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Property, plant and equipment $ (11) $ (10)

Related income tax effect 3 3

Adjustment to retained earnings $ (8) $ (7)

As noted previously, the Company has elected to apply IAS 23

prospectively from the date of transition, January 1, 2010;

consequently, there was no impact to the consolidated statements of

financial position at that date.

(f) Joint ventures:

(i) The Company applied IAS 31, Interests in Joint Ventures

(“IAS 31”), at January 1, 2010. The Company has elected to

use the equity method to recognize interests in joint

ventures as described in note 2(c). Previous Canadian GAAP

required that the Company proportionately consolidate its

interests in joint ventures. This change had no impact on

the Company’s net assets and consequently is presented as

a reclassification difference.

(ii) IFRS requires that the Company immediately recognize any

gains that arise on non-monetary contributions to a joint

venture to the extent of the other venturers’ interest in the

joint venture when certain conditions are met. Under

previous Canadian GAAP, these gains were deferred and

amortized into income over the life of the assets

contributed. The impact of this difference was to recognize

$15 million of unamortized gains in opening retained

earnings. Depreciation and amortization increased by

$4 million for the year ended December 31, 2010 as a result

of eliminating the amortization of the gain under previous

Canadian GAAP.

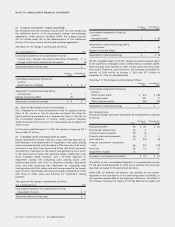

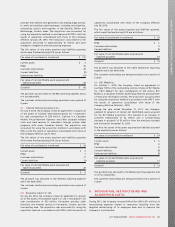

The impacts of applying IAS 31 are summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Operating revenue $ 41

Operating costs (19)

Depreciation and amortization–change from

proportionate consolidation (12)

Depreciation and amortization–remove amortization of

deferred gain 4

Share of the loss of associates and joint ventures accounted

for using the equity method (10)

Adjustment before income taxes $ 4

96 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT