Rogers 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

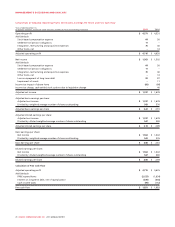

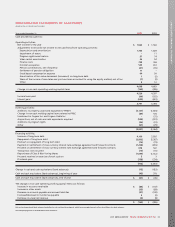

MANAGEMENT’S DISCUSSION AND ANALYSIS

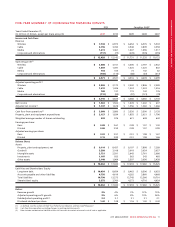

Calculations of Adjusted Operating Profit, Net Income, Earnings Per Share and Free Cash Flow

Years ended December 31,

(In millions of dollars, except per share amounts; number of shares outstanding in millions) 2011 2010

Operating profit $ 4,571 $ 4,531

Add (deduct):

Stock-based compensation expense 64 50

Settlement of pension obligations 11 –

Integration, restructuring and acquisition expenses 70 40

Other items, net –14

Adjusted operating profit $ 4,716 $ 4,635

Net income $ 1,563 $ 1,502

Add (deduct):

Stock-based compensation expense 64 50

Settlement of pension obligations 11 –

Integration, restructuring and acquisition expenses 70 40

Other items, net –14

Loss on repayment of long-term debt 99 87

Impairment of assets –11

Income tax impact of above items (60) (66)

Income tax charge, cash-settled stock options due to legislative change –40

Adjusted net income $ 1,747 $ 1,678

Adjusted basic earnings per share:

Adjusted net income $ 1,747 $ 1,678

Divided by: weighted average number of shares outstanding 543 576

Adjusted basic earnings per share $ 3.22 $ 2.91

Adjusted diluted earnings per share:

Adjusted net income $ 1,747 $ 1,678

Divided by: diluted weighted average number of shares outstanding 547 580

Adjusted diluted earnings per share $ 3.19 $ 2.89

Basic earnings per share:

Net income $ 1,563 $ 1,502

Divided by: weighted average number of shares outstanding 543 576

Basic earnings per share $2.88 $ 2.61

Diluted earnings per share:

Net income $ 1,563 $ 1,502

Divided by: diluted weighted average number of shares outstanding 547 580

Diluted earnings per share $2.86$ 2.59

Calculation of Free Cash Flow

Adjusted operating profit $ 4,716 $ 4,635

Add (deduct):

PP&E expenditures (2,127) (1,834)

Interest on long-term debt, net of capitalization (639) (666)

Cash income taxes (99) (152)

Free cash flow $1,851 $ 1,983

76 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT