Rogers 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Unrecognized stock-based compensation expense at December 31,

2011 related to stock-option plans was $9 million (2010 – $11 million),

and will be recorded in the consolidated statements of income over

the next four years as the options vest.

All outstanding options, including the performance options, are

classified as liabilities and are carried at their fair value as determined

through the use of a valuation model.

(b) Restricted share units:

(i) RSU plan:

The RSU plan enables employees, officers and directors of the

Company to participate in the growth and development of

the Company. Under the terms of the plan, RSUs are issued to

the participant and the units issued will cliff vest over a period

not to exceed three years from the grant date.

On the vesting date, the Company shall redeem all of the

participants’ RSUs in cash or by issuing one Class B Non-Voting

share for each RSU. The Company has reserved 4,000,000 Class B

Non-Voting shares for issuance under this plan. During the year

ended December 31, 2011, the Company granted 738,973 RSUs

(2010 – 631,655).

(ii) Performance RSUs:

During the year ended December 31, 2011, the Company

granted 189,571 performance-based RSUs (2010 – 187,508) to

certain key executives. The number of units that vest and will be

paid three years from the grant date will be within a range of

50% to 150% of the initial number granted based upon the

achievement of certain annual and cumulative three-year

non-market targets.

(iii) Summary of RSUs:

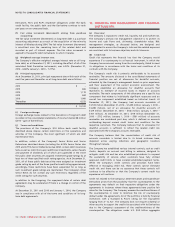

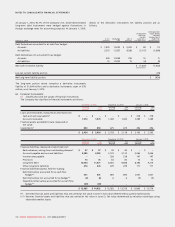

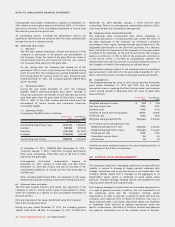

A summary of the RSU plans is as follows:

December 31,

2011 December 31,

2010

Number of units

Outstanding, beginning of year 1,616,370 1,060,223

Granted 928,544 819,163

Exercised (416,146) (217,877)

Forfeited (139,813) (45,139)

Outstanding, end of year 1,988,955 1,616,370

At December 31, 2011, 1,988,955 RSUs (December 31, 2010 –

1,616,370; January 1, 2010 – 1,060,223), including performance

RSUs, were outstanding. These RSUs vest at the end of three

years from the grant date.

Unrecognized stock-based compensation expense at

December 31, 2011, related to these RSUs was $32 million

(December 31, 2010 –$22 million) and will be recorded in the

consolidated statements of income over the next three years as

the RSUs vest.

RSUs, including performance RSUs, are measured at fair value,

determined using the Company’s Class B Non-Voting share price.

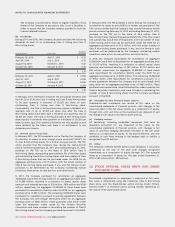

(c) Deferred share unit plan:

The DSU plan enables directors and certain key executives of the

Company to elect to receive certain types of remuneration in DSUs,

which are classified as a liability on the consolidated statements of

financial position.

DSUs are measured at fair value, determined using the Company’s

Class B Non-Voting share price.

During the year ended December 31, 2011, the Company granted

154,937 DSUs (2010 – 89,136). At December 31, 2011, 751,903 DSUs

(December 31, 2010 – 664,169; January 1, 2010 – 613,777) were

outstanding. There is no unrecognized compensation related to DSUs,

since these awards vest immediately when granted.

(d) Employee share accumulation plan:

The employee share accumulation plan allows employees to

voluntarily participate in a share purchase plan. Under the terms of

the plan, employees of the Company can contribute a specified

percentage of their regular earnings through payroll deductions. The

designated administrator of the plan then purchases, on a monthly

basis, Class B Non-Voting shares of the Company on the open market

on behalf of the employee. At the end of each month, the Company

makes a contribution of 25% to 50% of the employee’s contribution

in the month, which is recorded as compensation expense. The

administrator then uses this amount to purchase additional shares of

the Company on behalf of the employee, as outlined above.

Compensation expense related to the employee share accumulation

plan amounted to $23 million for the year ended December 31, 2011

(2010 – $20 million) and is included in employee salaries and benefits.

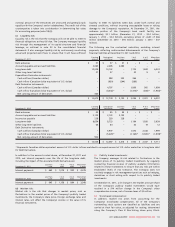

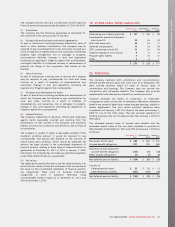

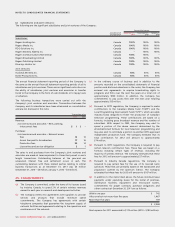

(e) Assumptions:

The weighted-average fair value of stock options granted during the

years ended December 31, 2011 and 2010 and the principal

assumptions used in applying the Black-Scholes model and trinomial

option pricing models to determine their fair value at grant date

were as follows:

December 31,

2011 December 31,

2010

Weighted average fair value $ 7.25 $ 7.66

Risk-free interest rate 2.8% 2.9%

Dividend yield 4.0%3.7%

Volatility of Class B Non-Voting shares 29.0%29.8%

Forfeiture rate 3.6%4.0%

Weighted average expected life 5.4 years 5.4 years

For Trinomial option pricing model only:

Weighted average time to vest 2.4 years 2.4 years

Weighted average time to expiry 7.0 years 7.0 years

Employee exit rate 3.6%4.0%

Suboptimal exercise factor 2.6 2.6

Lattice steps 50 50

Volatility has been estimated based on the actual trading statistics of

the Company’s Class B Non-Voting shares.

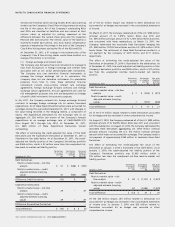

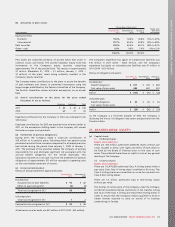

23. CAPITAL RISK MANAGEMENT:

The Company’s objectives in managing capital are to ensure sufficient

liquidity to pursue its strategy of organic growth combined with

strategic acquisitions and to provide returns to its shareholders. The

Company defines capital that it manages as the aggregate of its

shareholders’ equity (which is comprised of issued capital, share

premium, retained earnings, hedging reserve and available-for-sale

financial assets reserve) and long-term debt.

The Company manages its capital structure and makes adjustments to

it in light of general economic conditions, the risk characteristics of

the underlying assets and the Company’s working capital

requirements. In order to maintain or adjust its capital structure, the

Company, upon approval from its Board of Directors, may issue or

repay long-term debt, issue shares, repurchase shares, pay dividends

or undertake other activities as deemed appropriate under the

specific circumstances. The Board of Directors reviews and approves

any material transactions out of the ordinary course of business,

122 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT