Rogers 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

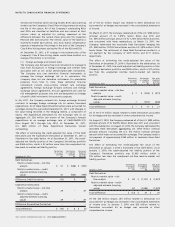

During 2011, the Company incurred $22 million (2010 – $5 million) of

restructuring expenses and other exit costs related to the closure of

underperforming retail store locations, primarily located in the

province of Ontario, and other exit costs.

During 2011, the Company incurred $4 million (2010 – $5 million) of

acquisition related transaction costs for business combinations and

integration expenses related to previously acquired businesses and

related restructuring.

During 2011, the Company incurred $nil (2010 – $9 million) of

restructuring expenses resulting from the outsourcing of certain

information technology functions.

The additions to the liabilities related to the integration, restructuring

and acquisition activities and payments made against such liabilities

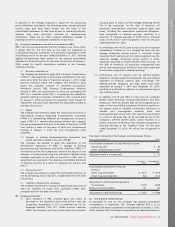

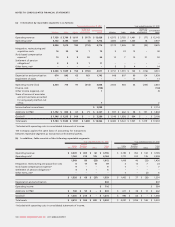

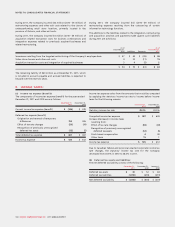

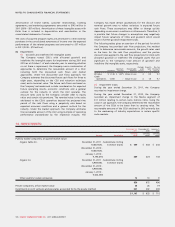

during 2011 are as follows:

As at

December 31,

2010 Additions Payments

As at

December 31,

2011

Severances resulting from the targeted restructuring of the Company’s employee base $ 47 $ 44 $ (45) $46

Video store closures and other exit costs 4 22 (11) 15

Acquisition transaction costs and integration of acquired businesses 3 4 (5) 2

$ 54 $ 70 $ (61) $63

The remaining liability of $63 million as at December 31, 2011, which

is included in accounts payable and accrued liabilities, is expected to

be paid over the next two years.

9. INCOME TAXES:

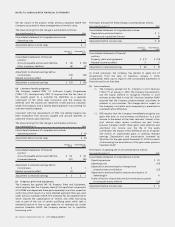

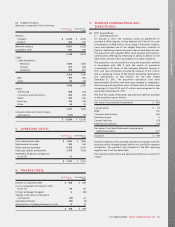

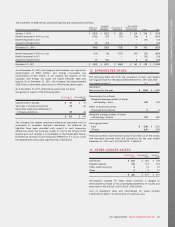

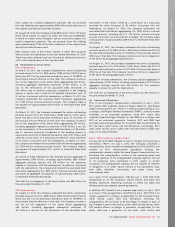

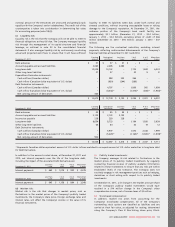

(a) Income tax expense (benefit):

The components of income tax expense (benefit) for the years ended

December 31, 2011 and 2010 were as follows:

December 31,

2011 December 31,

2010

Current income tax expense (benefit) $ (146) $ 245

Deferred tax expense (benefit)

Origination and reversal of temporary

differences 752 426

Effect of tax rate changes (59) (54)

Recognition of previously unrecognized

deferred tax assets (12) (5)

Total deferred tax expense $681$ 367

Income tax expense $ 535 $ 612

Income tax expense varies from the amounts that would be computed

by applying the statutory income tax rate to income before income

taxes for the following reasons:

December 31,

2011 December 31,

2010

Statutory income tax rate 28.0%30.5%

Computed income tax expense $587$ 645

Increase (decrease) in income taxes

resulting from:

Effect of tax rate changes (59) (69)

Recognition of previously unrecognized

deferred tax assets (12) (5)

Stock-based compensation 440

Other items 15 1

Income tax expense $ 535 $ 612

Due to Canadian federal and provincial enacted corporate income tax

rate changes, the statutory income tax rate for the Company

decreased from 30.5% in 2010 to 28.0% in 2011.

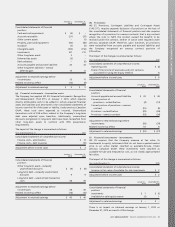

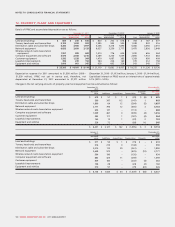

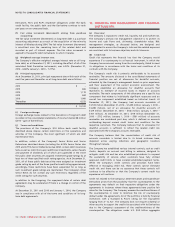

(b) Deferred tax assets and liabilities:

The net deferred tax liability consists of the following:

December 31,

2011 December 31,

2010 January 1,

2010

Deferred tax assets $30 $52 $84

Deferred tax liabilities (1,390) (655) (291)

Net deferred tax liability $ (1,360) $ (603) $ (207)

104 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT