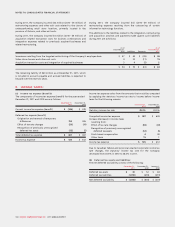

Rogers 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

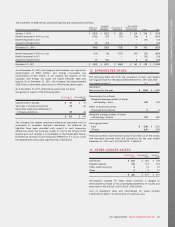

(j) Financial instruments – hedge accounting:

IAS 39 requires that the Company include credit risk when measuring

the ineffective portion of its cross-currency interest rate exchange

agreements. Under previous Canadian GAAP, the Company elected

not to include credit risk in the determination of the ineffective

portion of its cross-currency interest rate exchange agreements.

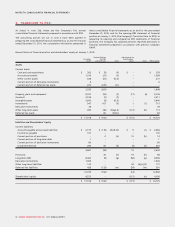

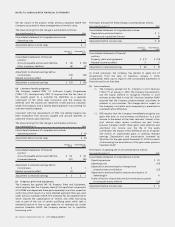

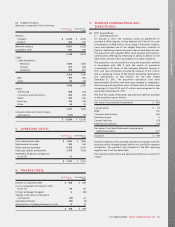

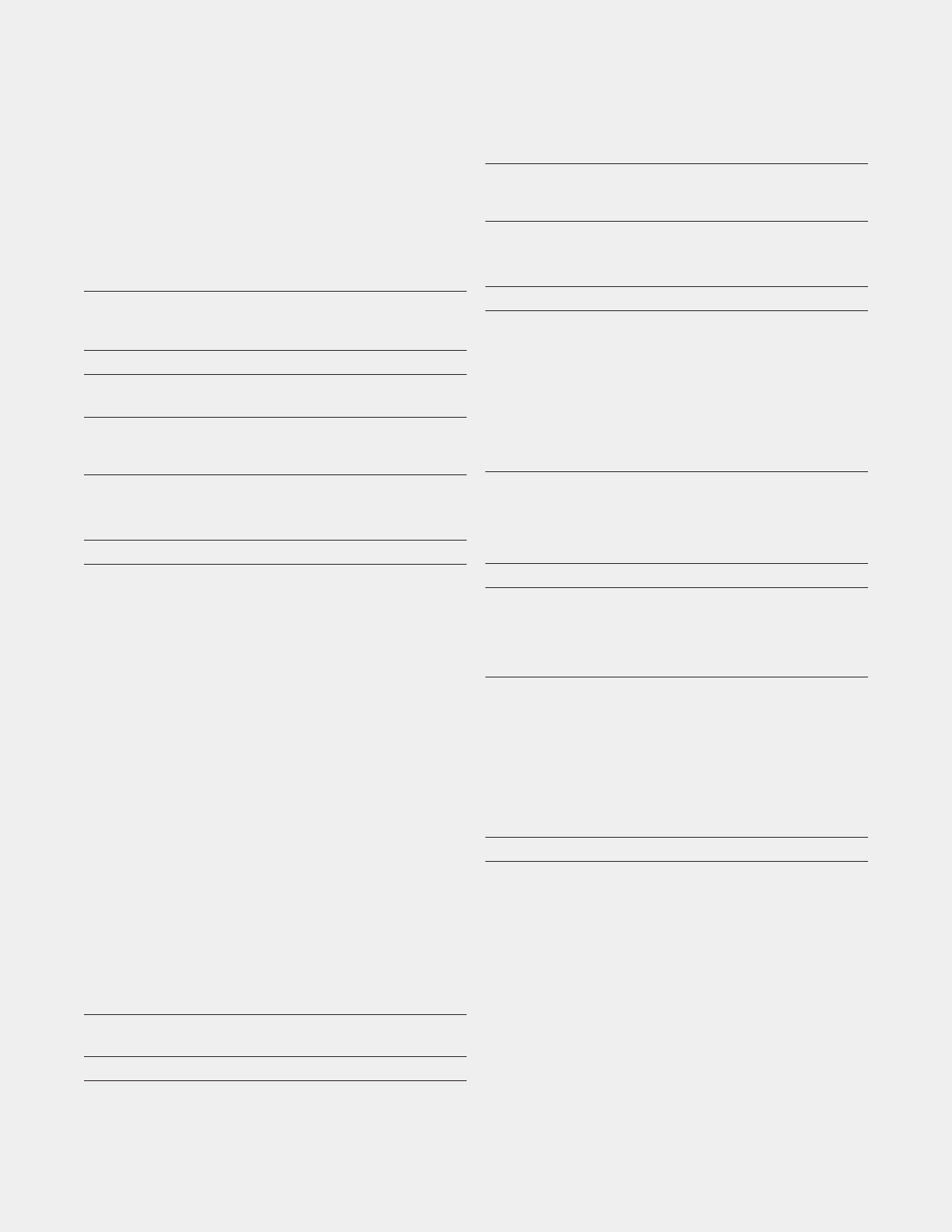

The impact of this change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Finance costs – change in fair value of derivative instruments $ 6

Change in fair value of derivative instruments (6)

Adjustment before income taxes $ –

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Equity reserves – hedging $ 7 $ 1

Adjustment to retained earnings before

income taxes 7 1

Related income tax effect (1) –

Adjustment to retained earnings $ 6 $ 1

(k) Share of the income or loss of associates:

IAS 1, Presentation of Financial Statements (“IAS 1”), requires that the

share of the income or loss of associates accounted for using the

equity method are presented as a separate line item on the face of

the consolidated statements of income. Under previous Canadian

GAAP, the share of the income or loss of associates was included with

other income.

For the year ended December 31, 2010, the impacts of applying IAS 1

was less than $1 million.

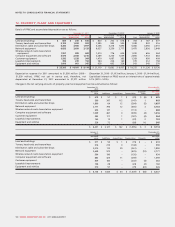

(l) Intangible assets and impairment of assets:

IAS 36, Impairment of Assets (“IAS 36”), uses a one-step approach for

both testing for and measurement of impairment, with asset carrying

values compared directly with the higher of fair value less costs to sell

and value in use (which uses discounted future cash flows) and assets

are tested for impairment at the level of cash generating units, which

is the lowest level of assets that generate largely independent cash

flows. Canadian GAAP, however, uses a two-step approach to

impairment testing: first comparing asset carrying values with

undiscounted future cash flows to determine whether impairment

exists; and then measuring any impairment by comparing asset

carrying values with fair values, and assets are grouped at the lowest

level for which identifiable cash flows are largely independent of the

cash flows of other assets and liabilities for impairment testing

purposes.

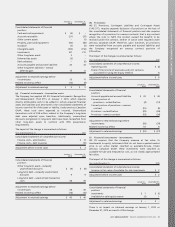

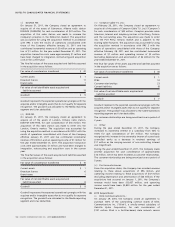

The impact of this change is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Impairment of assets $ 5

Adjustment before income taxes $ 5

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Intangible assets $ – $ (5)

Adjustment to retained earnings before

income taxes – (5)

Related income tax effect – 1

Adjustment to retained earnings $ – $ (4)

IAS 38, Intangible Assets (“IAS 38”), requires acquired program rights

to be classified as intangible assets. Under previous Canadian GAAP,

these amounts were classified as other current assets and other long-

term assets. Therefore, upon transition, the Company reclassified an

amount of $100 million at January 1, 2010 and $77 million at

December 31, 2010 to intangible assets.

The impact of the changes is summarized as follows:

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Other current assets $ (61) $ (49)

Intangible assets 100 77

Other long-term assets (39) (28)

Adjustment to retained earnings $ – $ –

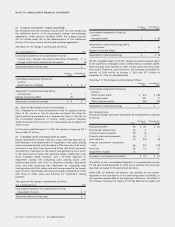

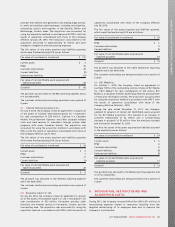

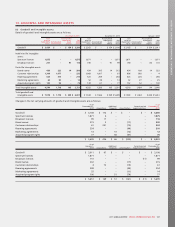

(m) Income taxes:

The above changes decreased (increased) the net deferred tax liability

as follows:

Note January 1,

2010 December 31,

2010

Employee benefits (b) $ 44 $ 64

Stock-based compensation (c) 4 –

Customer loyalty programs (d) (1) –

Property, plant and equipment (e) 3 3

Joint ventures (f) (10) (9)

Financial instruments – transaction

costs (g) (16) (15)

Provisions (h) 10 8

Impairment of assets (l) – 1

Decrease in net deferred tax liability $ 34 $ 52

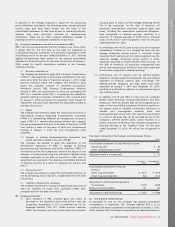

The effect on the consolidated statement of comprehensive income

for the year ended December 31, 2010 was to decrease the previously

reported tax charge for the period by $18 million.

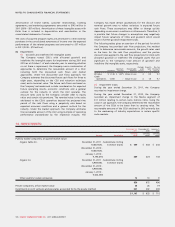

Under IFRS, all deferred tax balances are classified as non-current,

regardless of the classification of the underlying assets or liabilities, or

the expected reversal date of the temporary difference. The effect of

this change, including the impact of netting deferred tax assets and

98 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT