Rogers 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

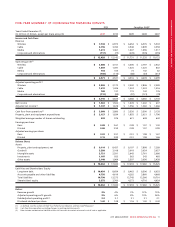

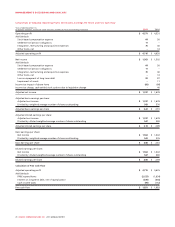

The following table illustrates the increase (decrease) in the accrued benefit obligation and pension expense for changes in these primary

assumptions and estimates:

Impact of Changes in Pension-Related Assumptions

(In millions of dollars)

Accrued Benefit

Obligation at End

of Fiscal 2011 Pension Expense

Fiscal 2011

Discount rate 5.50% 6.00%

Impact of: 1% increase $ (150) $ (10)

1% decrease 182 9

Rate of compensation increase 3.00% 3.00%

Impact of: 0.25% increase $8$2

0.25% decrease (8) (2)

Expected rate of return on assets N/A 6.80%

Impact of: 1% increase N/A $ 6

1% decrease N/A (6)

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such as

our historical collection and write-off experience, the number of days

the customer is past due and the status of the customer’s account

with respect to whether or not the customer is continuing to receive

service. As a result, fluctuations in the aging of subscriber accounts

will directly impact the reported amount of bad debt expense. For

example, events or circumstances that result in a deterioration in the

aging of subscriber accounts will in turn increase the reported

amount of bad debt expense. Conversely, as circumstances improve

and customer accounts are adjusted and brought current, the

reported bad debt expense will decline.

NEW ACCOUNTING STANDARDS

International Financial Reporting Standards

In February 2008, the Accounting Standards Board (“AcSB”)

confirmed that IFRS will be mandatory in Canada for profit-oriented

publicly accountable entities for fiscal periods beginning on or after

January 1, 2011. Our first annual IFRS financial statements are for the

year ending December 31, 2011 and include the comparative period

of 2010. Starting with the March 31, 2011 quarterly report, we have

provided unaudited consolidated quarterly financial information in

accordance with IFRS including comparative figures for 2010. Please

refer to Note 3 of our Audited Consolidated Financial Statements for

a summary of the differences between our financial statements

previously prepared under Canadian GAAP and to those under IFRS as

at January 1, 2010 and, for the year ended December 31, 2010.

First-Time Adoption of International Financial Reporting

Standards

Our adoption of IFRS required the application of IFRS 1, which

provides guidance for an entity’s initial adoption of IFRS. IFRS 1

generally requires that an entity apply all IFRS effective at the end of

its first IFRS reporting period retrospectively. However, IFRS 1 does

include certain mandatory exceptions and limited optional

exemptions in specified areas of certain standards from this general

requirement. The following are the significant optional exemptions

available under IFRS 1 that we have applied in preparing our first

financial statements under IFRS.

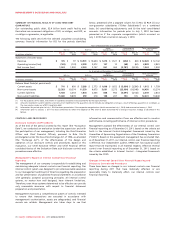

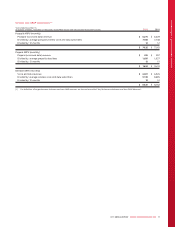

Business

Combinations

We have elected not to restate any Business

Combinations that have occurred prior to

January 1, 2010.

Borrowing

Costs

We have elected to apply the requirements

of IAS 23 Borrowing Costs prospectively from

January 1, 2010.

The information above is provided to allow investors and others to

obtain a better understanding of our IFRS changeover plan and the

resulting possible effects on, for example, our financial statements

and operating performance measures. These are estimates based on

our current understandings, and readers are cautioned that it may

not be appropriate to use such information for any other purpose.

This information also reflects our most recent assumptions and

expectations; circumstances may arise, such as changes in IFRS,

regulations or economic conditions, which could change these

assumptions or expectations.

RECENT ACCOUNTING PRONOUNCEMENTS

IFRS 7, Financial Instruments: Disclosures

In October 2010, the IASB amended IFRS 7, Financial Instruments:

Disclosures (“IFRS 7”). This amendment enhances disclosure

requirements to aid financial statement users in evaluating the nature

of, and risks associated with an entity’s continuing involvement in

derecognized financial assets. This amendment is effective for the

Company’s interim and annual consolidated financial statements

commencing January 1, 2012. The Company is assessing the impact of

this amended standard on its consolidated financial statements.

IAS 12, Deferred Tax: Recovery of Underlying Assets

In December 2010, the IASB amended IAS 12, Deferred Tax: Recovery

of Underlying Assets (“IAS 12”). IAS 12 will now include a rebuttal

presumption which determines that the deferred tax on the

depreciable component of an investment property measured using

the fair value model from IAS 40 should be based on its carrying

amount being recovered through a sale. The standard has also been

amended to include the requirement that deferred tax on

non-depreciable assets measured using the revaluation model in IAS

16 should be measured on the sale basis. This amendment is effective

for the Company’s interim and annual consolidated financial

statements commencing January 1, 2012. The Company is assessing

the impact of this amended standard on its consolidated financial

statements.

68 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT