Rogers 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

regularly by management. This is also useful to investors and analysts

in enabling them to analyze our enterprise and equity value and to

assess various leverage ratios as performance measures. This

non-GAAP measure does not have a standardized meaning and

should be viewed as a supplement to, and not a substitute for, our

results of operations or financial position reported under IFRS.

OUTSTANDING COMMON SHARE DATA

Set out below is our outstanding common share data as at

December 31, 2011 and at December 31, 2010. In the year ended

December 31, 2011 we purchased an aggregate 30,942,824 Class B

Non-Voting shares for cancellation pursuant to our NCIB for a total

purchase price of approximately $1,099 million. For additional

information, refer to Note 21 to our 2011 Audited Consolidated

Financial Statements.

December 31, 2011 December 31, 2010

Common shares(1)

Class A Voting 112,462,014 112,462,014

Class B Non-Voting 412,395,406 443,072,044

Total Common shares 524,857,420 555,534,058

Options to purchase Class B Non-Voting shares

Outstanding options 10,689,099 11,841,680

Outstanding options exercisable 5,716,945 6,415,933

(1) Holders of RCI’s Class B Non-Voting shares are entitled to receive notice of and to attend meetings of our shareholders, but, except as required by law or as stipulated by

stock exchanges, are not entitled to vote at such meetings. If an offer is made to purchase outstanding Class A Voting shares, there is no requirement under applicable law or

RCI’s constating documents that an offer be made for the outstanding Class B Non-Voting shares and there is no other protection available to shareholders under RCI’s

constating documents. If an offer is made to purchase both Class A Voting shares and Class B Non-Voting shares, the offer for the Class A Voting shares may be made on

different terms than the offer to the holders of Class B Non-Voting shares.

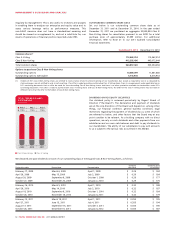

Class B Non-Voting Class A Voting

2009 20102011

(In millions)

TOTAL COMMON SHARES

OUTSTANDING

112.5 112.5 112.5

479.9 443.1412.4

DIVIDENDS ON RCI EQUITY SECURITIES

Our dividend policy is reviewed periodically by Rogers’ Board of

Directors (“the Board”). The declaration and payment of dividends

are at the sole discretion of the Board and depend on, among other

things, our financial condition, general business conditions, legal

restrictions regarding the payment of dividends by us, some of which

are referred to below, and other factors that the Board may at any

point consider to be relevant. As a holding company with no direct

operations, we rely on cash dividends and other payments from our

subsidiaries and our own cash balances and debt to pay dividends to

our shareholders. The ability of our subsidiaries to pay such amounts

to us is subject to the various risks as outlined in this MD&A.

We declared and paid dividends on each of our outstanding Class A Voting and Class B Non-Voting shares, as follows:

Declaration date Record date Payment date Dividend

per share Dividends paid

(in millions)

February 17, 2009 March 6, 2009 April 1, 2009 $ 0.29 $ 184

April 29, 2009 May 15, 2009 July 2, 2009 $ 0.29 $ 184

August 20, 2009 September 9, 2009 October 1, 2009 $ 0.29 $ 177

October 27, 2009 November 20, 2009 January 2, 2010 $ 0.29 $ 175

February 16, 2010 March 5, 2010 April 1, 2010 $ 0.32 $ 188

April 29, 2010 May 14, 2010 July 2, 2010 $ 0.32 $ 187

August 18, 2010 September 9, 2010 October 1, 2010 $ 0.32 $ 184

October 26, 2010 November 18, 2010 January 4, 2011 $ 0.32 $ 179

February 15, 2011 March 18, 2011 April 1, 2011 $ 0.355 $ 195

April 27, 2011 June 15, 2011 July 4, 2011 $ 0.355 $ 194

August 17, 2011 September 15, 2011 October 3, 2011 $ 0.355 $ 190

October 26, 2011 December 15, 2011 January 4, 2012 $ 0.355 $ 187

52 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT