Rogers 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

spending on advertising and promotion and data activations. These

increases were predominately offset by savings related to operating

and scale efficiencies across various functions.

Total retention spending, including subsidies on handset upgrades,

was flat year-over-year at $785 million in 2011, compared to

$788 million in 2010, as a result of lower volumes of smartphones

offset by a higher mix of smartphones, compared to 2010.

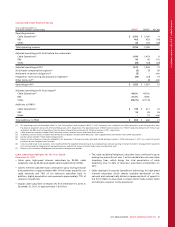

Wireless Adjusted Operating Profit

The 4% year-over-year decrease in adjusted operating profit and the

46.0% adjusted operating profit margin on network revenue (which

excludes equipment sales revenue) for 2011 primarily reflects the

increase in the total operating expenses, driven by the record high

volume of smartphone sales and activations as discussed above,

partially offset by the increase in network revenue.

($)

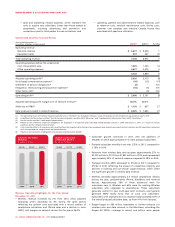

WIRELESS POSTPAID

MONTHLY ARPU

$73.93 $72.62 $70.26

2009 20102011

(%)

WIRELESS POSTPAID

MONTHLY CHURN

1.06%1.18% 1.32%

2009 20102011

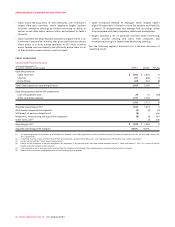

Wireless Additions to Property, Plant and Equipment

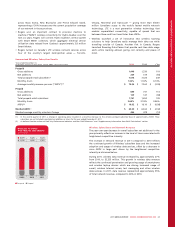

Wireless additions to PP&E are classified into the following categories:

Years ended December 31,

(In millions of dollars) 2011 2010 % Chg

Additions to PP&E

Capacity $628$ 446 41

Quality 250 284 (12)

Network – other 61 61 –

Information technology and other 253 146 73

Total additions to PP&E $ 1,192 $ 937 27

Wireless PP&E additions for 2011 reflect spending on network

capacity, such as radio channel additions, network core improvements

and network enhancing features, including the continued

deployment of our LTE and HSPA+ networks. Quality-related

additions to PP&E are associated with upgrades to the network to

enable higher throughput speeds, in addition to improved network

access associated activities such as site build programs and network

sectorization work. Moreover, Quality includes test and monitoring

equipment and operating support system activities. Investments in

Network – other are associated with network reliability and renewal

initiatives, infrastructure upgrades and new product platforms.

Information technology and other wireless specific system initiatives

include billing and back-office system upgrades, and other facilities

and equipment spending.

The increase in Wireless PP&E additions for 2011 is largely due to

investments to build out our LTE network across four of Canada’s top

markets with services now available in Ottawa, Toronto, Montreal

and Vancouver with expansion continuing into 2012. Information

technology investments on our customer billing systems and

platforms for new services contributed to the year-over-year increase

as well.

(%)

2011 WIRELESS ADDITIONS TO PP&E

CAPACITY 53%

QUALITY 21%

NETWORK - OTHER 5%

IT & OTHER 21%

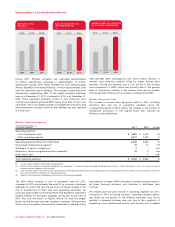

CABLE

CABLE’S BUSINESS

Cable is one of Canada’s largest providers of cable television, high-speed

Internet access and cable telephony services, and is also a facilities-based

telecommunications alternative to the traditional telephone companies.

Its business consists of the following three segments:

The Cable Operations segment had 2.3 million television subscribers

at December 31, 2011, representing approximately 32% of cable

television subscribers in Canada. At December 31, 2011, it provided

digital cable services to approximately 1.8 million of its television

subscribers and high-speed Internet service to approximately

1.8 million residential subscribers. Under the Rogers Home Phone

brand, it provides local telephone and long-distance services to

residential and small business customers and had over one million

subscriber lines at December 31, 2011.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 31