Rogers 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

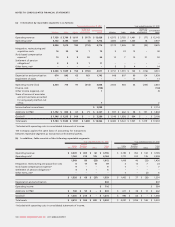

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

provider that delivers next generation and leading edge services,

to small and medium sized businesses, including municipalities,

universities, schools and hospitals, in the Oakville, Milton and

Mississauga, Ontario areas. The acquisition was accounted for

using the acquisition method in accordance with IFRS 3 with the

results of operations consolidated with those of the Company

effective January 29, 2010. The transaction costs related to the

acquisition amounted to approximately $1 million and were

charged to integration and restructuring expenses.

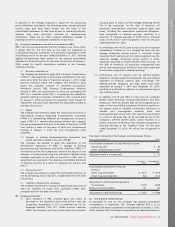

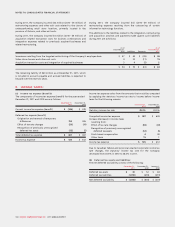

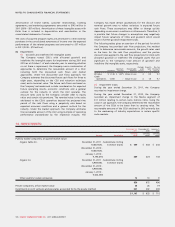

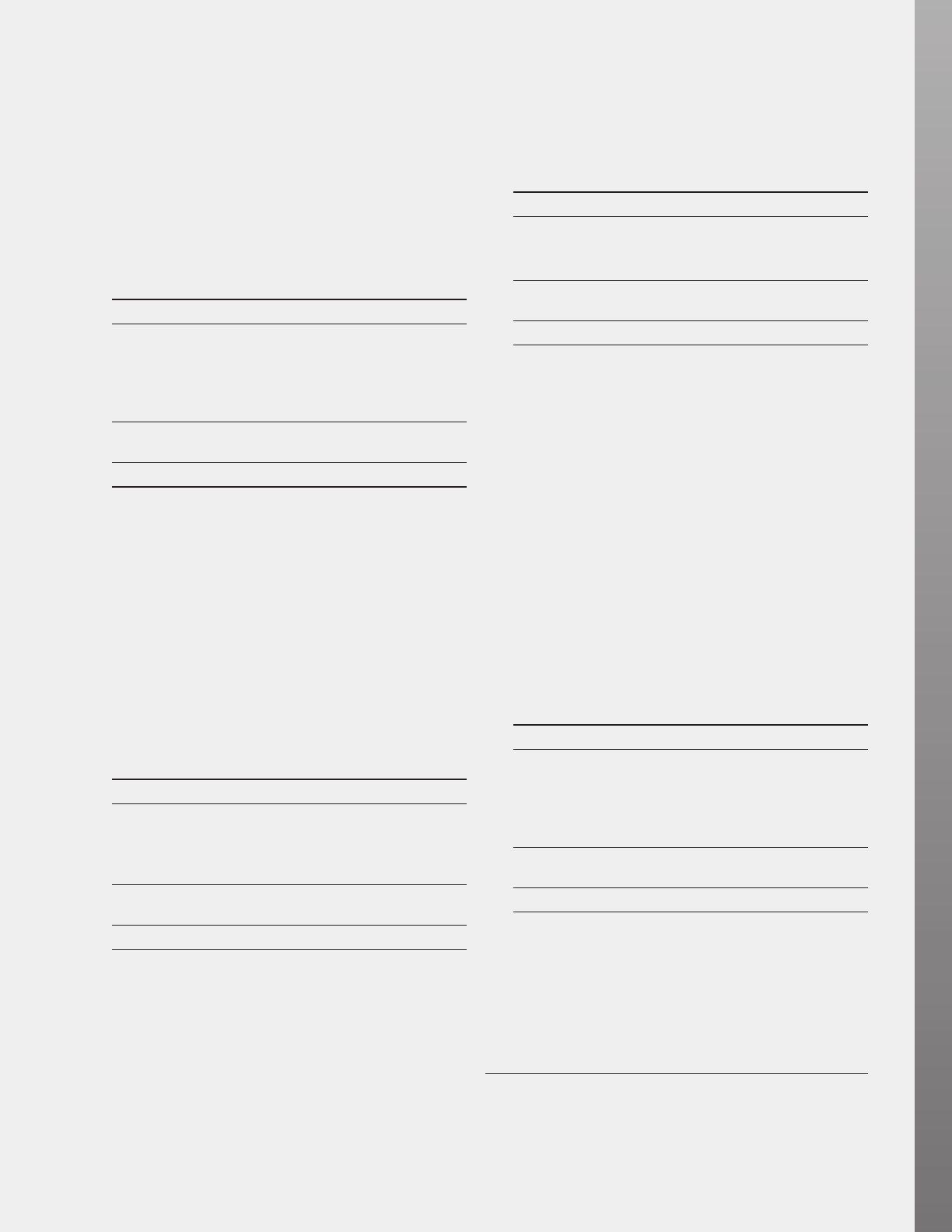

The fair values of the assets acquired and liabilities assumed,

which were finalized during 2010, are as follows:

Fair value of consideration transferred $ 131

Current assets $ 3

PP&E 35

Customer relationships 40

Current liabilities (2)

Deferred tax liabilities (11)

Fair value of net identifiable assets acquired and

liabilities assumed 65

Goodwill $ 66

The goodwill was allocated to the RBS reporting segment and is

not tax deductible.

The customer relationships are being amortized over a period of

5 years.

(ii) Cityfone Telecommunications Inc.:

On July 9, 2010, the Company closed an agreement to acquire all

of the assets of Cityfone Telecommunications Inc. (“Cityfone”)

for cash consideration of $26 million. Cityfone is a Canadian

Mobile Virtual Network Operator and offers postpaid wireless

voice and data services to subscribers through private label

programs with major Canadian brands. The acquisition was

accounted for using the acquisition method in accordance with

IFRS 3 with the results of operations consolidated with those of

the Company effective July 9, 2010.

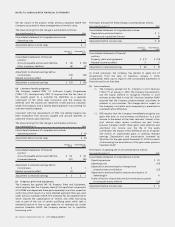

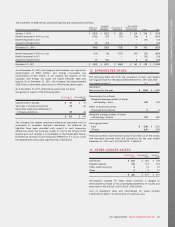

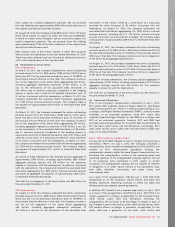

The fair values of the assets acquired and liabilities assumed,

which were finalized during 2010, are as follows:

Fair value of consideration transferred $ 26

Current assets $ 3

PP&E 1

Customer relationships 17

Current liabilities (1)

Fair value of net identifiable assets acquired and

liabilities assumed 20

Goodwill $ 6

The goodwill was allocated to the Wireless reporting segment

and is tax deductible.

The customer relationships are being amortized over a period of

5 years.

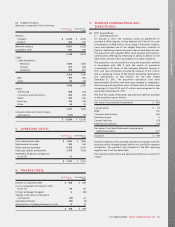

(iii) Kincardine Cable T.V. Ltd.:

On July 30, 2010, the Company closed an agreement to acquire

all of the assets of Kincardine Cable T.V. Ltd. (“Kincardine”) for

cash consideration of $20 million. Kincardine provides cable

television and Internet services in Kincardine, Ontario and the

surrounding area. The acquisition was accounted for using the

acquisition method in accordance with IFRS 3 with the results of

operations consolidated with those of the Company effective

July 30, 2010.

The fair values of the assets acquired and liabilities assumed,

which were finalized during 2010, are as follows:

Fair value of consideration transferred $ 20

PP&E $ 2

Customer relationships 9

Current liabilities (1)

Fair value of net identifiable assets acquired and

liabilities assumed 10

Goodwill $ 10

The goodwill was allocated to the Cable Operations reporting

segment and is tax deductible.

The customer relationships are being amortized over a period of

3 years.

(iv) BV! Media Inc:

On October 1, 2010, the Company closed an agreement to

purchase 100% of the outstanding common shares of BV! Media

Inc. (“BV! Media”) for cash consideration of $24 million. BV!

Media is a Canadian Internet advertising network and publisher

of news and information portals. The acquisition was accounted

for using the acquisition method in accordance with IFRS 3 with

the results of operations consolidated with those of the

Company effective October 1, 2010.

During the year ended December 31, 2011, the Company

updated its valuation of certain net identifiable assets acquired

for the BV! Media acquisition. This resulted in an increase in

customer relationships of $2 million and a corresponding

decrease in goodwill of $2 million from the amounts recorded

and disclosed at December 31, 2010.

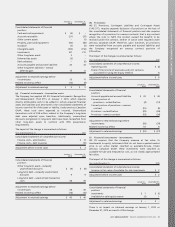

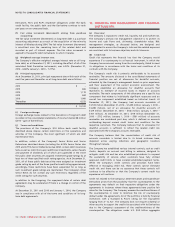

The final fair values of the assets acquired and liabilities assumed

in the acquisition are as follows:

Fair value of consideration transferred $ 24

Current assets $ 5

PP&E 4

Customer relationships 8

Current liabilities (3)

Deferred tax liabilities (3)

Fair value of net identifiable assets acquired and

liabilities assumed 11

Goodwill $ 13

The goodwill was allocated to the Media reporting segment and

is not tax deductible.

The customer relationships are being amortized over a period of

2 years.

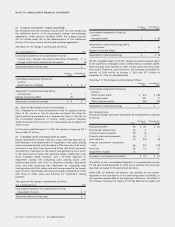

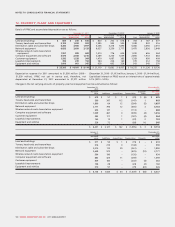

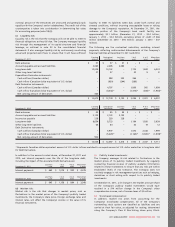

8. INTEGRATION, RESTRUCTURING AND

ACQUISITION COSTS:

During 2011, the Company incurred $44 million (2010–$21 million) of

restructuring expenses related to severances resulting from the

targeted restructuring of its employee base and to improve the

Company’s cost structure.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 103