Rogers 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Scholes and trinomial option pricing models. Both option pricing

models use the Company’s Class B Non-Voting share price during

the life of the option. All of the Company’s outstanding RSUs

and DSUs are classified as liabilities and are carried at their

intrinsic value, as adjusted for vesting, measured as the

difference between the current share price and the respective

RSU and DSU exercise price. The intrinsic value of the liability is

marked-to-market each period, and stock based compensation

expense is impacted by the change in the price of the Company’s

Class B Non-Voting shares during the life of the RSU and DSU.

At December 31, 2011, a $1 change in the market price of the

Company’s Class B Non-Voting shares would have resulted in a

change of $6 million in net income

(iii) Foreign exchange and interest rates:

The Company uses derivative financial instruments to manage its

risks from fluctuations in foreign exchange and interest rates

associated with its U.S. dollar denominated debt instruments.

The Company also uses derivative financial instruments to

manage the foreign exchange risk in its operations. The

Company does not use derivative instruments for speculative

purposes. From time to time, these derivative financial

instruments include cross-currency interest rate exchange

agreements, foreign exchange forward contracts and foreign

exchange option agreements. All such agreements are used for

risk management purposes only and are designated as a hedge

of specific debt instruments for economic purposes.

In July 2011, the Company entered into foreign exchange forward

contracts to manage foreign exchange risk on certain forecasted

expenditures. All of these Expenditure Derivatives were accounted for

as hedges during the year ended December 31, 2011, with changes in

fair value being recorded in the hedging reserve, a component of

equity. The Expenditure Derivatives fix the exchange rate on an

aggregate U.S. $20 million per month of the Company’s forecast

expenditures at an average exchange rate of Cdn$0.9643/U.S.$1

from August 2011 through July 2014. At December 31, 2011,

U.S. $620 million of these Expenditure Derivatives remain

outstanding.

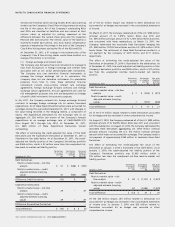

The effect of estimating the credit-adjusted fair value of the Debt

Derivatives and the Expenditure Derivatives at December 31, 2011 is

illustrated in the table below. As at December 31, 2011, the credit-

adjusted net liability position of the Company’s Derivatives portfolio

was $460 million, which is $2 million more than the unadjusted risk-

free mark-to-market net liability position.

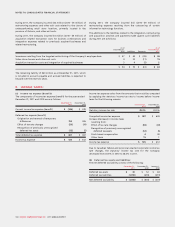

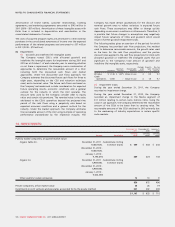

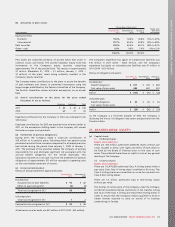

December 31, 2011

Derivatives

in an asset

position

(A)

Derivatives

in a liability

position

(B)

Net asset

(liability)

position

(A) + (B)

Debt Derivatives:

Mark-to-market value – risk-free

analysis $ 51 $ (548) $ (497)

Mark-to-market value – credit-

adjusted estimate (carrying

value) 41 (540) (499)

Difference, Debt Derivatives (10) 8 (2)

Expenditure Derivatives:

Mark-to-market value – risk-free

analysis 39 – 39

Mark-to-market value – credit-

adjusted estimate (carrying

value) 39 – 39

Difference, Expenditure Derivatives – – –

Total Difference $ (10) $ 8 $ (2)

All of the $2 million impact was related to Debt Derivatives not

accounted for as hedges and recorded in the consolidated statements

of income.

On March 21, 2011, the Company redeemed all of the U.S. $350 million

principal amount of its 7.875% Senior Notes due 2012 and

U.S. $470 million principal amount of its 7.25% Senior Notes due 2012,

and concurrent with these redemptions, on March 21, 2011, the

Company terminated the associated Debt Derivatives hedging the

U.S. $350 million 7.875% Senior Notes and the U.S. $470 million 7.25%

Senior Notes. The settlement of these Debt Derivatives resulted in a

net payment by the Company of $219 million and $111 million,

respectively.

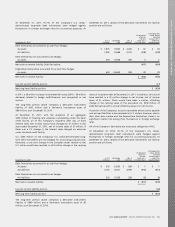

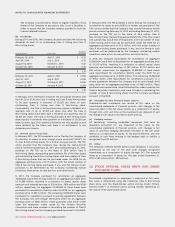

The effect of estimating the credit-adjusted fair value of the

Derivatives at December 31, 2010 is illustrated in the table below. As

at December 31, 2010, the credit-adjusted net liability position of the

Company’s derivatives portfolio was $900 million, which is $17 million

less than the unadjusted risk-free mark-to-market net liability

position.

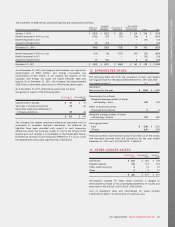

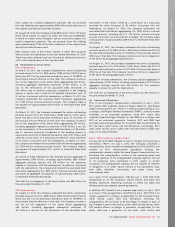

December 31, 2010

Derivatives

in an asset

position

(A)

Derivatives

in a liability

position

(B)

Net asset

(liability)

position

(A) + (B)

Debt Derivatives:

Mark-to-market value – risk-free

analysis $ 7 $ (924) $ (917)

Mark-to-market value – credit-

adjusted estimate (carrying

value) 7 (907) (900)

Total Difference $ – $ 17 $ 17

All of the $17 million impact related to Debt Derivatives accounted

for as hedges and was recorded in other comprehensive income.

On August 27, 2010, the Company redeemed all of the U.S. $490 million

principal amount of its 9.625% Senior Notes due 2011 and, concurrent

with this redemption, on August 27, 2010, the Company terminated the

associated Debt Derivatives aggregating U.S. $500 million notional

principal amount, including the U.S. $10 million notional principal

amount which were not accounted for as hedges. The Company made a

net payment of approximately $269 million to terminate these Debt

Derivatives.

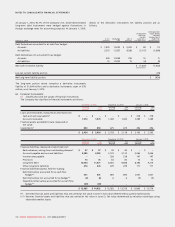

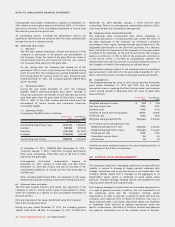

The effect of estimating the credit-adjusted fair value of the

Derivatives at January 1, 2010 is illustrated in the table below. As at

January 1, 2010, the credit-adjusted net liability position of the

Company’s Derivatives portfolio was $1,002 million, which is

$25 million less than the unadjusted risk-free mark-to-market net

liability position.

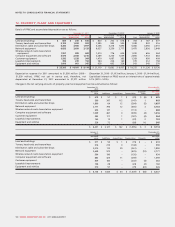

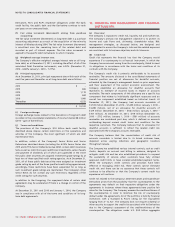

January 1, 2010

Derivatives

in an asset

position

(A)

Derivatives

in a liability

position

(B)

Net asset

(liability)

position

(A) + (B)

Debt Derivatives:

Mark-to-market value – risk-

free analysis $ 94 $ (1,121) $ (1,027)

Mark-to-market value – credit-

adjusted estimate (carrying

value) 82 (1,084) (1,002)

Total Difference $ (12) $ 37 $ 25

Of the $25 million impact, ($1) million related to Derivatives not

accounted for as hedges was recorded in the consolidated statements

of income prior to January 1, 2010 and $26 million related to

Derivatives accounted for as hedges was recorded in other

comprehensive income.

114 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT