Rogers 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

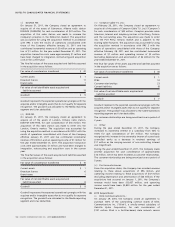

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Amortization of brand names, customer relationships, roaming

agreements, and marketing agreements amounted to $143 million in

2011 (2010 – $87 million). Amortization of these intangible assets with

finite lives is included in depreciation and amortization in the

consolidated statements of income.

The costs of acquired program rights are amortized to other external

purchases in the consolidated statements of income over the expected

performances of the related programs and amounted to $57 million

in 2011 (2010 – $74 million).

(b) Impairment:

(i) Goodwill and indefinite life intangible assets:

The Company tested CGU’s with allocated goodwill and

indefinite life intangible assets for impairment during 2011 and

2010 as at October 1 of each calendar year. In assessing whether

or not there is impairment, the Company uses a combination of

approaches to determine the recoverable amount of a CGU,

including both the discounted cash flows and market

approaches. Under the discounted cash flows approach, the

Company estimates the discounted future cash flows for three to

eight years, depending on the CGU and valuation technique

used, and a terminal value. The future cash flows are based on

the Company’s estimates and include consideration for expected

future operating results, economic conditions and a general

outlook for the industry in which the CGU operates. The

discount rates used by the Company consider debt to equity

ratios and certain risk premiums. The terminal value is the value

attributed to the CGU’s operations beyond the projected time

period of the cash flows using a perpetuity rate based on

expected economic conditions and a general outlook for the

industry. Under the market approach, the Company estimates

the recoverable amount of the CGU using multiples of operating

performance standardized by the respective industry. The

Company has made certain assumptions for the discount and

terminal growth rates to reflect variations in expected future

cash flows. These assumptions may differ or change quickly

depending on economic conditions or other events. Therefore, it

is possible that future changes in assumptions may negatively

impact future valuations of CGUs and goodwill which would

result in further goodwill impairment losses.

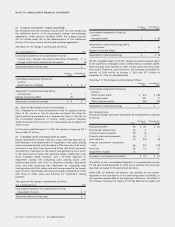

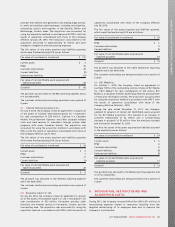

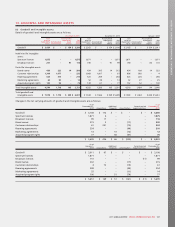

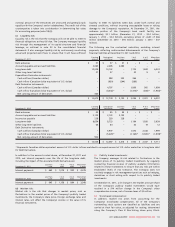

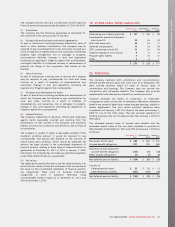

The following tables gives an overview of the periods for which

the Company has provided cash flow projections, the method

used to determine recoverable amounts, the growth rates used

as the basis for the cash flow projections, and the pre-tax

discount rates applied to the cash flow projections for CGUs with

allocated goodwill or indefinite life intangible assets that are

significant to the Company’s total amount of goodwill and

indefinite life intangible assets, respectively:

Goodwill Spectrum

licences Recoverable

Method

Periods

used

(years)

Growth

rates

%

Pre-tax

Discount

rates %

Wireless $ 1,146 $ 1,875 Value in use 4 0.5 9.7

Cable

operations 1,000 – Value in use 4 1.0 9.7

(ii) Impairment losses:

During the year ended December 31, 2011, the Company

recorded no impairment charge.

During the year ended December 31, 2010, the Company

recorded an impairment charge in the Media segment of

$11 million relating to certain radio stations CGUs. Using the

value in use approach, the Company determined the recoverable

amount of the CGUs to be lower than its carrying value. The

recoverable amounts of the CGUs declined in 2010 primarily due

to the weakening of industry expectations in certain specific

radio markets.

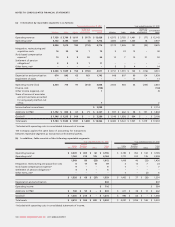

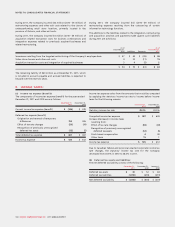

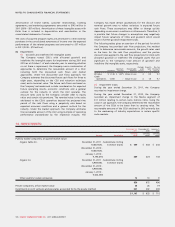

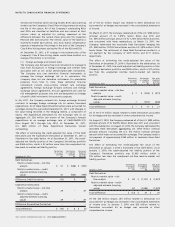

14. INVESTMENTS:

December 31,

2011 December 31,

2010 January 1,

2010

Number Description Carrying

value Carrying

value Carrying

value

Publicly traded companies, at quoted market value:

Cogeco Cable Inc. December 31, 2011 -

10,687,925,

Subordinate Voting

Common shares $ 549 $ 438 $ 343

(December 31, 2010 -

10,687,925,

January 1, 2010 -

9,795,675) 289224 144

Cogeco Inc. December 31, 2011 -

5,969,390,

Subordinate Voting

Common shares

(December 31, 2010 -

5,969,390,

January 1, 2010 -

5,023,300)

Other publicly traded companies 12 13 9

850 675 496

Private companies, at fair market value 36 26 19

Investments in joint ventures and associates accounted for by the equity method 221 232 200

$ 1,107 $ 933 $ 715

108 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT