Rogers 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

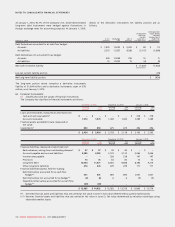

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

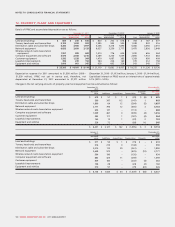

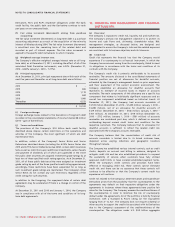

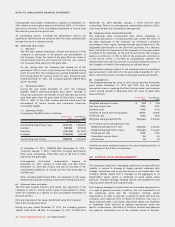

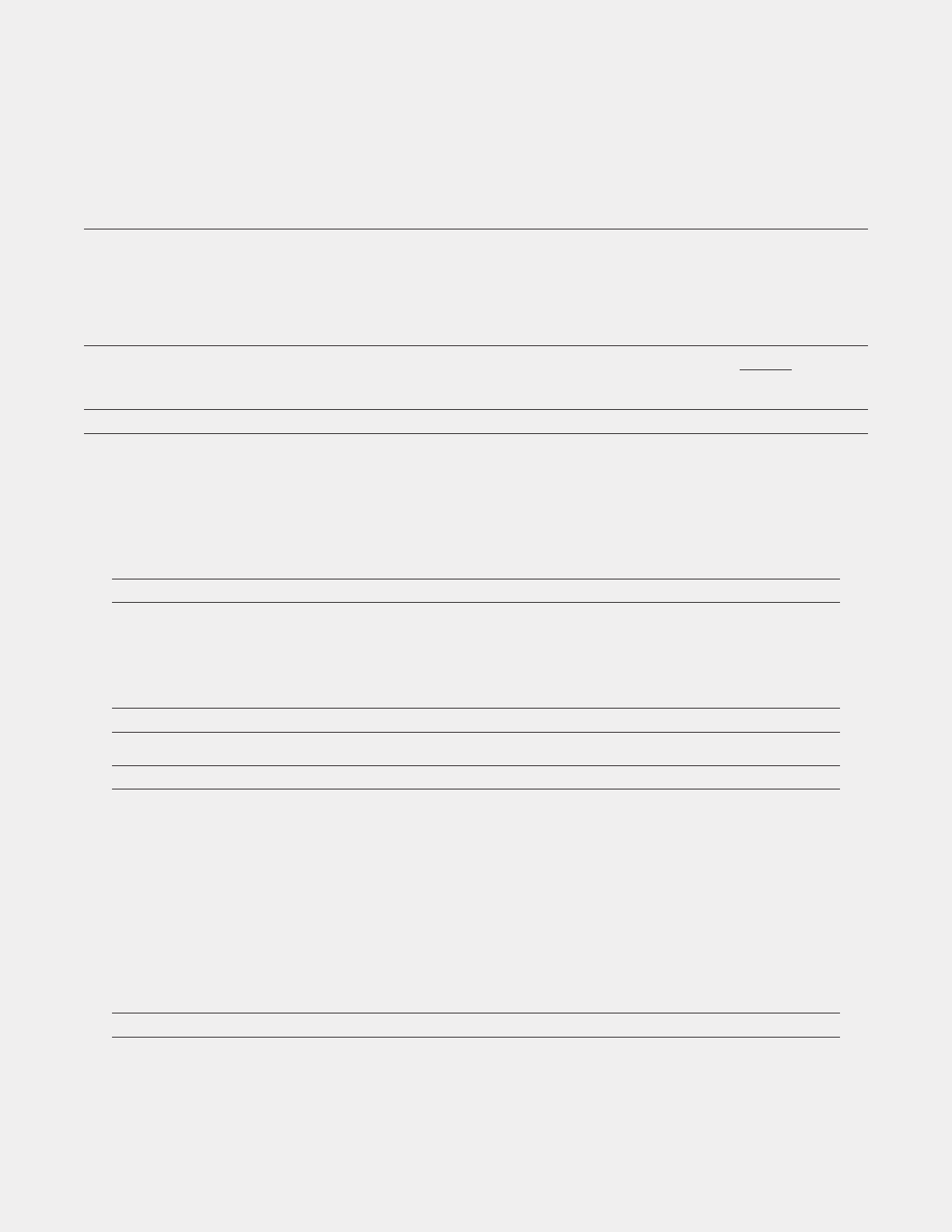

At January 1, 2010, 93.7% of the Company’s U.S. dollar-denominated

long-term debt instruments were hedged against fluctuations in

foreign exchange rates for accounting purposes. At January 1, 2010,

details of the derivative instruments net liability position are as

follows:

January 1, 2010 U.S. $

notional Exchange

rate Cdn. $

notional

Unadjusted

mark-to-

market

value on a

risk-free basis

Estimated fair

value, being

carrying

amount on a

credit risk

adjusted basis

Debt Derivatives accounted for as cash flow hedges:

As assets $ 1,975 1.0252 $ 2,025 $ 84 $ 73

As liabilities 3,215 1.3337 4,288 (1,117) (1,080)

Debt Derivatives not accounted for as hedges:

As assets 350 1.0258 359 10 9

As liabilities 10 1.5370 15 (4) (4)

Net mark-to-market liability $ (1,027) (1,002)

Less net current liability portion (76)

Net long-term liability portion $ (926)

The long-term portion above comprises a derivative instruments

liability of $1,004 million and a derivative instruments asset of $78

million, as at January 1, 2010.

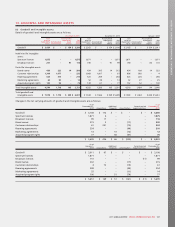

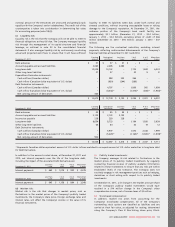

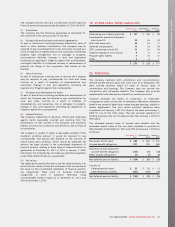

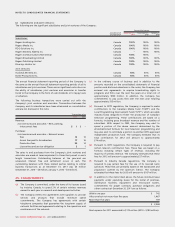

(e) Financial instruments:

(i) Classification and fair values of financial instruments:

The Company has classified its financial instruments as follows:

December 31, 2011 December 31, 2010 January 1, 2010

Carrying

amount Fair

value Carrying

amount Fair

value Carrying

amount Fair

value

Loans and receivables, measured at amortized cost:

Cash and cash equivalents* $–$–$ – $ – $ 378 $ 378

Accounts receivable 1,574 1,574 1,443 1,443 1,289 1,289

Financial assets, available-for-sale, measured at

fair value:

Investments* 850 850 675 675 496 496

$ 2,424 $ 2,424 $ 2,118 $ 2,118 $ 2,163 $ 2,163

December 31, 2011 December 31, 2010 January 1, 2010

Carrying

amount Fair

value Carrying

amount Fair

value Carrying

amount Fair

value

Financial liabilities, measured at amortized cost:

Bank advances, arising from outstanding cheques* $57$57$45$45$–$–

Accounts payable and accrued liabilities 2,085 2,0852,133 2,133 2,066 2,066

Income taxes payable ––238 238 147 147

Provisions 73 73 83 83 72 72

Long-term debt 10,034 11,471 8,654 9,688 8,396 9,315

Other long-term liabilities 276 276 229 229 177 177

Financial liabilities (assets), held-for-trading:

Debt Derivatives accounted for as cash flow

hedges** 501 501 894 894 1,007 1,007

Debt Derivatives not accounted for as hedges** (2) (2) 6 6 (5) (5)

Expenditure Derivatives accounted for as cash flow

hedges** (39) (39) ––––

$ 12,985 $ 14,422 $ 12,282 $ 13,316 $ 11,860 $ 12,779

(*) Denotes financial assets and liabilities that are carried at fair value in Level 1; fair value determined by quoted market prices

(**) Denotes financial assets and liabilities that are carried at fair value in Level 2; fair value determined by valuation technique using

observable market inputs

116 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT