Rogers 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

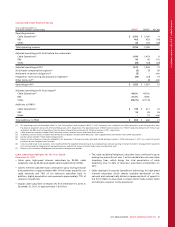

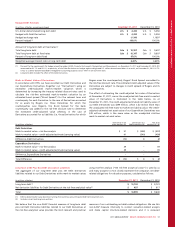

RECONCILIATION OF NET INCOME TO OPERATING

PROFIT AND ADJUSTED OPERATING PROFIT FOR

THE PERIOD

The items listed below represent the consolidated income and

expense amounts that are required to reconcile net income as defined

under IFRS to the non-GAAP measures operating profit and adjusted

operating profit for the year. See the section entitled “Supplementary

Information: Non-GAAP Calculations” for a full reconciliation to

adjusted operating profit, adjusted net income and adjusted earnings

per share. For details of these amounts on a segment-by-segment

basis and for an understanding of intersegment eliminations on

consolidation, the following section should be read in conjunction

with Note 4 to the 2011 Audited Consolidated Financial Statements

entitled “Segmented Information”.

Years ended December 31,

(In millions of dollars) 2011 2010 % Chg

Net income $ 1,563 $ 1,502 4

Income tax expense 535 612 (13)

Other income(1) (8)(1) n/m

Finance costs:

Interest on long-term debt 668669 –

Loss on repayment of long-term debt 99 87 14

Foreign exchange loss (gain) 6(20) n/m

Change in fair value of derivative instruments (14) 22 n/m

Capitalized interest (29) (3) n/m

Amortization of deferred transaction costs 813 (38)

Operating income 2,8282,881 (2)

Impairment of assets –11 n/m

Depreciation and amortization 1,743 1,639 6

Operating profit 4,571 4,531 1

Stock-based compensation expense 64 50 28

Settlement of pension obligations 11 – n/m

Integration, restructuring and acquisition expenses 70 40 75

Other items, net –14 n/m

Adjusted operating profit $ 4,716 $ 4,635 2

(1) Other income includes share of the income in associates and joint ventures accounted for using the equity method, net of tax.

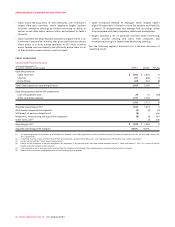

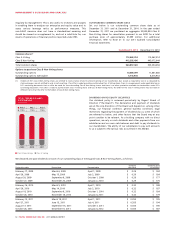

Net Income

The $61 million increase in net income compared to the prior year is

primarily due to the growth in adjusted operating profit of $81

million and a $77 million decline in income tax expenses, partially

offset by an increase in foreign exchange loss of $26 million and an

increase in loss on repayment of long-term debt of $12 million.

(In millions of dollars)

CONSOLIDATED ADJUSTED

NET INCOME

$1,556$1,678 $1,747

2009 20102011

Income Tax Expense

Our effective income tax rate for 2011 and 2010 was 25.5% and 28.9%,

respectively. The 2011 effective income tax rate was less than the 2011

statutory income tax rate of 28.0% primarily due to an income tax

recovery of $59 million resulting from the effect of tax rate changes.

The 2010 effective income tax rate was less than the 2010 statutory

income tax rate of 30.5% primarily due to an income tax recovery of

$69 million resulting from the effect of tax rate changes. In March

2010, the federal budget introduced proposed changes that impact the

tax deductibility of cash-settled stock options. The proposed legislative

changes were substantively enacted in December 2010. As a result, in

the year ended December 31, 2010, we recorded a one-time income

tax charge of $40 million to reduce deferred tax assets previously

recognized with respect to our stock option related liabilities.

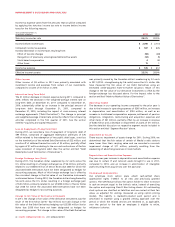

For the year ended December 31, 2011, our income taxes paid were

$99 million, compared to $152 million for the year ended

December 31, 2010. With respect to cash income tax payments as

opposed to accounting income tax expense, we expect to utilize

substantially all of our remaining non-capital income tax loss

carryforwards in 2012. As a result of the utilization of our non-capital

income tax loss carryforwards as well as of legislation eliminating the

deferral of partnership income that was substantially enacted on

October 4, 2011, we estimate our cash income tax payments will

increase significantly in 2012 from the $99 million we paid in 2011 as

detailed in the section of this MD&A entitled “2012 Financial

Guidance”. While both of these items impact the timing of cash taxes,

neither are expected to have a material impact to our income tax

expense for accounting purposes.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 45