Rogers 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

including proposals on acquisitions or other major investments or

divestitures, as well as annual capital and operating budgets.

In February 2011, the TSX accepted a notice filed by the Company of

its intention to renew its prior NCIB for a further one-year period. The

TSX notice provides that the Company may, during the twelve-month

period commencing February 22, 2011 and ending February 21, 2012,

purchase on the TSX up to the lesser of 39.8 million Class B

Non-Voting shares, representing approximately 9% of the then issued

and outstanding Class B Non-Voting shares, and that number of Class

B Non-Voting shares that can be purchased under the NCIB for an

aggregate purchase price of $1.5 billion, with the actual number of

Class B Non-Voting shares purchased, if any, and the timing of such

purchases to be determined by the Company considering market

conditions, share prices, its cash position, and other factors.

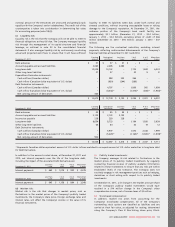

During 2011, the Company purchased for cancellation an aggregate

30,942,824 Class B Non-Voting shares for an aggregate purchase price

of $1,099 million, resulting in a reduction to stated capital, share

premium and retained earnings of $30 million, $870 million and

$199 million, respectively. An aggregate 21,942,824 of these shares

were purchased for cancellation directly under the NCIB for an

aggregate purchase price of $814 million. The remaining 9,000,000

shares were purchased for cancellation pursuant to private

agreements between the Company and arm’s-length third-party

sellers for an aggregate purchase price of $285 million. These

purchases were made under issuer bid exemption orders issued by the

Ontario Securities Commission and were included in calculating the

number of Class B Non-Voting shares that the Company purchased

pursuant to the NCIB. The NCIB expired on February 21, 2012.

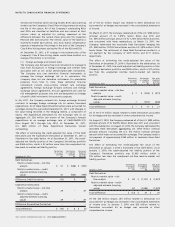

During 2011, the Company issued $1,450 million of 5.34% Senior

Notes due 2021 and $400 million of 6.56% Senior Notes due 2041

(note 17(c)).

During 2011, the Company redeemed the entire outstanding principal

amount of its U.S. $350 million ($342 million) 7.875% Senior Notes

due 2012 and U.S. $470 million ($460 million) 7.25% Senior Notes due

2012 (note 17(d)).

During 2011, the Company terminated the associated Debt

Derivatives hedging the U.S. $350 million 7.875% Senior Subordinated

Notes and the U.S. $470 million 7.25% Senior Subordinated Notes.

The settlement of these Debt Derivatives resulted in a net payment by

the Company of $219 million and $111 million, respectively

(note 17(d)).

The Company monitors debt leverage ratios as part of the

management of liquidity and shareholders’ return and to sustain

future development of the business.

The Company is not subject to externally imposed capital

requirements and its overall strategy with respect to capital risk

management remains unchanged from the year ended December 31,

2010.

24. RELATED PARTY TRANSACTIONS:

(a) Controlling shareholder:

The ultimate controlling shareholder of the Company is the Rogers

Control Trust which holds voting control of the Company. The

beneficiaries of the Trust are members of the Rogers family. The

Rogers family is represented as Directors, Senior Executive and

Corporate Officers of the Company.

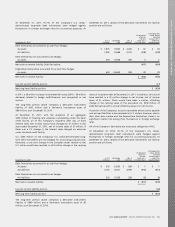

The Company entered into certain transactions with the ultimate

controlling shareholder of the Company and private Rogers’ family

holding companies controlled by the controlling shareholder of the

Company. These transactions, as summarized below, were recorded at

the amount agreed to by the related parties and are subject to the

terms and conditions of formal agreements approved by the Audit

Committee.

The Company sold an aircraft to a private Rogers’ family holding

company for cash proceeds of $19 million in 2010. There were no

other significant transactions during 2011 or 2010.

(b) Transactions with key management personnel:

Key management personnel include the Directors and the most Senior

Corporate Officers of the Company that are primarily responsible for

planning, directing and controlling the Company’s business activities.

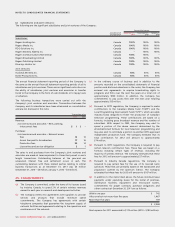

(i) Compensation:

The compensation expense associated with key management for

employee services was included in employee salaries and

benefits as follows:

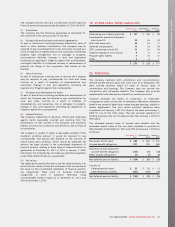

December 31,

2011 December 31,

2010

Salaries, pension and other short-

term employee benefits $11 $10

Stock-based compensation

expense 27 19

$38$29

(ii) Transactions:

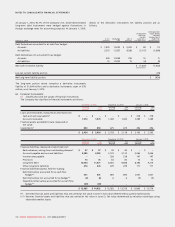

The Company has entered into business transactions with

companies, the partners or senior officers of which are Directors

of the Company, as summarized below:

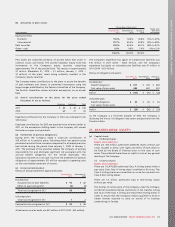

Transaction value Balance outstanding,

December 31,

2011 2010 2011 2010

Printing, legal services

and commission paid

on premiums for

insurance coverage $41 $39 $3 $8

A Director of the Company is Chairman and Chief Executive

Officer of a firm which is paid commissions for insurance

coverage. A Director of the Company is Senior Partner and

Chairman of a law firm which provides legal services. A Director

of the Company is Vice Chair and Vice President of a company

which provides printing services.

These transactions are recorded at the amount agreed to by the

related parties and are reviewed by the Audit Committee. The

outstanding balances owed to these related parties are

unsecured, interest free and due for payment in cash within

1 month from the date of the transaction. There are no

outstanding balances with these related parties relating to

similar transactions that occurred before January 1, 2010.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 123