Rogers 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

• the payment of an aggregate $1,208 million for the March 21, 2011

redemption of U.S. $350 million ($342 million) 7.875% Senior Notes

and U.S. $470 million ($460 million) 7.25% Senior Notes maturing

in 2012 (comprising $802 million principal and $76 million

premiums) and settlement of the associated Debt Derivatives and

forward contracts (comprising $330 million net settlement paid on

termination);

• the payment of quarterly dividends in the aggregate amount of

$758 million on our Class A Voting and Class B Non-Voting shares;

• the purchase for cancellation of approximately 31 million

Class B Non-Voting shares for an aggregate purchase price of

$1,099 million;

• acquisitions and other net investments aggregating $559 million,

including $426 million to acquire Atria, $40 million to acquire

Compton, $38 million to acquire two radio stations in Edmonton,

Alberta and London, Ontario, $16 million to acquire certain dealer

stores, $15 million for a long-term deposit, $11 million to acquire

the remaining ownership in Setanta Sports, and other net

investments of $13 million;

• payments for program rights of $56 million; and

• payments for transaction costs of $10 million.

Taking into account the opening cash deficiency balance of

$45 million at the beginning of the year and the cash sources and

uses described above, the cash deficiency at December 31, 2011,

represented by bank advances, was $57 million.

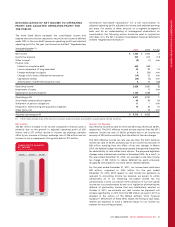

2011 USES OF CASH

2011

$5,906

Cash PP&E expenditures: $2,216

Redemption of long-term debt: $1,208

Repurchase of shares: $1,099

Dividends: $758

Acquisitions and other net investments: $559

Additions to program rights: $56

Transaction costs: $10

(In millions of dollars)

(In millions of dollars)

CONSOLIDATED CASH FLOW

FROM OPERATIONS

$3,526$3,880 $3,956

2009 20102011

Financing

Our long-term debt instruments and related derivatives are described

in Note 17 and Note 18 to the 2011 Audited Consolidated Financial

Statements. During 2011, the following financing activities took place.

Debt Issuances

On March 21, 2011, RCI issued in Canada $1,850 million aggregate

principal amount of Senior Notes, comprised of $1,450 million of

5.34% Senior Notes due 2021 (the “2021 Notes”) and $400 million of

6.56% Senior Notes due 2041 (the “2041 Notes”). The 2021 Notes

were issued at a discount of 99.954% for an effective yield of

5.346% per annum if held to maturity while the 2041 Notes were

issued at par to yield 6.56% if held to maturity. RCI received

aggregate net proceeds of approximately $1,840 million from the

issuance of the 2021 Notes and the 2041 Notes after deducting the

original issue discount, agents’ fees and other related expenses. The

aggregate net proceeds from the 2021 Notes and the 2041 Notes

were used to fund the March 2011 redemption of two public debt

issues maturing in 2012 together with the termination of the

associated Debt Derivatives, each as described below under “Debt

Redemptions and Termination of Debt Derivatives”, and to partially

repay outstanding advances under our bank credit facility.

Each of the 2021 Notes and the 2041 Notes are guaranteed by RCP

and rank pari passu with all of RCI’s other senior unsecured notes and

debentures and bank credit facility.

Debt Redemptions and Termination of Debt Derivatives

On March 21, 2011, RCI redeemed the entire U.S. $350 million

principal amount of its 7.875% Senior Notes due 2012 (the “7.875%

Notes”) and the entire U.S. $470 million principal amount of its 7.25%

Senior Notes due 2012 (the “7.25% Notes” and, together with the

“7.875% Notes”, the “2012 Notes”). RCI paid an aggregate amount of

approximately $878 million for the redemption of the 2012 Notes (the

“Redemptions”), including approximately $802 million aggregate

principal amount for the 2012 Notes and $76 million for the

premiums payable in connection with the Redemptions. Concurrently

with RCI’s redemption of the 2012 Notes, RCI made a net payment of

approximately $330 million to terminate the associated Debt

Derivatives (the “Derivatives Termination”). As a result, the total cash

expenditure associated with the Redemptions and the Derivatives

Termination was approximately $1,208 million and RCI recorded a loss

on repayment of long-term debt of $99 million, comprised of the

aggregate redemption premiums of $76 million, a net loss on the

termination of the related Debt Derivatives of $22 million, and

write-off of deferred financing costs of $2 million, offset by a write

down of a previously recorded fair value increment of $1 million.

48 ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT