National Grid 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

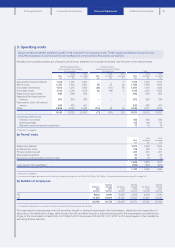

2. Segmental analysis

This note sets out the financial performance for the year split into the different parts of the business (operating segments). We monitor

and manage the performance of these operating segments on a day-to-day basis.

Our strategy in action

We own a portfolio of businesses that range from cash generative developed assets with minimal investment requirements (such as

National Grid Metering, included within Other activities) to businesses with high levels of investment and growth (such as UK

Electricity Transmission).

We generate 95% of our revenue from our regulated businesses in the UK and US. We work with our regulators to obtain agreements

that balance the risks we face with the opportunity to deliver reasonable returns for our investors. When investing in non-regulated

businesses we aim to leverage our core capabilities to deliver higher returns for investors.

Our regulated businesses earn revenue for the transmission, distribution and generation services they have provided during the year.

In any one year, the revenue recognised may differ from that allowed under our regulatory agreements and any such timing

differences are adjusted through future prices. Our non-regulated businesses earn revenue in line with their contractual terms.

Revenue primarily represents the sales value derived from the generation, transmission and distribution of energy, together with the

salesvalue derived from the provision of other services to customers and, previously, recovery of US stranded costs during the year.

Itexcludes value added (sales) tax and intra-group sales.

Revenue includes an assessment of unbilled energy and transportation services supplied to customers between the date of the last

meter reading and the year end. This is estimated based on historical consumption and weather patterns.

Where revenue exceeds the maximum amount permitted by regulatory agreement and adjustments will be made to future prices to

reflect this over-recovery, no liability is recognised, as such an adjustment relates to the provision of future services. Similarly no asset

isrecognised where a regulatory agreement permits adjustments to be made to future prices in respect of an under-recovery.

US stranded costs were various generation-related costs incurred prior to the divestiture of generation assets beginning in the late 1990s

and costs of legacy contracts that are being recovered from customers. The recovery of stranded costs and other amounts allowed to

be collected from customers under regulatory arrangements was recognised in the period in which these amounts were recoverable

from customers. The recovery of stranded costs was substantially completed at 31 March 2012.

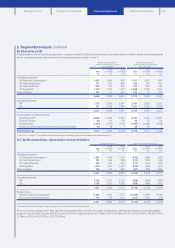

We present revenue and the results of the business analysed by operating segment, based on the information the Board of Directors

uses internally for the purposes of evaluating the performance of operating segments and determining resource allocation between

operating segments. The Board is National Grid’s chief operating decision-making body (as defined by IFRS 8 ‘Operating Segments’)

and assesses the performance of operations principally on the basis of operating profit before exceptional items, remeasurements and

stranded cost recoveries (see note 4).

Following the commencement of new RIIO regulatory arrangements in the UK, we have changed the way in which we report our

operational and financial performance. We have reviewed our segmental disclosure for the year ended 31 March 2014 with the

separation of our UK Transmission segment into two new segments: UK Electricity Transmission and UK Gas Transmission. We have

also moved the Great Britain-France electricity interconnector from UK Electricity Transmission to Other activities. The information given

in this note for the years ended 31 March 2013 and 2012 has been restated to provide a like-for-like comparison.

93