National Grid 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

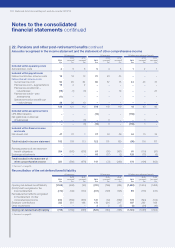

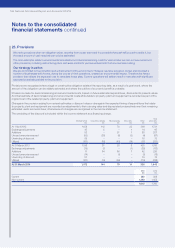

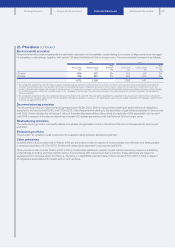

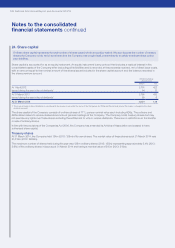

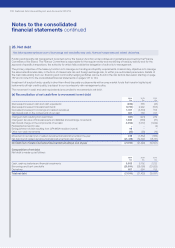

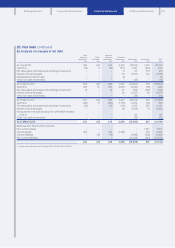

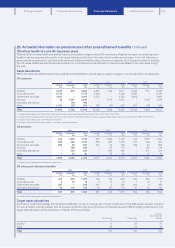

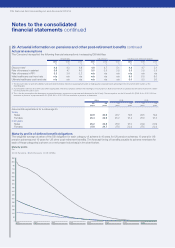

29. Actuarial information on pensions and other post-retirement benefits continued

National Grid UK Pension Scheme

The 2010 actuarial funding valuation showed that, based on long-term financial assumptions, the contribution rate required to meet

future benefit accrual was 35% of pensionable earnings (32% by employers and 3% by employees). In addition, National Grid makes

payments to the scheme to cover administration costs and the Pension Protection Fund levy. The employer contribution rate and

administration costs are being reviewed as part of the 2013 valuation.

Following the 2010 valuation, National Grid and the Trustees agreed a recovery plan which would see the funding deficit repaid by 31 March

2027. Under the schedule of contributions, no deficit contributions were made in 2010/11 or 2011/12. Annual payments of £47m, rising in

line with the RPI from March 2010, commenced in 2012/13 and (subject to the current valuation discussions) are due to continue until

2027. As part of the initial 2013 valuation discussions with the Trustees an additional payment of £6m was paid in March 2014.

As part of the 2010 agreement, National Grid has established security account arrangements with a charge in favour of the Trustees.

Thevalue of the assets in the security account at 31 March 2014 was approximately £199m. The assets in the security account will be

paid to the scheme in the event that National Grid Gas plc (NGG) is subject to an insolvency event, or is given notice of less than 12 months

that Ofgem intends to revoke its licence under the Gas Act 1986. The assets in the security account will be released back to National

Grid if the scheme moves into surplus.

This scheme ceased to allow new hires to join from 1 April 2002. A DC section of the scheme was offered for employees joining after

thisdate, which closed to future contributions on 31 October 2013 and was replaced by The National Grid YouPlan (see below).

National Grid Electricity Group of the Electricity Supply Pension Scheme

The 2010 actuarial funding valuation showed that, based on long-term financial assumptions, the contribution rate required to meet

future benefit accrual was 29.6% of pensionable earnings (23.7% by employers and an average of 5.9% by employees). The employer

contribution rate is being reviewed as part of the 2013 valuation.

Following the 2010 valuation, National Grid and the Trustees agreed a recovery plan that would see the funding deficit repaid by 31 March

2027. Under the schedule of contributions, payments of £45m were made in 2010/11 and 2011/12 and a further payment of £38m was

made in 2012/13. Thereafter annual payments of £38m rising in line with RPI are due to continue until 2027. The actual payment made in

2013/14 was £45m which included an additional payment of £7m following initial 2013 valuation discussions with the Trustees. A further

£35m paid in 2011/12 to support a de-risking initiative has been recognised from a funding perspective during 2013/14.

As part of this agreement, National Grid has established security account arrangements with a charge in favour of the Trustees. The value

of the assets in the security account at 31 March 2014 was approximately £35m. The assets in the security account will be paid to the

scheme in the event that National Grid Electricity Transmission plc (NGET) is subject to an insolvency event, or ceases to hold a licence

granted under the Electricity Act 1989. The assets in the security account will be released back to National Grid if the scheme moves

intosurplus.

National Grid has also agreed to make a payment in respect of the deficit up to a maximum of £220m should certain triggers be breached;

namely if NGET ceases to hold the licence granted under the Electricity Act 1989 or NGET’s credit rating by two out of three specified

agencies falls below certain agreed levels for a period of 40 days.

The scheme closed to new members from 1 April 2006.

The National Grid YouPlan

Following a review of the DC section of the National Grid UK Pension Scheme, National Grid established a new DC trust, The National

Grid YouPlan (YouPlan). This was launched on 1 November 2013 and future contributions for active members of the DC section were

paid to YouPlan from this date.

Under the rules of the plan, National Grid double matches contributions to YouPlan currently up to a maximum of 5% of employee salary.

Member accounts built up in the DC section prior to 1 November 2013 will be transferred to YouPlan in 2014.

YouPlan is the qualifying scheme used for automatic enrolment and National Grid’s staging date was 1 April 2013. All new hires are

enrolled into YouPlan.

US pension plans

National Grid’s DB pension plans in the US provide annuity or lump sum payments for vested employees. Non-union employees hired

onor after 1 January 2011 are provided with a core contribution into the DC plan, irrespective of the employee’s contribution to the plan.

A core contribution in the DC plan is also provided to new hires in ten groups of represented US employees. In addition, an employer

match is offered to eligible employees in the DC plan on their elective deferrals into the plan. The assets of the plans are held in separate

trusts and administered by the fiduciary committees.

Employees do not contribute to the DB pension plans. Employer contributions are made in accordance with the rules set forth by the

USInternal Revenue Code and can vary according to the funded status of the plans and the amounts that are tax deductible. At present,

there is some flexibility in the amount that is contributed on an annual basis. In general, the Company’s policy for funding the US pension

plans is to contribute amounts collected in rates and capitalised in the rate bases during the year. These contributions will be no less

than the amounts needed to meet the requirements of the Pension Protection Act of 2006.

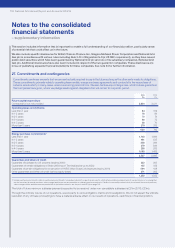

Notes to the consolidated

financial statements continued

134 National Grid Annual Report and Accounts 2013/14