National Grid 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

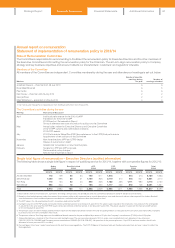

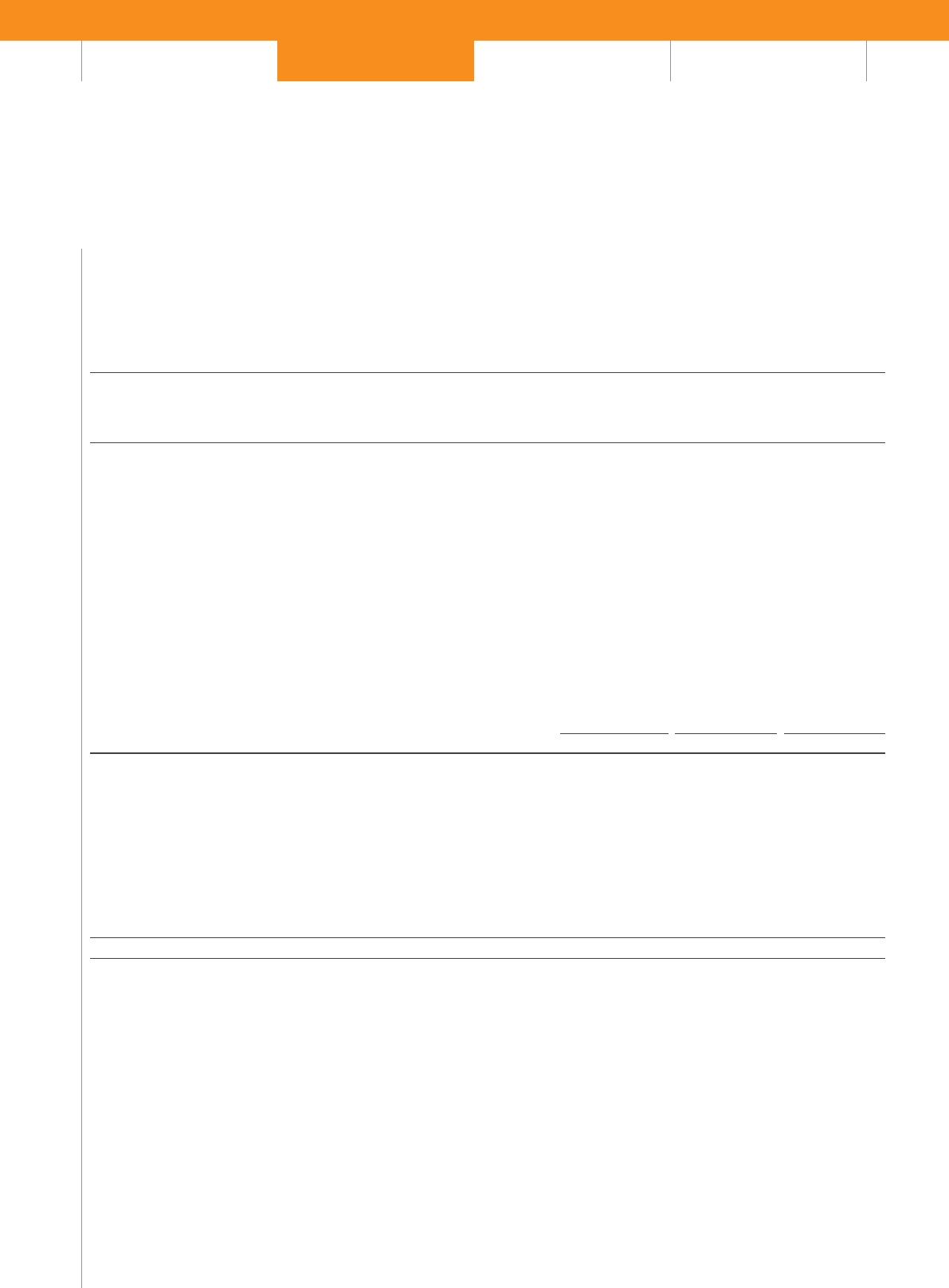

Total pension entitlements (audited information)

The table below provides details of the Executive Directors’ pension benefits:

Total

contributions

to DC-type

pension plan

£’000

Cash in lieu of

contributions

to DC-type

pension plan

£’000

Accrued

pension at

31 March 2014

£’000 pa

Increase

in accrued

pension over

year, net

of inflation

£’000 pa

Transfer value

of accrued

benefits as at

31 March 2014

£’000

Transfer value

of increase

in accrued

pension over

year, net

of inflation

£’000

Normal

retirement

date

Andrew Bonfield 28 185 ––––17/0 8/2027

Steve Holliday – – 506 17 13,013 379 26/10/2016

Tom King 8 – 491 55 4,112 462 01/01/2027

Nick Winser – – 284 10 6,341 173 06/09/2020

1. The UK-based Executive Directors participate in FPS, a salary sacrifice arrangement for pension contributions. Contributions paid via salary sacrifice have been deducted from the figures

in the tableabove.

2. For Steve Holliday, in addition to the pension above, there is an accrued lump sum entitlement of £125,000 as at 31 March 2014. There was no increase to the accumulated lump sum

including and excluding inflation in the year to 31 March 2014. The transfer value information above includes the value of the lump sum. Steve paid contributions of £44,000 via FPS.

3. For Nick Winser, in addition to the pension above, there is an accrued lump sum entitlement of £313,000 as at 31 March 2014. The increase to the accumulated lump sum including

inflationwas £7,000 and excluding inflation was £nil in the year to 31 March 2014. The transfer value information above includes the value of the lump sum. Nick paid contributions

of £33,000 via FPS.

4. For Tom King, the exchange rate as at 31 March 2014 was $1.67:£1 and as at 31 March 2013 was $1.52:£1. In addition to the transfer value quoted above, through participation in a

401(k)plan in the US, the Company made contributions worth £7,854 to a DC arrangement.

5. The increase in accrued pension figures for Steve Holliday and Nick Winser are net of inflation based on RPI for September 2013. The figures in the single figure table on page 67 are based

oninflation using CPI for September 2012. If the same inflation measure was used for this table the relevant figures would be an increase in pension of £23,100 for Steve and £12,250 for

Nick. Multiplying these figures by a factor of 20 and deducting member contributions correlates to the values in the single figure table. Tom King’s pension figures do not allow for inflation

as US pensions in payment or deferment do not increase in line with inflation. For Tom, multiplying the increase in accrued pension over the year, shown above (£55,150), by a factor of 20

and adding Company contributions to a DC-type pension plan, shown above, correlates to the value in the single figure table.

6. There are no additional benefits in the event of early retirement.

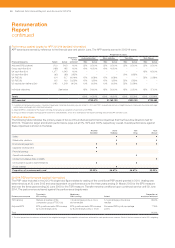

Single total figure of remuneration – Non-executive Directors (audited information)

The following table shows a single total figure in respect of qualifying service for 2013/14, together with comparative figures for 2012/13:

Fees

£’000

Other emoluments

£’000

Total

£’000

2013/14 2012/13 2013/14 2012/13 2013/14 2012/13

Philip Aiken 88 84 ––88 84

Nora Mead Brownell 88 73 ––88 73

Jonathan Dawson 84 6––84 6

Therese Esperdy 3–––3–

Sir Peter Gershon 475 475 17 17 492 492

Paul Golby 76 76 ––76 76

Ken Harvey 36 108 ––36 108

Ruth Kelly 76 76 ––76 76

Maria Richter 101 101 ––101 101

George Rose 30 91 ––30 91

Mark Williamson 99 44 ––99 44

Total 1,156 1,134 17 17 1,173 1,151

1. Sir Peter Gershon’s other emoluments comprise private medical insurance, cash in lieu of a car and the use of a driver when required.

Payments for loss of office or to past Directors (audited information)

No payments were made in 2013/14 for these circumstances.

69