National Grid 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

Annual report on remuneration

Statement of implementation of remuneration policy in 2013/14

Role of Remuneration Committee

The Committee is responsible for recommending to the Board the remuneration policy for Executive Directors and the other members of

the Executive Committee and for setting the remuneration policy for the Chairman. The aim is to align remuneration policy to Company

strategy and key business objectives and ensure it reflects our shareholders’, customers’ and regulators’ interests.

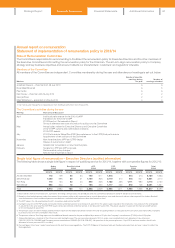

Members of the Committee

All members of the Committee are independent. Committee membership during the year and attendance at meetings is set out below:

Member

Number of possible

meetings during

the year

Number of

meetings attended

Jonathan Dawson – chairman from 29 July 2013 6 6

Nora Mead Brownell 6 5

Paul Golby 6 6

Ken Harvey – chairman until 29 July 2013 2 2

George Rose 2 2

Mark Williamson – appointed on 29 July 2013 4 4

1. Ken Harvey and George Rose stepped down from the Board with effect from 29 July 2013.

The Committee’s activities during the year

Meeting Main areas of discussion

April Individual performance for the 2012/13 APP

Framework for the 2013/14 APP

2013 Directors’ Remuneration Report

Terms of reference and code of conduct for advisors to the Committee

May Annual salary review for Executive Directors and Executive Committee

2012/13 APP outturns and confirmation of awards

2013 LTPP awards

July 2010 Performance Share Plan (PSP, the predecessor to the LTPP) final performance

Appointment of new advisors to the Committee

November New incentive plans (APP and LTPP) design

Review of outcome from AGM

January Shareholder consultation on new incentive plans

February Targets for LTPP and APP proposals

Remuneration policy changes

New format remuneration report

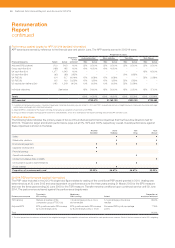

Single total figure of remuneration – Executive Directors (audited information)

The following table shows a single total figure in respect of qualifying service for 2013/14, together with comparative figures for 2012/13:

Salary

£’000

Benefits in kind

£’000

APP

£’000

PSP

£’000

Pension

£’000

Total

£’000

2013/14 2012/13 2013/14 2012/13 2013/14 2012/13 2013/14 2012/13 2013/14 2012 /13 2013/14 2012/13

Andrew Bonfield 712 709 55 54 790 677 1,418 –214 213 3 ,18 9 1,653

Steve Holliday 1,000 996 35 31 1,169 846 2,179 670 418 627 4,801 3,170

Tom King 715 734 23 24 595 526 1,732 466 1,111 980 4,176 2,730

Nick Winser 546 543 12 11 704 500 1,177 335 212 148 2,651 1,537

Total 2,973 2,982 125 120 3,258 2,549 6,506 1,471 1,955 1,968 14,817 9,090

1. Base salaries were last increased on 1 June 2012. Tom King’s annual salary was $1,158,000 and was converted at $1.62:£1 in 2013/14 and $1.57:£1 in 2012/13.

2. Benefits in kind include private medical insurance, life assurance, either a fully expensed car or a cash alternative to a car and the use of a driver when required. For Andrew Bonfield,

acash allowance in lieu of additional pension contributions is included within pension rather than benefits in kind.

3. The APP value is the full award before the 50% mandatory deferral into the DSP.

4. During the year, the 2010 PSP award vested and entered a retention period, to be released in June 2014. The above value is based on the share price (744 pence) on the vesting date

(1July2013). In the prior year the 2009 PSP award vested and entered a retention period, to be released in June 2013. The above valuation is based on the share price (681 pence)

onthevesting date (2 July 2012).

5. The pension values for Steve Holliday and Nick Winser represent the additional benefit earned in the year (excluding inflation as measured by the consumer price index (CPI)), multiplied

bya factor of 20, less the contributions they made.

6. The pension value for Tom King represents the additional benefit earned in the year multiplied by a factor of 20, plus the Company’s contributions (£7,854) to the 401(k) plan.

7. Andrew Bonfield was a member of the DC pension plan during the year. The pension value represents 30% of salary via a combination of cash allowance in lieu of pension

£185,120(2012/13: £184,385) and Company pension contributions £28,480 (2012/13: £28,367). He opted out of the pension plan from 1 April 2014 and now receives the full cash

allowance in lieu of pension of 30% of salary.

8. Pension figures in last year’s report were based on the draft disclosure regulations. The 2012/13 figures in the above table are therefore amended from last year’s report to reflect the

finalregulations.

67