National Grid 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

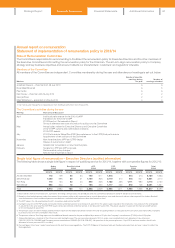

Directors

Share

ownership

requirements

(multiple

of salary)

Number

of shares

required

to hold

Number

of shares

owned

outright

(including

connected

persons)

Number

of shares

held as a

multiple of

current salary

Share

ownership

requirements

met

Vested but

unreleased

share award

subject to

continuous

employment

(PSP 2010)

Conditional

share awards

subject to

performance

conditions

(LTPP 2011,

2012 and 2013)

Conditional

share awards

subject to

continuous

employment

(DSP 2011,

2012 and 2013)

Executive Directors

Andrew Bonfield 125% 108,273 699 <1% No 190,589 6 3 7,3 5 6 130,040

Steve Holliday 200% 243,309 752,031 618% Yes 292,880 1,006,643 230,410

Tom King 125% 21,058 71,336 423% Yes 46,556 131,378 32,388

Nick Winser 125% 83,029 355,413 535% Yes 158,262 4 8 7,7 8 0 121,777

Non-executive Directors

Philip Aiken – – 4,900 n/a n/a – – –

Nora Mead Brownell – – 5,000 n/a n/a –––

Jonathan Dawson – – 24,000 n/a n/a –––

Therese Esperdy – – – n/a n/a –––

Sir Peter Gershon – – 75,771 n/a n/a –––

Paul Golby – – 2,500 n/a n/a –––

Ken Harvey – – 5,236 n/a n/a –––

Ruth Kelly – – 800 n/a n/a –––

Maria Richter – – 14,357 n/a n/a –––

George Rose – – 6,792 n/a n/a –––

Mark Williamson – – 4,726 n/a n/a –––

1. The salary used to calculate the value of shareholding is the salary earned in the year.

2. Andrew Bonfield has not met the shareholding requirement as none of the share awards in the plans in which he has participated have been released yet.

3. Tom King’s holdings and awards are shown as ADSs and each ADS represents five ordinary shares.

4. The release date for the PSP 2010 is 29 June 2014.

5. On 31 March 2014 Andrew Bonfield held 3,421 options granted under the Sharesave plan. These options were granted at a value of 445 pence per share, and they can be exercised at

445pence per share between April 2016 and September 2016.

6. On 12 June 2013 Steve Holliday exercised two Share Match awards, totalling 37,475 shares. This comprised (i) an award of 16,092 options, expiring in June 2013, exercised for 100 pence

in total, and (ii) an award of 21,383 options, expiring in May 2014, exercised for nil value. These shares are included in the table above (‘Number of shares owned outright’). In addition, on

7April 2014, he exercised a Sharesave option over 3,921 shares at the option price of 427.05 pence per share before expiration in September 2014.

7. For Andrew Bonfield, the number of conditional share awards subject to performance conditions is as follows: LTPP 2011: 229,463; LTPP 2012: 213,095; LTPP 2013: 194,798. The number

of conditional share awards subject to continuous employment is as follows: DSP 2011: 29,184; DSP 2012: 55,150; DSP 2013: 45,706.

8. For Steve Holliday, the number of conditional share awards subject to performance conditions is as follows: LTPP 2011: 362,148; LTPP 2012: 336,702; LTPP 2013: 307,793. The number of

conditional share awards subject to continuous employment is as follows: DSP 2011: 97,359; DSP 2012: 75,933; DSP 2013: 57,118.

9. For Tom King, the number of conditional awards over ADSs subject to performance conditions is as follows: LTPP 2011: 45,537; LTPP 2012: 44,616; LTPP 2013: 41,225. The number of

conditional awards over ADSs subject to continuous employment is as follows: DSP 2011: 13,937; DSP 2012: 11,332; DSP 2013: 7,119.

10. For Nick Winser, the number of conditional share awards subject to performance conditions is as follows: LTPP 2011: 174,986; LTPP 2012: 163,412; LTPP 2013: 149,382. The number of

conditional share awards subject to continuous employment is as follows: DSP 2011: 48,354; DSP 2012: 39,682; DSP 2013: 33,741.

11. The normal vesting dates for the conditional share awards subject to performance conditions are 1 July 2014 and 1 July 2015; 1 July 2015 and 1 July 2016; and 1 July 2016 and 1 July

2017 for the LTPP 2011, LTPP 2012 and LTPP 2013 respectively. The normal vesting dates for the conditional share awards subject to continuous employment are 15 June 2014; 14 June

2015; and 13 June 2016 for the DSP 2011, DSP 2012 and DSP 2013 respectively.

12. Non-executive Directors do not have a shareholding requirement.

13. In April and May 2014 a further 30 shares were purchased on behalf of both Steve Holliday and Andrew Bonfield via the Share Incentive Plan (an HMRC approved all-employee share plan),

thereby increasing their beneficial interests. There have been no other changes in Directors’ shareholdings between 1 April 2014 and 18 May 2014.

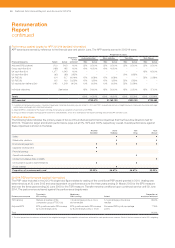

External appointments and retention of fees

The table below details the Executive Directors who served as non-executive directors in other companies during the year ended

31March 2014:

Company Retained fees (£)

Andrew Bonfield Kingfisher plc 81,200

Steve Holliday Marks and Spencer Group plc 85,000

Nick Winser Kier Group plc 53,700

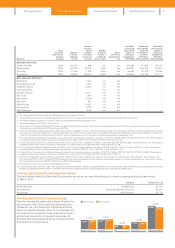

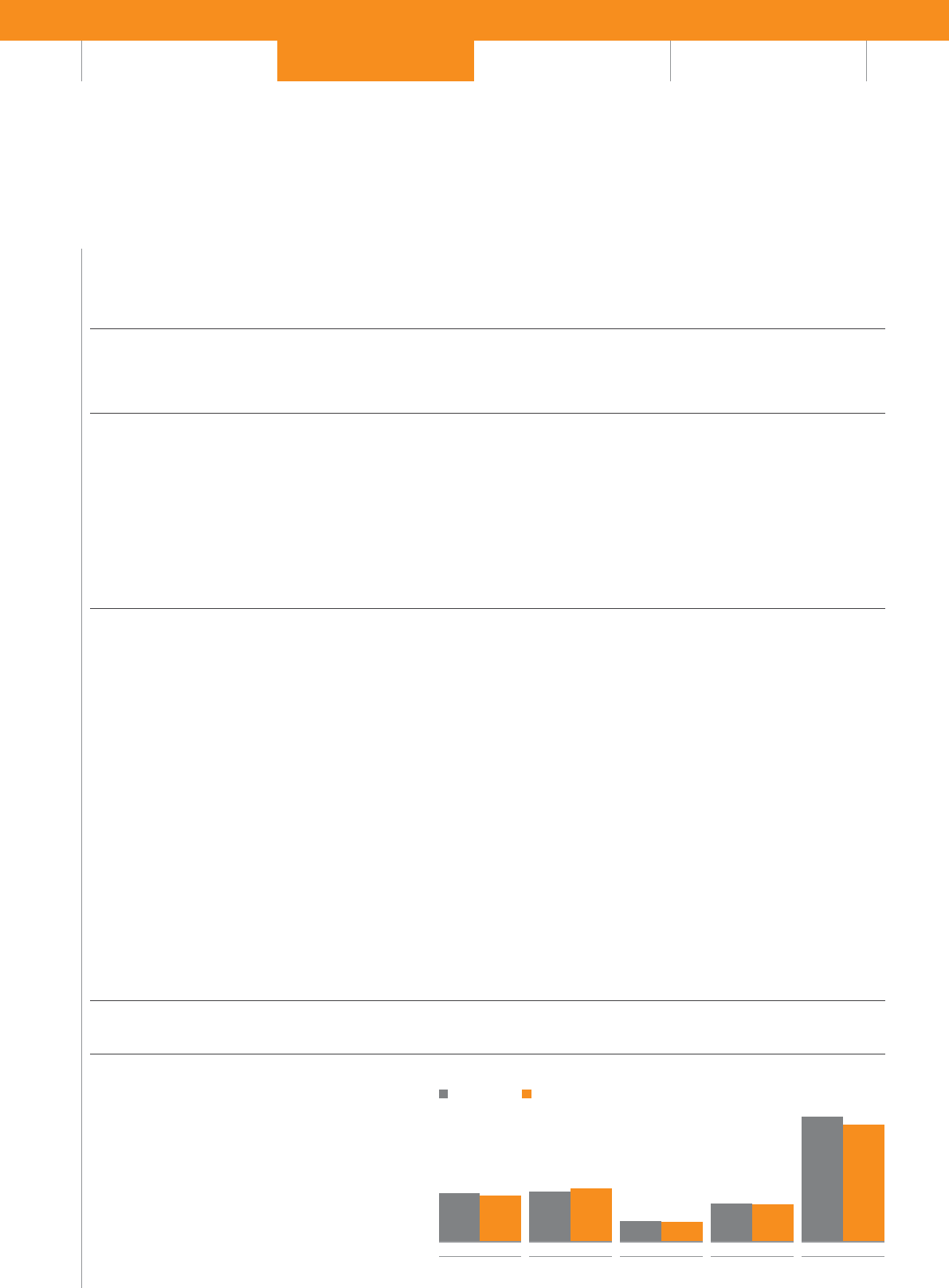

Relative importance of spend on pay

This chart shows the relative importance ofspend on

pay compared with other costs and disbursements

(dividends, tax, net interest and capitalexpenditure).

Given the capital-intensive natureof our business and

the scale of our operations, these costs were chosen

as the most relevant for comparison purposes. All

amounts exclude exceptional items, remeasurements

and stranded cost recoveries.

Payroll costs

Dividends Tax Net interest Capital expenditure

1,373

1,434 1,567

581

619

1,108

1,124

3,441

3,686

1,491

-4.3% +5.1%

-6.1%

-1.4%

-6.6%

2012/13 £m 2013/14 £m

71