National Grid 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

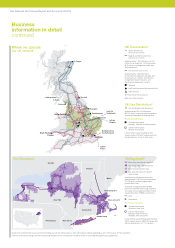

Business

information in detail

continued

Risk factors

Law and regulation

Changes in law or regulation or decisions by governmental

bodies or regulators could materially adversely affect us.

Most of our businesses are utilities or networks subject to

regulation by governments and other authorities. Changes in

lawor regulation or regulatory policy and precedent, including

decisions of governmental bodies or regulators, in the countries

or states in which we operate could materially adversely affect

us. If we fail to engage in the energy policy debate, we may not

be able to influence future energy policy and deliver our strategy.

Decisions or rulings concerning, for example:

(i) whether licences, approvals or agreements to operate or

supply are granted, amended or renewed, whether consents

for construction projects are granted in a timely manner or

whether there has been any breach of the terms of a licence,

approval or regulatory requirement; and

(ii) timely recovery of incurred expenditure or obligations, the

ability to pass through commodity costs, a decoupling of

energy usage and revenue, and other decisions relating

tothe impact of general economic conditions on us, our

markets and customers, implications of climate change,

whether aspects of our activities are contestable, the level

ofpermitted revenues and dividend distributions for our

businesses and in relation to proposed business

development activities,

could have a material adverse impact on our results of

operations, cash flows, the financial condition of our businesses

and the ability to develop those businesses in the future.

As the result of control weaknesses in our US business, we

maybe unable to provide timely regulatory reporting, which may

include the provision of financial statements. This could result in

the imposition of regulatory fines, penalties and other sanctions,

which could impact our operations, our reputation and our

relationship with our regulators and other stakeholders.

For further information see pages 160 to 165, which explain

ourregulatory environment in detail.

Business performance

Current and future business performance may not meet our

expectations or those of our regulators and shareholders.

Earnings maintenance and growth from our regulated gas and

electricity businesses will be affected by our ability to meet or

exceed efficiency targets and service quality standards set by,

oragreed with, our regulators.

If we do not meet these targets and standards, or if we do not

implement the transformation projects we are carrying out as

envisaged, including to our US financial systems and controls

over financial reporting, or are not able to deliver our RIIO

operating model and the US Elevate 2015 strategy successfully,

we may not achieve the expected benefits, our business may be

materially adversely affected and our performance, results of

operations and reputation may be materially harmed and we

maybe in breach of regulatory or contractual obligations.

Growth and business development activity

Failure to respond to external market developments and

execute our strategic ambition may negatively affect our

performance. Conversely, new businesses or activities that

we undertake alone or with partners may not deliver target

outcomes and may expose us to additional operational and

financial risk.

Failure to grow our core business sufficiently and have viable

options for new future business over the longer term could

negatively affect the Group’s credibility and reputation and

jeopardise the achievement of intended financial returns.

Business development activities and the delivery of our growth

ambition, including acquisitions, disposals, joint ventures,

partnering and organic investment opportunities (including

organic investments made as a result of changes to the energy

mix), are subject to a wide range of both external uncertainties

(including the availability of potential investment targets and

attractive financing), and internal uncertainties (including actual

performance of our various existing operating companies and

ourbusiness planning model assumptions and ability to integrate

acquired businesses effectively). As a result, we may suffer

unanticipated costs and liabilities and other unanticipated effects.

We may also be liable for the past acts, omissions or liabilities

ofcompanies or businesses we have acquired, which may be

unforeseen or greater than anticipated. In the case of joint

ventures, we may have limited control over operations and our

joint venture partners may have interests that diverge from our

own. The occurrence of any of these events could have a material

adverse impact on our results of operations or financial condition,

and could also impact our ability to enter into other transactions.

Cost escalation

Changes in foreign currency rates, interest rates or

commodity prices could materially impact earnings

orourfinancial condition.

We have significant operations in the US and so are subject to the

exchange rate risks normally associated with non UK operations,

including the need to translate US assets and liabilities, and income

and expenses, into sterling, our primary reporting currency.

Inaddition, our results of operations and net debt position may

beaffected because a significant proportion of our borrowings,

derivative financial instruments and commodity contracts are

affected by changes in interest rates, commodity price indices and

exchange rates, in particular the dollar to sterling exchange rate.

Furthermore, our cash flow may be materially affected as a result

of settling hedging arrangements entered into to manage our

exchange rate, interest rate and commodity price exposure,

orbycash collateral movements relating to derivative market

values, which also depend on the sterling exchange rate into euro

and other currencies.

168 National Grid Annual Report and Accounts 2013/14