National Grid 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

Unaudited commentary on the consolidated income statement

The consolidated income statement shows all revenue

earned and costs incurred in the year, with the difference

being the overall profit for the year.

Revenue

Revenue for the year ended 31 March 2014 increased by £450m

to £14,809m. This increase was driven by higher revenues in our

UKElectricity Transmission and UK Gas Distribution businesses,

principally as a result of the new RIIO regulatory arrangements.

Revenue in our US Regulated businesses was also higher,

reflecting higher pass-through costs such as gas and electricity

commodity costs, partially offset by the end of the Niagara

Mohawk deferral revenue recoveries at 31 March 2013 and the

impact of the weaker dollar.

Operating costs

Operating costs for the year ended 31 March 2014 of £11,074m

were £464m higher than the prior year. This increase in costs was

predominantly due to increases in pass-through costs in our UK

and US Regulated businesses, together with higher depreciation

and amortisation as a result of continued investment and increases

in our controllable costs.

Exceptional items, remeasurements and stranded cost recoveries

included in operating costs for the year ended 31 March 2014

were £39m lower than the prior year. Net exceptional gains

included in 2013/14 of £55m primarily consisted of a net gain

onthe LIPA MSA transition in the US of £254m, a gain of £16m

following the sale to a third party of a settlement award,

restructuring costs of £136m and UK gas holder demolition

costsof £79m. The 2013/14 results also included a gain of £16m

onremeasurements of commodity contracts.

There were no major storms affecting our operations in the year

ended 31 March 2014. In 2012/13, two major storms in the US,

Superstorm Sandy and Storm Nemo, increased operating costs

by£136m.

Net finance costs

For the year ended 31 March 2014, net finance costs before

exceptional items and remeasurements were £16m lower than

2012/13 at £1,108m, mainly due tothe impact of the weaker

dollar(£17m).

Finance costs for the year ended 31 March 2014 also included

again of £93m on financial remeasurements relating to net

gainsand losses on derivative financial instruments.

Taxation

The tax charge on profits before exceptional items, remeasurements

and stranded cost recoveries was £38m lower than 2012/13. This

was mainly due to a 1% decrease in the UK statutory corporation

tax rate in the year and a change in the UK/US profit mix where

higher UK profits were taxed at the lower UK tax rate. Our tax

charge was also affected by changes in tax provisions in respect

ofprior years.

Exceptional tax for 2013/14 included an exceptional deferredtax

credit of £398m arising from a reduction in theUKcorporation tax

rate from 23% to 21% applicable from1April 2014 and a further

reduction to 20% from 1 April 2015.

Adjusted earnings and EPS

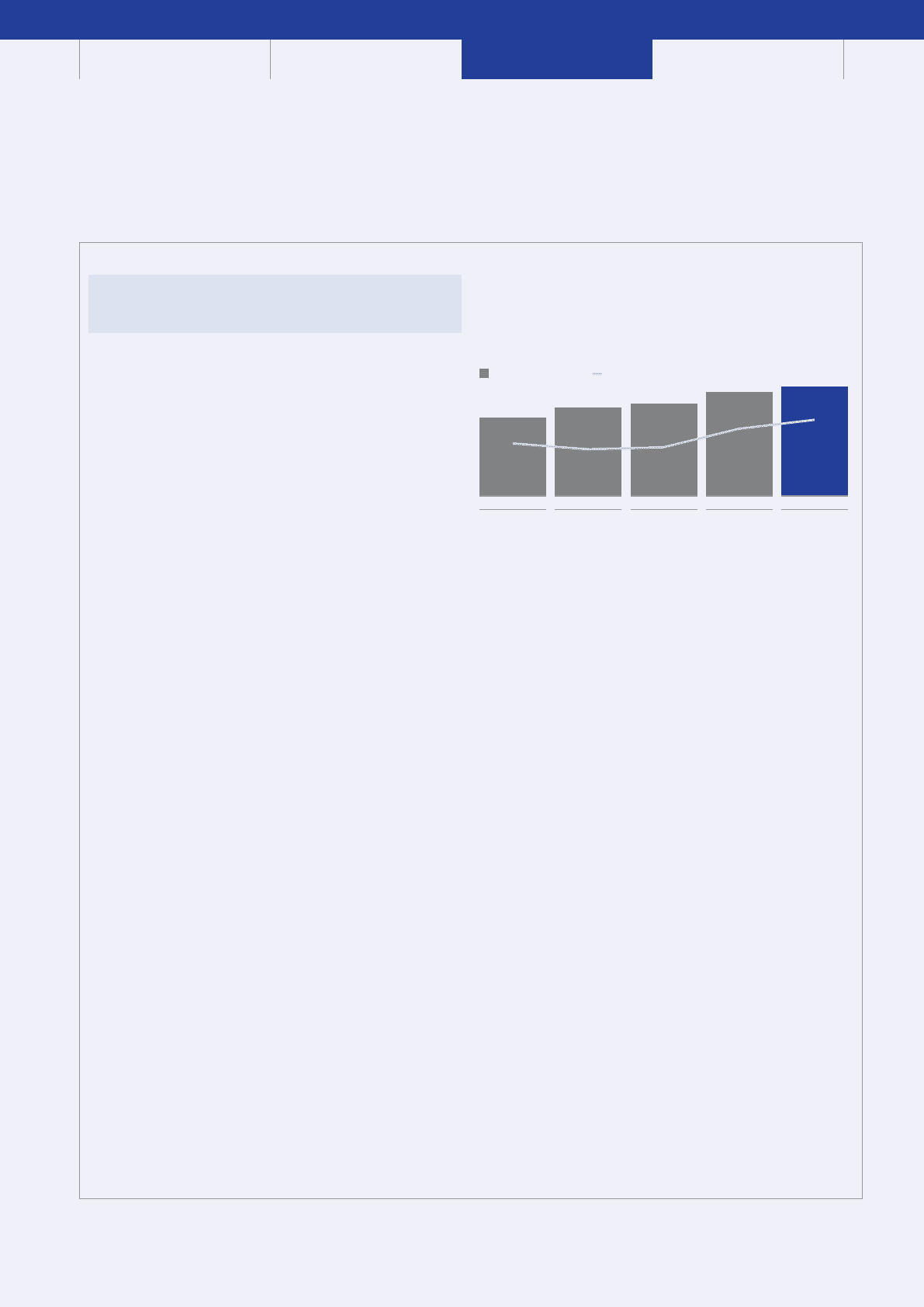

The following chart shows the five year trend in adjusted profit

attributable to equity shareholders of the parent (adjusted

earnings) and adjusted EPS.

£1,447m£1,627m£1,709m

2009/10 2010/11 2011/12 2012/13 2013/14

£1,913m£2,015m

47.1p 45.4p 46.0p

51.4p 54.0p

Adjusted earnings and adjusted EPS1

Adjusted EPSAdjusted earnings

1. All comparatives restated for IAS 19 (revised). See note 1 on page 92. Adjusted earnings

and adjusted EPS are attributable to equity shareholders of the parent.

The above earnings performance translated into adjusted EPS

growth in 2013/14 of 2.6p (5%).

In accordance with IAS 33, all EPS and adjusted EPS amounts

forcomparative periods have been restated for shares issued via

scrip dividends and the bonus element of the 2010 rights issue.

Exchange rates

Our financial results are reported in sterling. Transactions for

ourUS operations are denominated in dollars, so the related

amounts that are reported in sterling depend on the dollar to

sterling exchange rate. The weighted average dollar rate

weakened to $1.62:£1 in 2013/14 from $1.57:£1 in 2012/13.

Consequently, if2012/13 results had been translated at 2013/14

exchange rates,revenue, adjusted operating profit and operating

profit reported in sterling would have been £242m, £34m and

£39m lower respectively.

The statement of financial position has been translated at

anexchange rate of $1.67:£1 at 31 March 2014 ($1.52: £1

at31March 2013).

This unaudited commentary does not form part of the financial statements.

85