National Grid 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

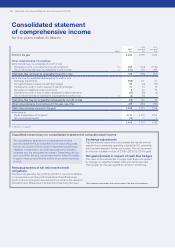

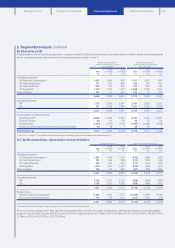

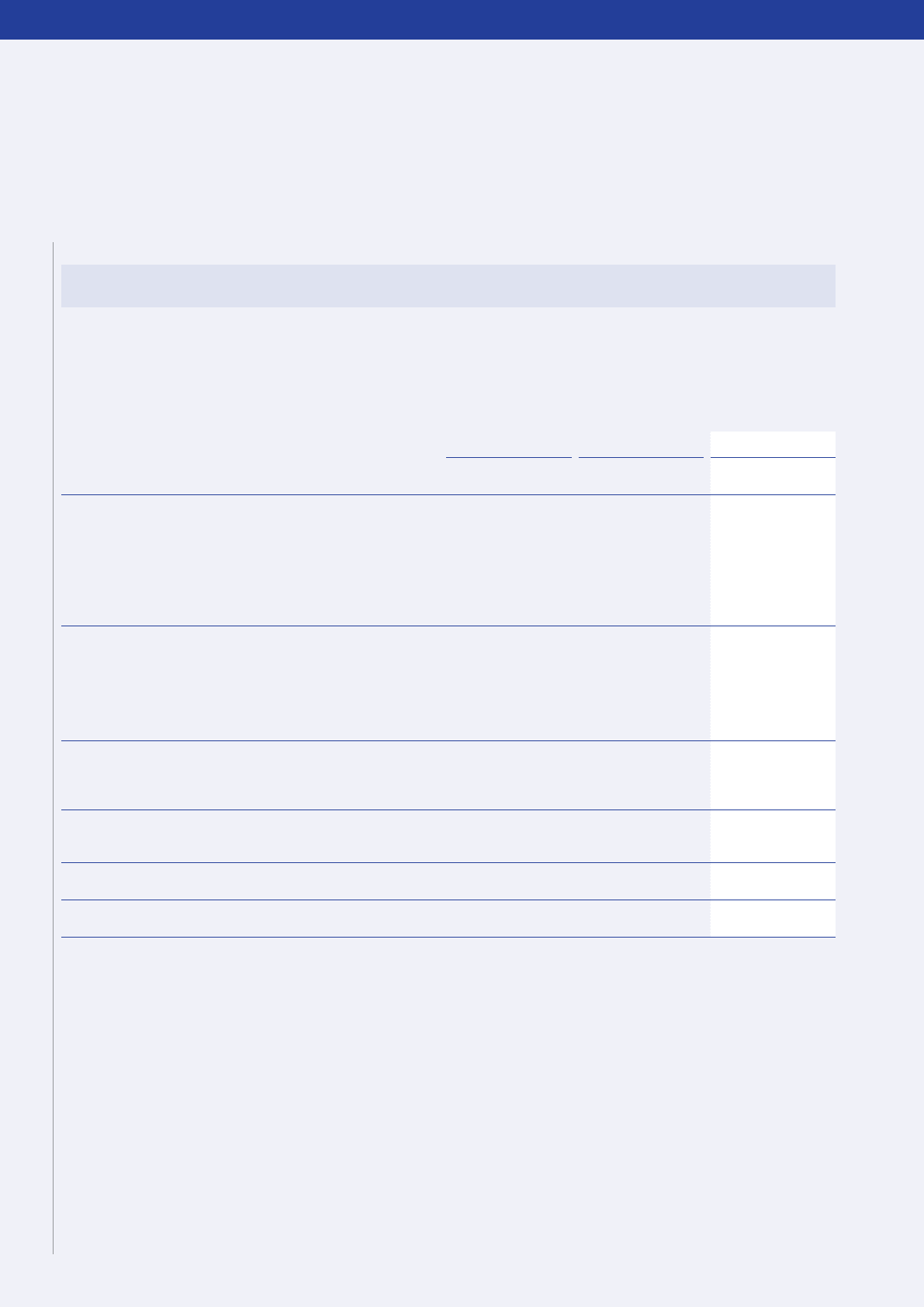

1. Adoption of IAS 19 (revised) ‘Employee benefits’

This note sets out the impact that the required adoption of IAS 19 (revised) ‘Employee benefits’ has had on our previously reported

results. It provides details of the originally reported and the restated figures.

During the year, the Group adopted IAS 19 (revised) ‘Employee benefits’. The adoption constitutes a change in accounting policy and

therefore the comparative information has been restated.

The standard requires past service costs to be recognised immediately in profit or loss and all actuarial gains and losses are recognised

in other comprehensive income as they occur. The standard also replaces the interest cost on the DB obligation and the expected return

on plan assets with a net interest cost based on the net DB asset or liability and the discount rate, measured at the beginning of the year.

The impact on the Group for the years ended 31 March 2013 and 31 March 2012 is set out in the table below:

As previously reported

Restatement for

IAS 19 (revised) As restated

31 March

2013

£m

31 March

2012

£m

31 March

2013

£m

31 March

2012

£m

31 March

2013

£m

31 March

2012

£m

Consolidated income statement

Operating costs (10,605) (10,293) (5) (4) (10,610) (10,297)

Total operating profit 3,754 3,539 (5) (4) 3,749 3,535

Total finance income 1,252 1,301 (1,222) (1,273) 30 28

Total finance costs (2,104) (2,288) 1,018 1,10 0 (1,086) (1,188)

Total profit before tax 2,920 2,559 (209) (177) 2,711 2,382

Total taxation (624) (521) 67 58 (557) (463)

Profit for the year 2,296 2,038 (142) (119) 2,154 1,919

Consolidated statement of financial position

Deferred tax liabilities (4,076) (3,738) (1) 2(4,077) (3,736)

Pensions and other post-retirement benefit obligations (3,694) (3,088) 2(5) (3,692) (3,093)

Total non-current liabilities ( 37, 0 27 ) (31,998) 1(3) (37,026) (32,001)

Total liabilities (44,472) (38,089) 1(3) (44,471) (38,092)

Retained earnings 13,132 12,297 1(3) 13,133 12,294

Total equity 10,233 9,246 1(3) 10,234 9,243

Consolidated statement of other comprehensive income

Remeasurements of net retirement benefit obligations (930) (1,325) 216 185 (714) (1,140)

Tax on items that will never be reclassified to profit or loss 249 403 (70) (61) 179 342

Total comprehensive income for the year 1,769 1,151 4 5 1,773 1,156

Consolidated statement of changes in equity

Other comprehensive income (527) (887) 146 124 (381) (763)

Total comprehensive income for the year 1,769 1,151 4 5 1,773 1,156

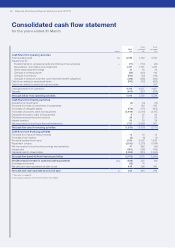

Consolidated cash flow statement

Pensions and other post-retirement benefit obligations (413) (386) 5 4 (408) (382)

EPS – basic 62.6p 55.6p (4.8)p (4.0)p 57.8p 51.6p

EPS – diluted 62.3p 55.4p (4.8)p (4.1) p 57.5p 51.3p

The restated amounts for EPS in the above table reflect the impact of additional shares issued as scrip dividends. The effect of the change

in accounting policy on the statement of cash flows was immaterial, with no impact on the cash position at any of the reporting dates.

We have revised our pension and other post-retirement benefit obligations disclosures in notes 22 and 29 to provide greater clarity by

separately presenting our UK and US pension plans due to their different risk profiles.

Notes to the consolidated

financial statements

– analysis of items in the primary statements

92 National Grid Annual Report and Accounts 2013/14