National Grid 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

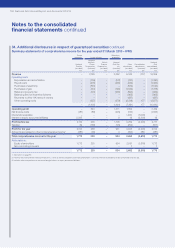

8. Reserves

Share

premium

account

£m

Cash flow

hedge

reserve

£m

Available-

for-sale

reserve

£m

Other equity

reserves

£m

Profit and

loss account

£m

At 1 April 2012 1,355 9 – 220 4,579

Transferred from equity in respect of cash flow hedges (net of tax) – 3 – – –

Shares issued in lieu of dividends (11) – – – –

Issue of treasury shares ––––19

Purchase of own shares ––––(6)

Share awards to employees of subsidiary undertakings – – – 20 –

Loss for the financial year – – – – (382)

At 31 March 2013 1,344 12 –240 4,210

Transferred from equity in respect of cash flow hedges (net of tax) – 8 – – –

Net gains taken to equity – – 1 – –

Shares issued in lieu of dividends (8) – – – –

Issue of treasury shares ––––14

Purchase of own shares ––––(3)

Share awards to employees of subsidiary undertakings –––20 –

Loss for the financial year ––––(83)

At 31 March 2014 1,336 20 1260 4,138

There were no gains and losses, other than losses for the years stated above; therefore no separate statement of total recognised

gainsand losses has been presented. At 31 March 2014, £86m (2013: £86m) of the profit and loss account reserve relating to gains

onintra-group transactions was not distributable to shareholders.

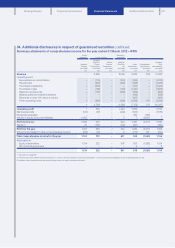

9. Reconciliation of movements in total shareholders’ funds

2014

£m

2013

£m

Profit for the financial year 976 428

Dividends1(1,059) (810)

Loss for the financial year (83) (382)

Issue of treasury shares 14 19

Purchase of own shares (3) (6)

Shares issued in lieu of dividends2(2) –

Movement on cash flow hedge reserve (net of tax) 83

Movement on available-for-sale reserve 1–

Share awards to employees of subsidiary undertakings 20 20

Net decrease in shareholders’ funds (45) (346)

Opening shareholders’ funds 6,239 6,585

Closing shareholders’ funds 6,194 6,239

1. For further details of dividends paid and payable to shareholders, refer to note 8 to the consolidated financial statements.

2. Included within share premium account are costs associated with scrip dividends.

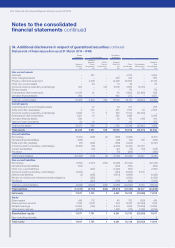

10. Parent Company guarantees

The Company has guaranteed the repayment of the principal sum, any associated premium and interest on specific loans due by certain

subsidiary undertakings primarily to third parties. At 31 March 2014, the sterling equivalent amounted to £2,713m (2013: £2,767m). The

guarantees are for varying terms from less than one year to open-ended.

11. Audit fees

The audit fee in respect of the parent Company was £26,750 (2013: £25,750). Fees payable to PricewaterhouseCoopers LLP for non-audit

services to the Company are included within note 3 (e) to the consolidated financial statements.

159