National Grid 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

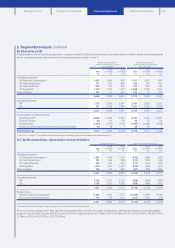

Called up

share

capital

£m

Share

premium

account

£m

Retained

earnings

£m

Other

equity

reserves1

£m

Total

shareholders’

equity

£m

Non-

controlling

interests

£m

Total

equity

£m

Equity as at 1 April 2011 as previously reported 416 1,361 12,15 3 (4,870) 9,060 99,069

Impact of change in accounting policy2– – (8) –(8) –(8)

Equity as at 1 April 2011 (restated) 416 1,361 12,145 (4,870) 9,052 99,061

Profit for the year2– – 1,917 –1,917 21,919

Total other comprehensive (loss)/income for the year2– – (798) 35 (763) –(763)

Total comprehensive income for the year2– – 1,119 35 1,15 4 21,156

Equity dividends – – (1,319) –(1,319) –(1,319)

Scrip dividend related share issue36(6) 313 –313 –313

Issue of treasury shares – – 13 –13 –13

Purchase of own shares – – (4) –(4) –(4)

Other movements in non-controlling interests –––––(4) (4)

Share-based payment – – 24 –24 –24

Tax on share-based payment – – 3 – 3 – 3

At 31 March 2012 (restated) 422 1,355 12,294 (4,835) 9,236 79,243

Profit for the year2– – 2,15 3 –2,153 12,15 4

Total other comprehensive (loss)/income for the year2– – (535) 154 (381) –(381)

Total comprehensive income for the year2– – 1,618 154 1,772 11,773

Equity dividends – – (1,433) –(1,433) –(1,433)

Scrip dividend related share issue311 (11) 623 –623 –623

Issue of treasury shares – – 19 –19 –19

Purchase of own shares – – (6) –(6) –(6)

Other movements in non-controlling interests –––––(3) (3)

Share-based payment – – 20 –20 –20

Tax on share-based payment – – (2) –(2) –(2)

At 31 March 2013 (restated) 433 1,344 13,133 (4,681) 10,229 510,234

Profit for the year – – 2,476 –2,476 (12) 2,464

Total other comprehensive income/(loss) for the year – – 313 (78) 235 –235

Total comprehensive income/(loss) for the year – – 2,789 (78) 2,711 (12) 2,699

Equity dividends – – (1,503) –(1,503) –(1,503)

Scrip dividend related share issue36(8) 444 –442 –442

Issue of treasury shares – – 14 –14 –14

Purchase of own shares – – (5) –(5) –(5)

Other movements in non-controlling interests – – (4) –(4) 15 11

Share-based payment – – 20 –20 –20

Tax on share-based payment – – 7 – 7 – 7

At 31 March 2014 439 1,336 14,895 (4,759) 11,911 811,919

1. For further details of other equity reserves, see note 25 on page 129.

2. See note 1 on page 92.

3. Included within share premium account are costs associated with scrip dividends.

Unaudited commentary on consolidated statement of changes in equity

The consolidated statement of changes in equity shows the

additions (where it came from) and reductions (where it went)

to equity. For us, the main items included here are the profit

earned and dividends paid in the year.

Dividends

We paid a total of £1,503m dividends to shareholders in the

year(2012/13: £1,433m) of which £444m (2012/13: £623m)

wassettled via scrip issues. The Directors are proposing a

finaldividend of 27.54p, bringing the total dividend forthe year

to42.03p, a2.9% increase on 2012/13. The Directors intend to

continue the dividend policy announced last year of increasing

the annual dividend by at least the rate of RPI inflation for the

foreseeable future.

Consolidated statement

of changes in equity

for the years ended 31 March

This unaudited commentary does not form part of the financial statements.

87