National Grid 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

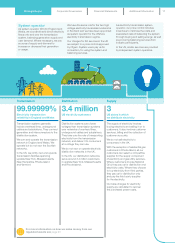

Non-financial KPIs

pages 10 – 11

Our vision

andstrategy

pages 14 – 15

Our revised financial KPIs

KPI Definition 2013/14 result

Adjusted EPS Adjusted earnings divided by the weighted average number of shares. 54.0p

Group RoE Adjusted earnings with certain regulatory-based adjustments divided by equity. 11.4%

Regulated asset growth Growth in the total UK RAV and US rate base versus the prior year. 3%

Value added Annual growth in our assets after deducting dividends, goodwill and net debt. £ 2.1b n

We measure the achievement of our objectives, make

operational and investment decisions and reward our

employees using both qualitative assessments and quantitative

indicators. To provide a full and rounded view of our business,

we use non-financial as well as financial measures. Although

allthese measures are important, some are considered to be

more significant than others, and these are designated as KPIs.

KPIs are used to measure our progress on strategic priorities,

aligning with those activities that combine to deliver our strategy.

Financial KPIs are trailing indicators of the success of past

initiatives and specific programmes. They also highlight areas

for further improvement and allow us to make sure our actions

culminate in sustainable long-term growth in shareholder value.

We have changed our financial KPIs during 2013/14 to reflect

thechanging metrics used to monitor the Group following RIIO.

We have included ‘value added’, a new metric that we use to

monitor the value delivered to shareholders through dividends

and growth in the value of National Grid’s assets net of the growth

in net debt. A derivative of this metric, value growth, is also used

to incentivise our Executive Directors. See page 58 for further

detail on our remuneration policy.

We have included regulated asset growth, as this is a measure of

the ability of the business to generate revenue in the future. While

we continue to focus on efficient capital expenditure, the value of

our regulated assets drives our revenue allowances in future years.

We have stopped reporting our regulated controllable operating

costs metric. This was included to monitor cost control, but

following the introduction of RIIO, all our businesses’ activities

arefocused on costs, through innovative and efficient delivery of

high-quality services. Our ability to control costs is also reflected

in the adjusted EPS and Group RoE metrics, which are based

onour adjusted earnings.

In the US, cumulative timing over-recoveries at

31March 2014 were £117 million (2013: £110 million).

The majority of that balance will be returned to

customers next year.

In addition to the timing adjustments described

above, following the start of the RIIO price controls

inthe UK, outperformance against allowances as

aresult of the totex incentive mechanism, together

with changes in output-related allowances included

in the original price control, will almost always be

adjusted in future revenue recoveries, typically

starting in two years’ time.

Our current IFRS revenues and earnings include

theamounts that will need toberepaid but exclude

amounts that will be recovered in future periods.

Such adjustments willform an important part of the

continuing difference between reported IFRS results

and underlying economic performance based on

ourregulatory obligations.

For our UK regulated businesses as a whole,

regulated revenue adjustments totalled £106 million

in the year. This is based on our estimates of: work

carried out in line with allowances; in expectation

offuture allowances; or work avoided altogether –

either as a result of us finding innovative solutions

orof the need being permanently removed.

In the US, accumulated regulatory entitlements

tofuture revenue net of over- or under-recoveries

amounted to £1,027 million at 31 March 2014

(2013:£1,311 million). These entitlements cover

arange of different areas, with the most significant

being environmental remediation and pension

assets, as well as deferred storm costs.

All regulatory entitlements are recoverable

(orrepayable) over different periods, which are

agreed with the regulators to match the expected

payment profile for the liabilities. As at 31 March

2014, these extend until 2059.

Major storms

Despite the very cold winter across much of the US,

there were no major storms in 2013/14. In 2012/13,

two major storms in the US, Superstorm Sandy and

Storm Nemo, as well as a number of smaller storms,

had a material effect on the results of National Grid,

reducing operating profit by £136million.

The table below shows adjusted operating profit and

operating profit for the past three years, excluding

the impact of timing differences and major storms.

Year ended 31 March

Excluding the impact of timing

differences and major storms

2014

£m

2013

£m

2012

£m

Adjusted operating profit 3,706 3,759 3,589

Operating profit 3,777 3,869 3,633

09